Market Overview

The Philippines auto finance market is valued at USD 3.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8% from 2024-2030, reflecting the growth driven by rising consumer demand for vehicle ownership and convenient financing options. The continued expansion of the automotive sector, coupled with improving financial literacy and access to credit, supports this market size. Key factors fueling growth include government initiatives aiming to increase auto ownership rates, which have led to an influx of financing solutions from various providers, creating a more competitive market landscape.

Metro Manila, particularly the National Capital Region (NCR), along with key urban centers in Cebu and Davao, dominate the auto finance market due to their large populations and robust economic activity. The presence of major automotive manufacturers in these locations enhances access to financing options, as well as a broader consumer base interested in purchasing vehicles. The region’s higher disposable income levels further contribute to the prominence of these cities in the auto finance sector, enabling more residents to consider vehicle ownership as a viable option.

Market Segmentation

By Vehicle Type

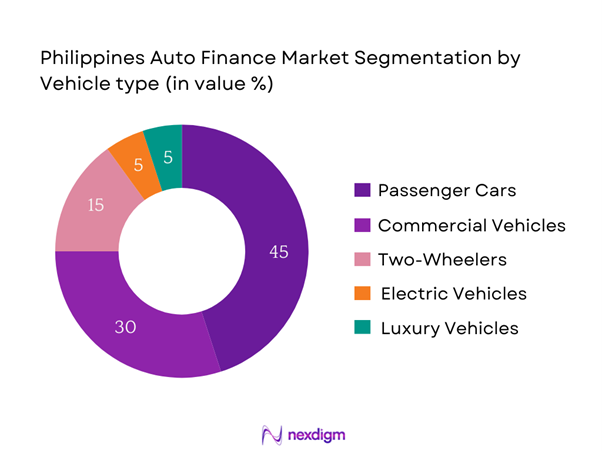

The Philippines auto finance market is segmented by vehicle type into passenger cars, commercial vehicles, two-wheelers, electric vehicles, and luxury vehicles. Among these, passenger cars are currently dominating the market share, accounting for approximately 45% in 2024. This dominance can be attributed to the growing middle class and the increasing preference for convenience and mobility. Passenger cars cater to the day-to-day commuting needs of the population, supported by a variety of attractive financing options that entice consumers. Furthermore, offerings from banks and financing institutions, often tailored for family-use vehicles, enhance affordability and accessibility, making passenger cars a popular choice.

By Financing Type

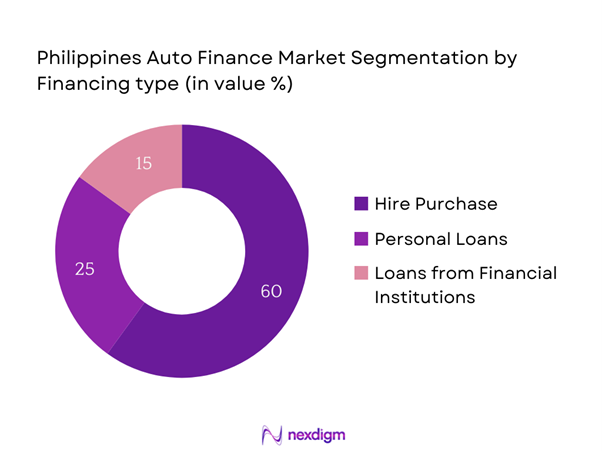

The market is also segmented by financing type into hire purchase, personal loans, and loans from financial institutions. Among these, hire purchase arrangements have emerged as the predominant financing option, representing around 60% of the market share in 2024. This financing approach is favored due to its structure, which allows consumers to pay for a vehicle over time while enjoying immediate access to it. It aligns well with car buyers who may not have the full upfront payment available but want to secure a vehicle for personal or business use. Additionally, hire purchase agreements often offer competitive interest rates and flexible repayment terms, further accelerating their popularity among consumers.

