Market Overview

The Vietnam Cold Chain Market is valued at USD 1.2 billion in 2024, with an approximated compound annual growth rate (CAGR) of 9% from 2024-2030, based on a five-year historical analysis. The market’s growth is primarily driven by the increasing demand for perishable goods, including fresh fruits, vegetables, and pharmaceuticals, resulting from rising urbanization and changing consumption patterns. Moreover, advancements in refrigeration technology and logistics infrastructure, supported by government initiatives to improve food safety and quality, are fostering the development of this sector.

Key dominant cities in the Vietnam Cold Chain Market include Ho Chi Minh City and Hanoi. Ho Chi Minh City, as an economic hub, hosts a significant portion of the logistics infrastructure and cold storage facilities, catering to the increasing demand from the food and beverage industry. Hanoi, being the political capital, benefits from government infrastructure investments and is central to policies promoting modernized supply chains, thereby enhancing cold chain logistics and services in the region.

The food processing industry in Vietnam has seen substantial growth, valued at approximately USD 20 billion in 2022, reflecting a robust expansion rate as reported by various economic surveys. This growth is driven by both domestic consumption and exports, with food processing becoming a critical sector for employment and economic diversification. Consequently, there is a corresponding need for enhanced cold chain infrastructure to support the processing, storage, and distribution of perishable products.

Market Segmentation

By Type

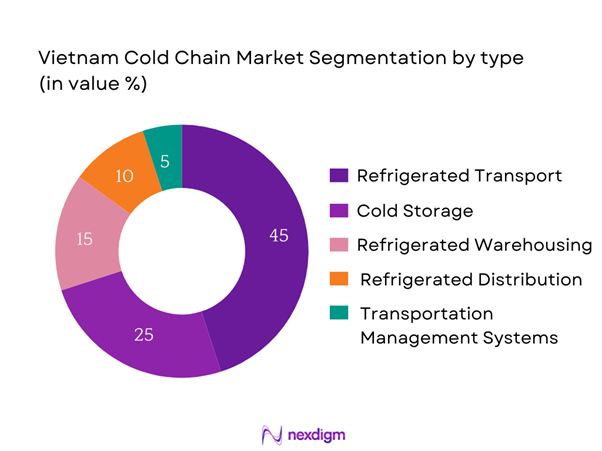

The Vietnam Cold Chain Market is segmented by type into refrigerated transport, cold storage, refrigerated warehousing, refrigerated distribution, and transportation management systems. Among these, refrigerated transport dominates the market due to its critical role in ensuring that temperature-sensitive products maintain quality during transit. The rapid growth of eCommerce and increasing demand for fresh food deliveries have further solidified the importance of refrigerated transport. Major players are investing in fleets equipped with temperature-controlled capabilities, addressing consumer preferences for freshness and safety in food delivery.

By Application

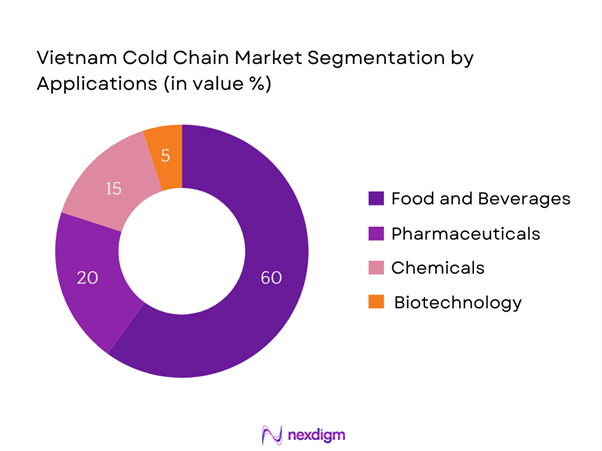

The market is also segmented by application into food and beverages, pharmaceuticals, chemicals, and biotechnology. The food and beverages segment accounts for the largest share due to the Vietnamese population’s rising consumption of fresh produce and processed foods. With a growing focus on food safety and quality standards, stakeholders are increasingly prioritizing efficient cold chain solutions that enhance product shelf life and comply with regulatory requirements.

Competitive Landscape

The Vietnam Cold Chain Market is dominated by several major players, including local companies and international brands. Key companies leverage their logistics capabilities, technological innovations, and extensive distribution networks to capture market share. Consolidation among these firms highlights the market’s competitive nature, where having a robust operational footprint and strategic partnerships is crucial for success.

| Company Name | Establishment Year | Headquarters | Total Revenue | Cold Storage Facilities | Fleet Size | Temperature Monitoring System | Product Portfolio | Market Strategy |

| VIETPHAT Group | 1999 | Ho Chi Minh City | – | – | – | – | – | – |

| Cold Storage THANG LOI | 2005 | Hanoi | – | – | – | – | – | – |

| TransContinental | 2010 | Ho Chi Minh City | – | – | – | – | – | – |

| Vinamilk | 1976 | Ho Chi Minh City | – | – | – | – | – | – |

| CJ Logistics | 2017 | South Korea | – | – | – | – | – | – |

Vietnam Cold Chain Market Analysis

Growth Drivers

Expanding Urban Population

The urban population of Vietnam is projected to surpass 51% of the total population by end of 2025, driven by rapid urbanization trends. According to the World Bank, urban areas in Vietnam are experiencing significant growth, with cities like Ho Chi Minh City and Hanoi becoming economic powerhouses. This increasing urban concentration leads to higher demand for fresh produce, dairy, and other perishable goods, necessitating effective cold chain logistics to maintain product freshness and safety during transport and storage. As urban areas continue to grow, the demand for efficient cold chain services is expected to rise correspondingly.

