Market Overview

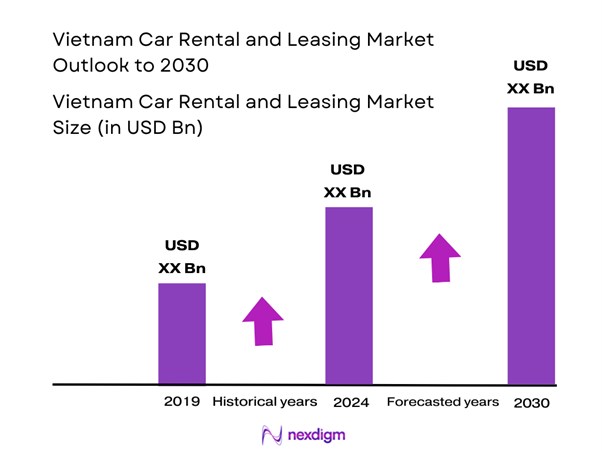

The Vietnam car rental and leasing market is valued at USD 0.77 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 13.83% from 2025-2030, supported by the rising demand for flexible mobility solutions and an increasing trend in domestic tourism. The market is driven by factors such as growing urbanization, a surge in business travel, and a preference for rental services over ownership, as consumers prioritize convenience and cost-effectiveness.

Specific cities dominate the market, including Ho Chi Minh City, Hanoi, and Da Nang. These urban centers are experiencing rapid development, leading to higher tourism rates and a significant influx of businesses. Ho Chi Minh City, as the economic hub, attracts numerous corporate clients who require rental services for business travel. Hanoi, with its historical significance, draws tourists and travelers, while Da Nang’s strategic location as a tourist destination amplifies car rental demand. Together, these cities create a robust market for car rental and leasing services.

The rise of e-commerce in Vietnam is reshaping consumer behavior, with a reported growth of around 18% annually in the e-commerce sector, expected to reach USD 23 billion by 2025. This boom results in increased business travel as companies seek to meet the demand for quick and reliable logistics. Alongside this growth, the number of business trips taken is expected to escalate, creating a higher demand for short-term rental vehicles.

Market Segmentation

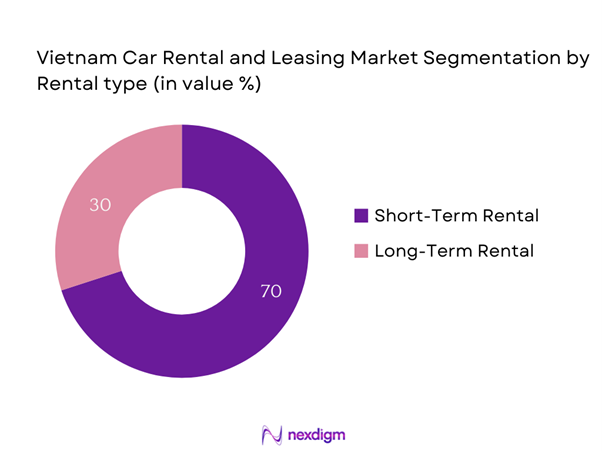

By Rental Type

The Vietnam car rental market is segmented into short-term rentals and long-term rentals. Short-term rentals dominate the market primarily due to the increasing number of tourists and business travelers seeking flexible transportation solutions. The convenience of hiring a vehicle for short durations aligns well with the preferences of domestic and international travelers, especially in urban areas where public transportation may not meet all needs. Service providers are enhancing their offerings with various vehicle options and competitive pricing, further consolidating the short-term rental segment’s position.

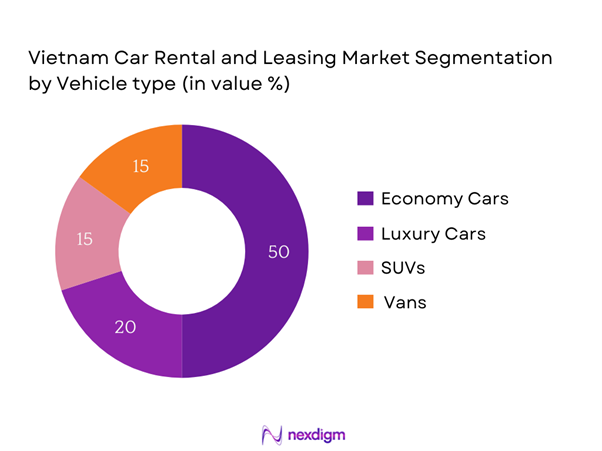

By Vehicle Type

The market is further segmented by vehicle type into economy class, luxury vehicles, SUVs, and vans/minivans. The economy class vehicle segment captures the largest share due to affordability and accessibility, catering to a diverse audience ranging from budget travelers to local businesses. The rising number of young professionals and students seeking economical travel options bolsters this segment. Additionally, with ongoing promotions and flexible rental policies, consumers are increasingly inclined towards economy class vehicles, solidifying their dominance in the Vietnam car rental market.

