Market Overview

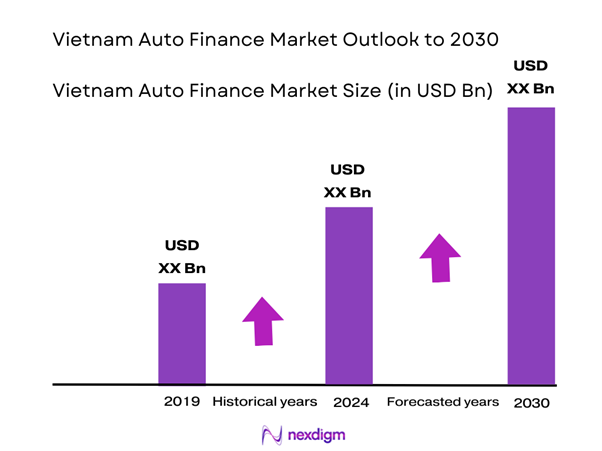

The Vietnam Auto Finance market is valued at USD 6.45 billion in 2024 with an approximated compound annual growth rate (CAGR) of 12.12% from 2024-2030, demonstrating a robust growth trajectory fueled by rising disposable incomes and increasing vehicle ownership. This market is predominantly driven by the growing demand for auto loans, with financial institutions expanding their offerings to cater to a wider consumer base. The availability of competitive interest rates and flexible financing options has further accelerated this growth, making financing more accessible to the average consumer.

Key cities such as Ho Chi Minh City and Hanoi dominate the Vietnam Auto Finance market due to their significant economic activities, dense population, and high vehicle registration rates. These urban centers are characterized by increased consumer awareness regarding financing options, and local policies encouraging automobile ownership. Furthermore, the presence of major financial institutions and auto dealers in these cities facilitates streamlined access to auto financing, contributing to their market dominance.

The auto financing landscape in Vietnam is evolving, with more financial institutions providing tailored products to meet consumer needs. In 2022, around 67% of all vehicles purchased were financed through loans, compared to 50% in 2018, reflecting a growing reliance on credit. Furthermore, as fintech solutions proliferate, lending becomes more accessible, particularly for younger, tech-savvy consumers.

Market Segmentation

By Loan Type

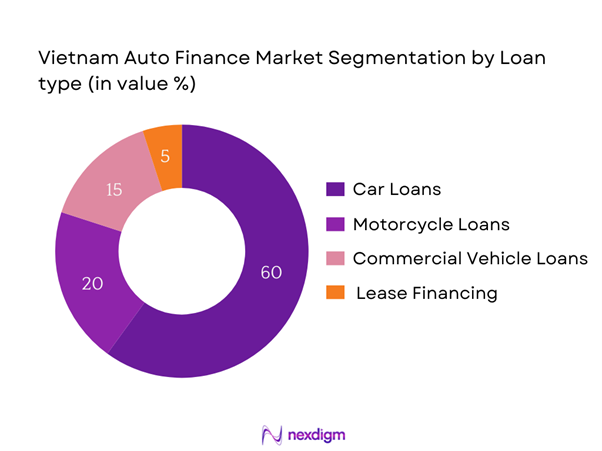

The Vietnam Auto Finance market is segmented by loan type into car loans, motorcycle loans, commercial vehicle loans, and lease financing. Among these segments, car loans hold a dominant market share, driven by the surge in private vehicle ownership as urban lifestyles evolve. Increased availability of competitive loan products and attractive promotional financing options offered by banks and financial institutions have contributed to this trend. The growing middle-class population, with a higher propensity to spend on personal vehicles, also enhances the demand for car loans.