Increasing Demand for Perishable Goods

In Vietnam, the demand for perishable goods—spanning fresh produce, meat, and dairy products—has surged, reflecting a growing middle class and changing dietary preferences. The food and beverage sector reportedly contributed USD 58 billion to the national economy in 2022, showcasing the rising consumer appetite for high-quality food products. As consumer awareness about food safety and nutrition increases, there is a heightened need for cold chain facilities to ensure minimal spoilage and maximum quality throughout the supply chain. This trend positions the cold chain industry at the core of food distribution and retailing.

Market Challenges

High Operational Costs

Operational costs for maintaining cold chain logistics in Vietnam are notably high, with estimates suggesting that businesses can incur costs upwards of 30% more than traditional logistics due to the need for specialized equipment and energy consumption. The national average electricity cost is around USD 0.07 per kWh, which significantly impacts refrigeration costs. Moreover, the volatility in fuel prices, particularly due to global supply chain disruptions, puts additional strain on cold chain operators, limiting their ability to expand services to meet rising demand.

Regulatory Compliance Issues

Cold chain operators in Vietnam face stringent regulatory compliance challenges, particularly regarding food safety and quality standards mandated by the Ministry of Health. The government has been implementing strict regulations under the Food Safety Law, requiring businesses to adhere to specific temperature controls for perishable goods. Compliance with these regulations often necessitates significant investment in training and infrastructure. Failure to meet these standards can lead to penalties and loss of business, thereby impacting the overall growth potential of the cold chain market.

Market Opportunities

Technological Advancements

The integration of advanced technologies in cold chain logistics presents significant opportunities for growth in Vietnam. Technologies such as automated temperature monitoring and smart logistics systems can enhance efficiency and reduce energy consumption. The current logistics and transportation market is valued at approximately USD 25 billion, with tech adoption projected to increase operational efficiencies by around 20%. Therefore, companies standing at the forefront of technology adoption are likely to gain a competitive edge by improving service quality and reliability in cold chain management.

Adoption of IoT in Cold Chain

The current landscape of cold chain logistics also presents substantial opportunities through the adoption of Internet of Things (IoT) technology. Presently, the IoT market in Vietnam is experiencing exponential growth, with a potential reach of USD 7 billion by end of 2025. This technology can help monitor and optimize cold chain processes in real-time, ensuring compliance with safety standards and reducing wastage. Enhanced traceability and data analytics through IoT can significantly improve operational efficiency and boost market confidence in quality perishable goods, thereby unlocking further growth.

Future Outlook

Over the next five years, the Vietnam Cold Chain Market is expected to witness significant expansion, driven by continuous government support, advancements in cold chain technology, and increasing demand for perishable goods. As urbanization accelerates and consumer preferences shift toward fresh and safe food options, investments in cold storage solutions and refrigerated transport will be paramount. Furthermore, regulatory initiatives aimed at improving food safety standards will act as a catalyst for market growth, encouraging stakeholders to enhance their cold chain operations.

Major Players

- VIETPHAT Group

- Cold Storage THANG LOI

- TransContinental

- Vinamilk

- CJ Logistics

- Long An Cold Storage

- GNH Logistics

- Seabrook Logistics

- Kuehne + Nagel

- Maers

- Sinotrans

- BS Transport

- United Logistics

- Logista Vietnam

- BHG Group

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Ministry of Industry and Trade)

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Logistics and Supply Chain Operators

- Retail Chains and Supermarkets

- Agricultural Producers and Exporters

- Cold Storage Facility Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all major stakeholders within the Vietnam Cold Chain Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather detailed industry-level information. The objective is to define and understand the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Vietnam Cold Chain Market is compiled and analyzed. This includes assessing market penetration, the relationship between marketplaces and service providers, and revenue generation. An evaluation of service quality statistics will be performed to ensure the reliability and accuracy of the revenue estimates derived.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through interviews with industry experts and practitioners across various companies involved in cold chain logistics. These consultations will provide operational and financial insights that will help refine and corroborate the market data presented.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with multiple cold chain service providers to acquire detailed insights regarding product segments, sales performance, consumer preferences, and other relevant factors. This interaction will serve to verify and complement the statistics gathered from prior analyses, thus ensuring a comprehensive, accurate, and validated representation of the Vietnam Cold Chain Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Trends

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Expanding Urban Population

Increasing Demand for Perishable Goods

Growth of the Food Processing Industry - Market Challenges

High Operational Costs

Regulatory Compliance Issues - Market Opportunities

Technological Advancements

Adoption of IoT in Cold Chain - Trends

Shift Towards Sustainable Cold Chain Solutions

Enhancements in Cold Chain Technology - Government Regulation

Food Safety Regulations

Export and Import Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Refrigerated Transport

Cold Storage

Refrigerated Warehousing

Refrigerated Distribution

Transportation Management Systems - By Application (In Value %)

Food and Beverages

Pharmaceuticals

Chemicals

Biotechnology - By End-User Industry (In Value %)

Retail

Wholesale

E-commerce - By Distribution Channel (In Value %)

Direct Distribution

Third-Party Logistics (3PL)

Last-Mile Delivery - By Region (In Value %)

North Vietnam

Central Vietnam

South Vietnam

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue Analysis, Distribution Networks, Market Positioning, and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

VIETPHAT Group

Cold Storage THANG LOI

TransContinental

Vinamilk

Deutsche Post DHL

SSV Logistics

Long An Cold Storage

GNH Logistics

Seabrook Logistics

Kuehne + Nagel

CJ Logistics

Maersk

Sinotrans

BS Transport

Transworld

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Needs

- Consumer Preferences and Trends

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030