Market Overview

The Philippines Cold Chain Market is valued at USD 1.3 billion in 2024, reflecting a robust growth trajectory driven by increasing consumer demand for perishable goods and the expansion of the food service industry. This market is propelled by factors such as urbanization, rising populations, and changing consumption patterns, creating a pressing need for efficient cold chain logistics solutions. The emphasis on food safety and quality standards among manufacturers and distributors contributes significantly to the market’s growth in the region.

Major cities like Manila, Cebu, and Davao dominate the cold chain market due to their strategic locations, economic activities, and growing urban populations. Manila, as the capital, is a central hub for logistics and trade, making it a prime target for investments in cold chain infrastructure. The rapid expansion of the food processing and e-commerce sectors in these cities has further reinforced their dominance, driving the demand for temperature-controlled transportation and storage facilities.

Technological advancements in logistics and refrigeration technology significantly contribute to the growth of the cold chain market in the Philippines. The introduction of advanced automated inventory management systems and IoT-enabled monitoring solutions allows for real-time tracking of temperature and product quality. In 2023, the number of refrigerated vehicles equipped with modern technology was over 30,000, reflecting a growing trend of embracing hybrid and electric-powered trucks for sustainability.

Market Segmentation

By Refrigerated Transportation Type

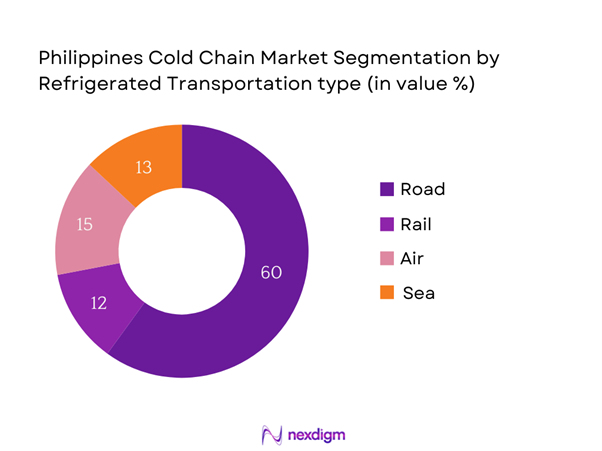

The Philippines Cold Chain Market is segmented by refrigerated transportation type into road, rail, air, and sea. Currently, the road refrigeration segment leads the market, accounting for a significant share due to the widespread use of trucks for food delivery and logistics. The convenience and flexibility offered by road transportation makes it indispensable for both urban and rural distribution of perishable goods, enhancing the supply chain’s efficiency. Reliable road networks, coupled with a growing fleet of refrigerated vehicles, have significantly contributed to its dominance in the market.

By Temperature Control System

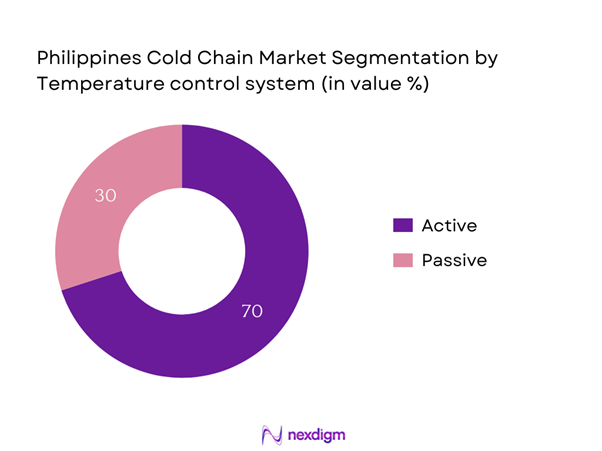

The market is further segmented by temperature control system into active and passive systems. Active temperature control systems hold the largest market share, driven by their ability to maintain precise temperature settings throughout the logistics process. They offer better reliability and tracking capabilities, essential for sensitive products, especially in the pharmaceutical and biotechnology sectors. The increasing adoption of IoT technology in active systems is also facilitating better real-time monitoring, significantly enhancing operational efficiency.

Competitive Landscape

The Philippines Cold Chain Market is characterized by the presence of key players, maintaining a competitive edge through advanced technology and innovative logistics solutions. Companies like Thermo King, GEFCO, and others lead the marketplace by developing specialized services that cater to various sectors, including food processing and pharmaceuticals. This concentration of major firms indicates a strong competitive landscape, focused on quality service and efficiency.

| Company | Establishment Year | Headquarters | Refrigerated Fleet Size | Market Coverage | Key Services | Innovation Focus |

| Thermo King | 1962 | Delaware, USA | – | – | – | – |

| GEFCO | 1949 | France | – | – | – | – |

| Prime Cold Logistics | 2008 | Manila, Philippines | – | – | – | – |

| Nikken Logistics | 1990 | Tokyo, Japan | – | – | – | – |

| RAC Logistics | 1995 | Manila, Philippines | – | – | – | – |

Philippines Cold Chain Market Analysis

Growth Drivers

Urbanization and Population Growth

Urbanization is a significant driver of the Philippines Cold Chain Market, with the urban population reaching approximately 57 million, representing over 50% of the total population. This rapid urbanization is driven by economic opportunities, leading to increased demand for fresh and perishable goods in urban areas. As cities like Manila, Cebu, and Davao grow, the need for efficient cold chain logistics becomes paramount to ensure food safety and quality. Additionally, the country’s population is projected to grow to 118 million, further amplifying consumer demand for a steady supply of perishable products.