By Customer Segment

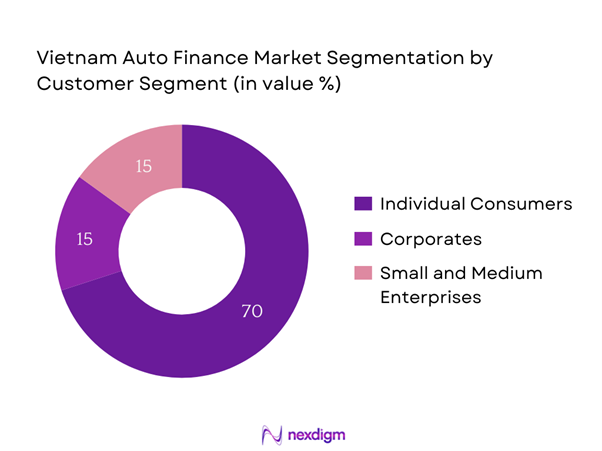

The market is further segmented by customer type into individual consumers, corporates, and small and medium enterprises (SMEs). Individual consumers are the leading segment due to the growing trend of personal mobility solutions among Vietnam’s youthful population. The rise in e-commerce and delivery services has triggered a demand for fleet financing among SMEs, though individual consumers still maintain a preferential disposition towards obtaining personal auto loans. This trend is expected to continue as financial literacy increases and more consumers opt for financing options for vehicle purchases.

Competitive Landscape

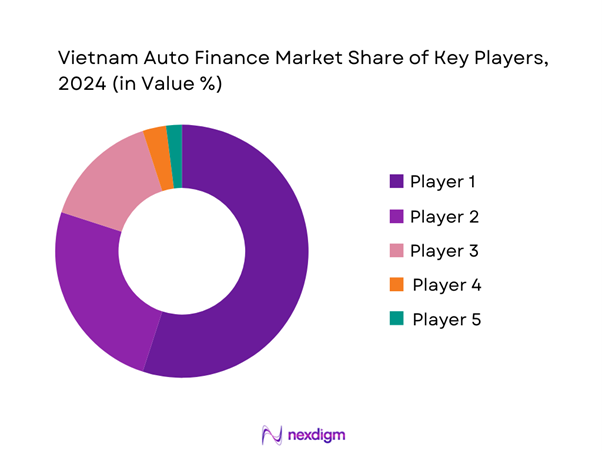

The Vietnam Auto Finance market is competitive, predominantly featuring established players along with emerging fintech companies. Major players include local banks as well as international banks offering Vietnamese consumers a variety of auto financing options. The competitive landscape ensures that consumers benefit from lower interest rates and better loan conditions.

| Company Name | Establishment Year | Headquarters | Market Share | Number of Branches | Customer Segments Served | Key Offerings |

| Vietcombank | 1963 | Hanoi | – | – | – | – |

| BIDV | 1957 | Hanoi | – | – | – | – |

| Techcombank | 1993 | Hanoi | – | – | – | – |

| Military Bank | 1994 | Hanoi | – | – | – | – |

| VPBank | 1993 | Hanoi | – | – | – | – |

Vietnam Auto Finance Market Analysis

Growth Drivers

Rise in Vehicle Ownership

Vietnam has witnessed a remarkable increase in vehicle ownership, with over 4.2 million newly registered vehicles in 2022, a significant leap from previous years. This surge is fueled by increasing personal incomes and a growing middle-class population, which has reached around 40 million people as of 2022. The annual vehicle ownership growth rate is expected to stay robust, driven by urbanization trends, with more than 45% of the population living in urban areas by end of 2025. This rising affluence enables more consumers to invest in personal transportation options, thus propelling the auto finance market.

Economic Growth and Urbanization

Vietnam’s GDP growth rate was approximately 8% in 2022, showcasing a strong recovery following the pandemic’s economic impact. This growth is complemented by rapid urbanization; as urban centers expand, disposable incomes rise, allowing consumers to allocate more resources toward vehicle purchases. The urban population is projected to reach 50% of the total population by end of 2025, thereby increasing the demand for transportation solutions, including auto financing. Additionally, rising employment opportunities in urban areas contribute to greater access to loans for vehicle purchases.