Competitive Landscape

The Philippines auto finance market is dominated by several key players, including local and international financing institutions. The presence of major financial companies, such as banks and automotive financing firms, highlights the competitive nature of the landscape, where companies continuously innovate to attract potential customers.

| Company | Establishment Year | Headquarters | Market Share (%) | Financing Options | Key Products | Customer Focus |

| BDO Unibank | 1968 | Makati City | – | – | – | – |

| Metrobank | 1962 | Makati City | – | – | – | – |

| RCBC | 1960 | Makati City | – | – | – | – |

| Toyota Financial Services | 1995 | Manila | – | – | – | – |

| Honda Cars Philippines | 1990 | Manila | – | – | – | – |

Philippines Auto Finance Market Analysis

Growth Drivers

Increasing Demand for Personal Mobility

The increasing demand for personal mobility in the Philippines is driven by a growing population, which reached approximately 116 million in 2024, alongside urbanization trends where around 47% of the population lives in urban settings. As more Filipinos seek convenient transportation options, the demand for vehicles continues to rise, creating a robust need for financing solutions. To support this sector, the government has implemented various infrastructure projects, allocating USD 350 billion for road expansions and improvements to ensure better accessibility for vehicle owners. This infrastructure development is crucial in facilitating personal mobility across densely populated areas.

Expansion of Automotive Sector

The automotive sector in the Philippines is experiencing rapid growth, with the Philippine Automotive Industry Roadmap projecting the production of 500,000 units annually by end of 2025. In 2023, the automotive industry produced approximately 216,000 vehicles, marking a significant increase from previous years as the domestic vehicle production system is strengthening. Furthermore, the increasing foreign investments in local manufacturing, such as the establishment of several assembly plants, are expected to generate around 100,000 jobs, stimulating the economy and boosting disposable income for households. These factors collectively fuel the demand for auto financing.

Market Challenges

Economic Instability

Economic instability poses considerable challenges to the auto finance market in the Philippines. The country’s GDP growth in 2023 was recorded at 5.1%, a slight decline compared to the previous year, driven by inflation rates hovering around 6% as of early 2024. These macroeconomic conditions contribute to reduced consumer spending power, affecting long-term financing commitments. Furthermore, fluctuations in foreign exchange rates and global market uncertainties can affect vehicle imports and, consequently, auto financing availability. Factors such as these make both consumers and lenders more cautious in financial decision-making.

Regulatory Constraints

Regulatory constraints also significantly impact the Philippines auto finance market, particularly as compliance with the Bangko Sentral ng Pilipinas (BSP) regulations continues to evolve. With guidelines established for risk management and consumer protection, financial institutions must adapt to comply with regulations that mandate lower interest rates and more favorable loan terms. The current regulations specify that lenders must maintain a capital adequacy ratio of at least 10%, which can limit their capacity to extend financing options. Non-compliance, leading to penalties, discourages smaller players from entering the market, limiting competition.

Opportunities

Adoption of Innovative Financing Solutions

The Philippines presents a ripe opportunity for the adoption of innovative financing solutions within the auto finance sector, as digital lending platforms and fintech solutions are expanding. As of 2023, around 44% of Filipino adults had bank accounts, and the Central Bank aims to increase this figure to 70% by end of 2025. This push presents an opportunity for easier access to loans and financing options through advanced technology, including mobile applications and online platforms that meet the needs of tech-savvy consumers. Emerging fintech companies are already transforming the landscape by offering hassle-free financing alternatives tailored for millennials who are driving new car purchases.

Rise in Financial Literacy

The rise in financial literacy among Filipinos is shaping a favorable environment for the auto finance market. Recent initiatives by the government and NGOs are leading to a notable increase in financial awareness, with 27% of adults reporting improved understanding of financing products due to targeted campaigns. The aim is to elevate this to over 50% by end of 2025, fostering informed decisions regarding personal finance and auto loans. This increasing awareness empowers consumers to better navigate financing options, encouraging vehicle ownership and allowing financial institutions to tailor their products to meet evolving customer needs.