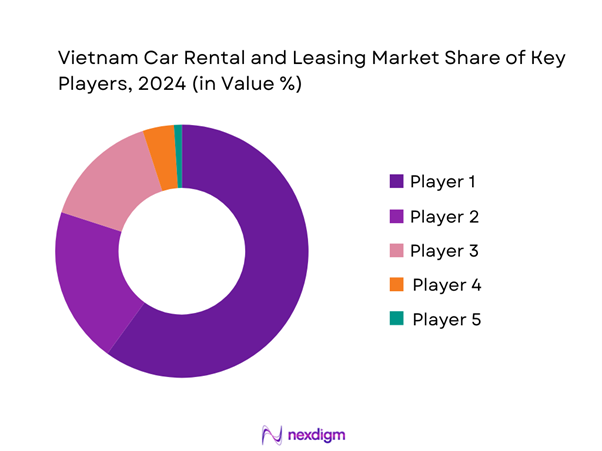

Competitive Landscape

The Vietnam car rental market is dominated by several key players, including both local and international brands. Major players such as Thue Xe Viet and Avis Vietnam leverage their established networks and strong brand presence to maintain market leadership. The competitive landscape is characterized by an increasing number of players offering diverse services, fostering innovation and competitive pricing, which enhances consumers’ choices in the marketplace.

| Company | Establishment Year | Headquarters | Market Presence | Fleet Size | Service Offerings | Customer Focus |

| Thue Xe Viet | 2000 | Ho Chi Minh City | – | – | – | – |

| Avis Vietnam | 1996 | Ho Chi Minh City | – | – | – | – |

| Budget Vietnam | 2005 | Hanoi | – | – | – | – |

| VITRANSTO | 2008 | Da Nang | – | – | – | – |

| Sixt Vietnam | 2012 | Ho Chi Minh City | – | – | – | – |

Vietnam Car Rental and Leasing Market Analysis

Growth Drivers

Rise in Domestic Tourism

Vietnam is experiencing remarkable growth in domestic tourism, supported by government initiatives to promote local travel. In 2022, Vietnam welcomed approximately 102 million domestic tourists, which is an increase from 88 million in 2019, fueled by a growing middle-class population and improving disposable incomes. The World Bank indicates that Vietnam’s GDP per capita is projected to reach USD 4,700 by end of 2025, contributing to a heightened demand for car rental services as more citizens travel both for leisure and business purposes. The substantial increase in tourism leads to a rising need for flexible and convenient transportation options, directly benefiting the car rental sector.

Increasing Urbanization

Urbanization in Vietnam is steadily progressing, with the urban population projected to constitute around 40% of the total population by end of 2025. This rapid urban migration has created increased demand for transportation solutions, including car rentals. The government estimates that urbanization has contributed to the growth of key cities like Ho Chi Minh City and Hanoi, where the annual average income has risen by approximately 8% per year, enhancing the need for flexible travel solutions. As urban areas expand, the necessity for easily accessible car rental options becomes paramount, which drives market growth.

Challenges

Regulatory Barriers

The Vietnam car rental market faces significant regulatory barriers, which can impede growth. The government has introduced various licensing requirements for rental agencies, which include extensive documentation and compliance procedures. In 2023, approximately 30% of rental businesses experienced operational delays due to stringent regulations. Additionally, the Ministry of Transport has set regulations requiring all rented vehicles to meet emissions standards, which can pose financial challenges for smaller operators who may struggle to comply with these requirements. Regulatory complexities can deter potential entrants and limit competition within the market.

Competition from Ride-Hailing Services

The rise of ride-hailing services like Grab has disrupted the Vietnam car rental market significantly. In 2022, ride-hailing services accounted for nearly 45% of the daily transport market, effectively shifting consumer preferences towards convenience and lower costs. This increasing competition presents challenges for traditional car rental businesses, which must adapt their offerings to meet changing customer expectations. Additionally, with over 67% of urban dwellers now using mobile applications for transportation-related services, car rental companies are pressured to innovate and enhance service efficiency to maintain relevancy and competitiveness in this evolving landscape.