Market Challenges

High Default Rates

One of the major challenges facing the Vietnam Auto Finance market is the issue of high default rates among borrowers. Data from 2022 indicates that delinquency rates for auto loans reached approximately 3.8%, leading to increased risk for financial institutions. The Central Bank has expressed concern regarding these rates, which remain above industry benchmarks. A combination of borrowers’ limited financial literacy and increased economic pressures could exacerbate defaults, necessitating enhanced borrower education programs and stricter lending criteria to mitigate this risk.

Regulatory Hurdles

The regulatory environment for auto financing in Vietnam often presents significant challenges. Complexities surrounding documentation requirements can deter potential borrowers; for instance, recent studies indicate that nearly 30% of loan applications are rejected due to incomplete paperwork. Moreover, compliance with regulations set forth by the State Bank of Vietnam requires financial institutions to maintain stringent criteria, which, while aimed at protecting consumers, can also limit funding access for low-income borrowers. These hurdles create a barrier for many potential customers who may be interested in financing a vehicle.

Opportunities

Digital Transformation

The rapid adoption of digital technologies presents substantial opportunities for the Vietnam Auto Finance market. The number of internet users in Vietnam reached around 71 million in 2022, representing about 70% of the population, and increasing smartphone penetration is driving further digital engagement. As consumers become more comfortable with online transactions, financial institutions are increasingly utilizing digital platforms to enhance the loan application process, making financing more accessible. This shift is expected to improve customer experiences and broaden the market reach, particularly among younger demographics.

Growing Middle-Class Affluent Segment

The expanding middle-class segment in Vietnam is creating significant opportunities for auto finance. With approximately 40% of the population belonging to the middle class currently, and forecasts suggesting this will increase to 70% by 2030, there is a strong potential market for auto loans. Affluence in this demographic is prompting lifestyle changes, where owning a vehicle is becoming a necessity rather than a luxury. The increasing propensity to spend on automobiles will drive demand for financing options tailored to this growing segment

Future Outlook

Over the next several years, the Vietnam Auto Finance market is poised for significant growth, driven by continuous government support, increasing urbanization, and a burgeoning middle-class population seeking personal mobility solutions. Additionally, advancements in digital finance are expected to make auto loans more accessible and efficient, further stimulating market demand. With changing consumer preferences towards financing alternatives, including digital platforms, the market is moving towards greater inclusivity and flexibility in auto financing options.

Major Players

- Vietcombank

- BIDV

- Techcombank

- Military Bank

- VPBank

- Sacombank

- MBBank

- LienVietPostBank

- ACB Bank

- Ocean Bank

- SHB Bank

- HDBank

- Agribank

- Eximbank

- SeABank

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (State Bank of Vietnam)

- Financial Institutions

- Auto Manufacturers

- Automotive Dealerships

- Payment Processing Companies

- Fleet Management Companies

- Consumer Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Auto Finance Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam Auto Finance Market. This includes assessing market penetration, the ratio of financing providers to consumers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple financial institutions and automobile dealers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Auto Finance market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in Vehicle Ownership

Economic Growth and Urbanization

Increased Financing Options - Market Challenges

High Default Rates

Regulatory Hurdles - Opportunities

Digital Transformation

Growing Middle-Class Affluent Segment - Trends

Shift Towards Green Financing

Increasing Use of Fintech Solutions - Government Regulation

Policies Affecting Credit Availability

Compliance and Consumer Protection Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Loan Type (In Value %)

Car Loans

Motorcycle Loans

Commercial Vehicle Loans

Lease Financing - By Customer Segment (In Value %)

Individual Consumers

Corporates

Small and Medium Enterprises (SMEs) - By Distribution Channel (In Value %)

Banks

Non-Banking Financial Companies (NBFCs)

Online Platforms - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Interest Rate Type (In Value %)

Fixed Rate

Floating Rate

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Loan Type, Distribution Channels, Number of Dealers/Branches, Marketing Tactics, Consumer Engagement Practices, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Loan Types for Major Players

- Detailed Profiles of Major Companies

Vietcombank

BIDV

Sacombank

Techcombank

Military Bank

VPBank

VietinBank

MBBank

SeABank

FPT Corporation

HD Bank

LienVietPostBank

Ocean Bank

SHB Bank

HDBank

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030