Future Outlook

Over the next five years, the Philippines auto finance market is expected to show significant growth driven by increasing economic stability, rising disposable incomes, and continuous government support through e-vehicle initiatives. Additionally, advancements in financing technology and digital platforms are making it easier for consumers to access vehicle financing. The growing trend of mobility services, including ride-hailing and leasing, presents further opportunities for financing institutions to innovate their offerings and adapt to changing consumer preferences.

Major Players

- BDO Unibank

- Metrobank

- RCBC

- Toyota Financial Services

- Honda Cars Philippines

- EastWest Bank

- Union Bank of the Philippines

- Mitsubishi Motors Philippines Corporation

- Isuzu Philippines Corporation

- Nissan Philippines, Inc.

- Ford Philippines

- Hyundai Asia Resources, Inc.

- Suzuki Philippines, Inc.

- Kia Philippines

- Chery Auto Philippines

- Volkswagen Philippines

Key Target Audience

- Automobile Manufacturers

- Fleet Management Companies

- Insurance Companies

- Banks and Financial Institutions

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Trade and Industry, Bangko Sentral ng Pilipinas)

- Automotive Dealerships

- Online Auto Financing Platforms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines auto finance market. This step is backed by extensive desk research, utilizing a combination of secondary sources, including industry reports and government publications, to gather comprehensive insights. The primary objective is to identify and define the critical variables that influence market dynamics, such as the number of vehicles financed, consumer preferences, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Philippines auto finance market. This includes assessing market penetration rates, the ratio of financing options available compared to vehicle sales, and the resulting revenue generation. Additionally, an analysis of user demographics and market trends will be conducted to ensure the validity and relevance of our findings, allowing for accurate and reliable market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through targeted consultations with industry experts and stakeholders. This includes conducting surveys and interviews with representatives from banks, automotive manufacturers, and financial institutions to gain insights into their operations and strategies. Expert feedback is invaluable for refining market data and confirming trends and challenges identified in prior research.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data obtained through previous steps to produce a comprehensive analysis of the Philippines auto finance market. This involves direct engagement with multiple stakeholders to gather insights into product segments, sales performance, consumer preferences, and competitive strategies. The collected insights will be integrated to produce a validated, accurate, and insightful report covering all aspects of the market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Historical Evolution of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Personal Mobility

Expansion of Automotive Sector - Market Challenges

Economic Instability

Regulatory Constraints - Opportunities

Adoption of Innovative Financing Solutions

Rise in Financial Literacy - Trends

Digital Transformation in Financing

Growth of Eco-Friendly Vehicles - Government Regulations

Financial Compliance Guidelines

Consumer Protection Laws - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

Commercial Vehicles

Two-Wheelers

Electric Vehicles

Luxury Vehicles - By Financing Type (In Value %)

Hire Purchase

Personal Loans

Loans from Financial Institutions - By Distribution Channel (In Value %)

Banks

Credit Unions

Non-Banking Financial Companies (NBFCs) - By Region (In Value %)

National Capital Region (NCR)

Luzon

Visayas

Mindanao - By Consumer Type (In Value %)

Individual Consumers

Corporate Clients

- Market Share of Major Players based on Value and Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Annual Revenues, Revenues by Financing Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Interest Rates, Unique Value Proposition, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis for Major Players

- Detailed Profiles of Major Companies

BDO Unibank

Metrobank

RCBC

Union Bank of the Philippines

EastWest Bank

Mitsubishi Motors Philippines Corp.

Toyota Financial Services Philippines

Honda Cars Philippines

Ford Philippines

Isuzu Philippines Corporation

Nissan Philippines, Inc.

Hyundai Asia Resources, Inc.

Suzuki Philippines, Inc.

Kia Philippines

Chery Auto Philippines

- Market Demand and Utilization

- Consumer Preferences and Budget Allocations

- Regulatory and Compliance Needs

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030