Opportunities

Eco-Friendly Vehicle Demand

The demand for eco-friendly vehicles is burgeoning in Vietnam as environmental awareness continues to rise among consumers. With the government targeting a reduction of greenhouse gas emissions by 20% by end of 2025, there is a parallel increase in demand for electric vehicles (EVs) and hybrid options in the rental fleet. Sales for electric vehicles surged by over 120% from 2021 to 2022, showcasing a clear trend towards sustainable transport solutions. As car rental companies integrate more eco-friendly options, they can leverage this growing trend to attract environmentally conscious customers, thus enhancing their market positioning.

Technological Advancements in Booking Systems

Current advancements in technology, particularly in online booking systems, present immense opportunities for the car rental sector. In Vietnam, the IT sector is projected to contribute over 8% to the national GDP by end of 2025, facilitating the development of efficient digital platforms. Consumers now prefer seamless online rental experiences, with 70% of bookings anticipated to be made through mobile apps by 2025. Companies that embrace technological solutions can enhance customer engagement and operational efficiency, thereby capitalizing on the growing reliance on digital services in the travel sector.

Future Outlook

Over the next five years, the Vietnam car rental and leasing market is projected to experience substantial growth driven by evolving consumer preferences, a surge in urban mobility demands, and increasing vehicular accessibility through technology. As local and international tourism continues to thrive, alongside the rise of remote work and business trips, the mobility needs of consumers will diversify, promoting further innovation and service enhancement within the sector. Additionally, the ongoing digital transformation fosters competitive dynamics, providing opportunities for growth and expansion.

Major Players

- Thue Xe Viet

- Avis Vietnam

- Budget Vietnam

- VITRANSTO

- Sixt Vietnam

- Hertz Vietnam

- Tugo Vietnam

- VinFast Car Rental

- com.vn

- VN Car

- ThueXeToanLan

- Car Rental Vietnam

- MyRentACar

- HaNoi Car Rental

- EcoRentals

Key Target Audience

- Corporate Clients

- Small and Medium Enterprises (SMEs)

- Tour Operators

- Travel Agencies

- Local Businesses

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Transport)

- Automotive Enthusiasts

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves building a comprehensive ecosystem map that incorporates all key stakeholders within the Vietnam car rental and leasing market. This step utilizes extensive desk research, leveraging both secondary and proprietary databases to gather relevant industry-level information. The primary goal is to identify and define the essential variables that influence market dynamics and consumer behaviors.

Step 2: Market Analysis and Construction

In this phase, historical data on the Vietnam car rental and leasing market is compiled and analyzed. This analysis includes assessing market penetration, categorizing the number of rental service providers, and quantifying the resultant revenue generation. Importantly, an evaluation of customer satisfaction and property quality metrics will be undertaken to ensure data accuracy and reliability in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in prior steps will be validated through structured interviews with industry experts from diverse sectors. These consultations yield valuable insights on operational trends and financial health, directly from practicing professionals. Such qualitative data is instrumental in refining existing market data and understanding market sentiment.

Step 4: Research Synthesis and Final Output

In the final phase, direct interactions with main car rental providers will occur to acquire detailed insights into vehicle segments, sales performance, consumer preferences, and other pertinent factors. This engagement serves to verify and complement statistics derived from the previously mentioned methodologies, ensuring a comprehensive, accurate, and validated analysis of the Vietnam car rental and leasing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Key Historical Developments

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in Domestic Tourism

Increasing Urbanization

Growth of E-commerce and Business Travel - Market Challenges

Regulatory Barriers

Competition from Ride-Hailing Services - Opportunities

Eco-Friendly Vehicle Demand

Technological Advancements in Booking Systems - Trends

Shift to Subscription Models

Demand for Integrated Mobility Solutions - Government Regulation

Vehicle Licensing and Standards

Consumer Protection Laws - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rate, 2019-2024

- By Rental Type (In Value %)

Short-Term Rentals

Long-Term Rentals - By Vehicle Type (In Value %)

Economy Class

Luxury Vehicles

SUVs

Vans and Minivans - By Customer Type (In Value %)

Corporate Clients

Individual Consumers - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Booking Channel (In Value %)

Online Platforms

Travel Agents

Direct Rentals

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Customer Service Offerings, Fleet Composition, Technological Integration, and Sustainability Practices)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Vehicle Types for Major Players

- Detailed Profiles of Major Companies

Thue Xe Viet

Tugo Vietnam

Gia Huy Rent Car

Avis Vietnam

Budget Vietnam

Sixt Vietnam

Hertz Vietnam

VITRANSTO

Oto.com.vn

VN Car

VCars

ThueXeToanLan

Vietnam Local Rent

Car Rental Vietnam

Rent-A-Car Vietnam

- Market Demand and Utilization

- Customer Preferences and Insights

- Regulatory and Compliance Requirements

- Decision-Making Process

- Travel Behavior Patterns

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Rate, 2025-2030