Increasing Demand for Perishable Goods

The demand for perishable goods in the Philippines is on the rise due to rapidly changing consumer preferences and dietary habits. In 2023, per capita seafood consumption was approximately 42 kg, with poultry and meat consumption also rising. The growing middle-class population, which is estimated at around 26 million, shows a higher inclination towards purchasing fresh produce and meat products. This trend necessitates an efficient cold chain infrastructure capable of maintaining freshness and extending shelf life. As consumer awareness around food safety increases, the demand for refrigerated transport systems continues to grow.

Market Challenges

High Operational Costs

High operational costs present a considerable challenge to the Philippines Cold Chain Market. The cost of electricity in the country is among the highest in Southeast Asia, averaging at around USD 0.13 per kWh in 2023. Additionally, the maintenance costs of refrigerated vehicles and equipment can significantly increase operational expenses, particularly for smaller logistics firms. The combined effect of these factors can result in shrinking profit margins. Furthermore, logistics companies are burdened with the need to continuously upgrade their facilities and technology to meet evolving regulations, placing additional financial pressure on operations.

Regulatory Compliance

Regulatory compliance poses another significant challenge for those operating within the cold chain market. The Philippines’ regulatory landscape requires adherence to strict food safety standards mandated by the Food and Drug Administration (FDA). Failure to comply can lead to hefty fines and operational disruptions. As of 2023, over 75% of food distributors faced challenges maintaining compliance due to the complexity of regulations concerning temperature control, transport, and storage practices. Continuous monitoring and training are essential to meet these regulatory demands, which can be burdensome for logistics operators.

Opportunities

Expansion of E-Commerce

The growth of e-commerce is a transformative opportunity for the Philippines Cold Chain Market, with online grocery sales in the country reaching an estimated value of USD 1.6 billion in 2023. As more consumers shift towards online shopping for perishable products, the demand for efficient cold chain logistics is expected to escalate. Filipino online platforms are currently expanding their offerings to include a wider variety of fresh produce and meat products, necessitating a reliable cold chain network for timely deliveries. This trend highlights the potential for cold chain providers to innovate and integrate their services with e-commerce solutions.

Growth in Food Processing Sector

The food processing sector in the Philippines is a vital opportunity for cold chain growth, with the industry valued at around USD 30 billion in 2023 and projected to grow as domestic consumption continues to rise. Increased investments in food processing technologies and facilities drive the need for reliable cold chain solutions to ensure that perishable goods maintain their quality from production to consumption. With a significant portion of processed goods requiring temperature control, cold chain logistics providers are well-positioned to expand their services in tandem with this burgeoning sector.

Future Outlook

Over the next five years, the Philippines Cold Chain Market is expected to exhibit substantial growth driven by continuous urbanization, technological advancements in logistics, and a rising consumer preference for fresh and safe food products. The collaboration between the public and private sectors is crucial for enhancing cold chain infrastructure, which will further facilitate the penetration of innovative logistics solutions across the archipelago.

Major Players

- Thermo King

- GEFCO

- Prime Cold Logistics

- Nikken Logistics

- RAC Logistics

- Cold Chain Technologies

- Manila Cold Storage

- DB Schenker

- Kuehne + Nagel

- APL Logistics

- JRS Express

- Transmolder Cold Chain

- Cosmos Group

- APM Terminals

- UTI Worldwide

Key Target Audience

- Food Manufacturer Executives

- Food Retailers and Distributors

- Cold Storage Facility Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Trade and Industry, Department of Agriculture)

- Pharmaceutical and Biotech Companies

- Logistic Service Providers

- Food Quality and Safety Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines Cold Chain Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Philippines Cold Chain Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cold chain logistics providers to acquire detailed insights into product segments, service performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Philippines Cold Chain Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization and Population Growth

Increasing Demand for Perishable Goods

Technological Advancements - Market Challenges

High Operational Costs

Regulatory Compliance - Opportunities

Expansion of E-commerce

Growth in Food Processing Sector - Trends

Adoption of IoT in Cold Chain

Sustainable Practices - Government Regulation

Standards for Temperature Control

Compliance with Health Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Refrigerated Transportation Type (In Value %)

Road

Rail

Air

Sea - By Temperature Control System (In Value %)

Active

Passive - By Application (In Value %)

Food and Beverage

Pharmaceuticals

Biotechnology - By End-User Sector (In Value %)

Retail

Food Service

Healthcare - By Region (In Value %)

Luzon

Visayas

Mindanao

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Distribution Points, Number of Vehicles, Operational Capacity, Unique Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Thermo King

GEFCO

Prime Cold Logistics

JRS Express

Cold Chain Technologies

Nikken Logistics

Ryder

DB Schenker

Kuehne + Nagel

APL Logistics

APM Terminals

Manila Cold Storage

Cosmos Group

Transmolder Cold Chain

RAC Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030