Market Overview

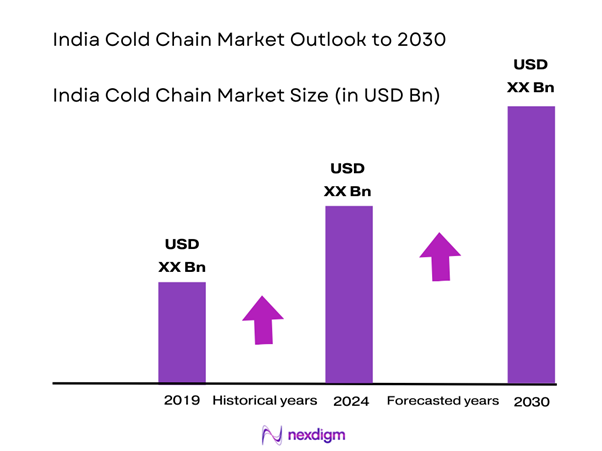

The India Cold Chain Market is valued at approximately USD 10,601.3 million in 2024 with an approximated compound annual growth rate (CAGR) of 23% from 2024-2030, reflecting significant growth driven by rising demand for perishable goods and an expanding retail infrastructure. The growth is attributed to the increasing need for effective transportation and storage solutions in the food and pharmaceutical sectors, alongside government investments aimed at enhancing logistics capabilities in the country.

Key cities such as Mumbai, Delhi, and Bengaluru dominate the cold chain market due to their concentration of industries, retail establishments, and significant population densities. Additionally, these cities benefit from advanced infrastructure and connectivity, facilitating efficient supply chain and logistics operations. The presence of large consumer markets in these regions fosters growth opportunities for cold chain service providers, making them pivotal to the overall market landscape.

The Indian government has been actively promoting the cold chain sector through various initiatives and investments, including the Pradhan Mantri Kisan SAMPADA Yojana, which offers subsidies for infrastructure development. In the 2022 budget, the government allocated INR 1.5 trillion towards agricultural investment, focusing on enhancing food processing and cold storage facilities. This commitment is vital in mitigating post-harvest losses, which are estimated to be around 30% for fruits and vegetables. These efforts aim to create a robust cold chain ecosystem that supports farmers and the agri-business sector.

Market Segmentation

By Type of Cold Chain

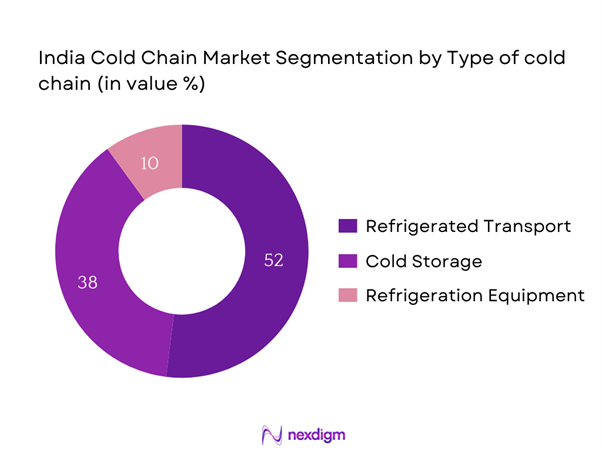

The India Cold Chain Market is segmented by type into refrigerated transport, cold storage, and refrigeration equipment. Among these, refrigerated transport holds a dominant market share due to its critical role in ensuring the timely delivery of perishable goods such as food products and pharmaceuticals. Efficient and speedy transportation methods have become paramount as consumer preferences shift toward fresh products. Additionally, advancements in refrigerated transport technology, such as IoT-enabled tracking and monitoring systems, further enhance operational efficiency and reliability, thereby propelling its leadership in the market.

By Application

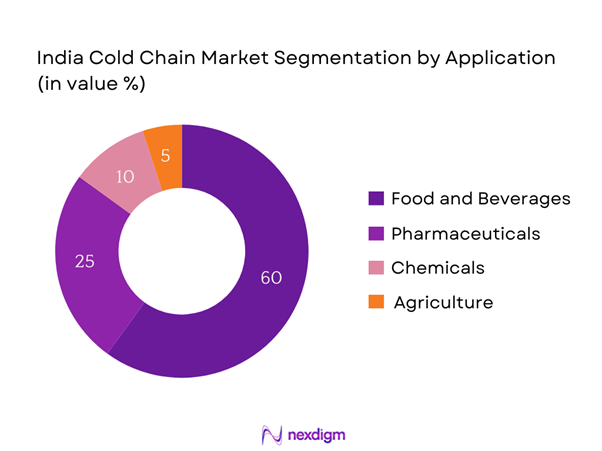

The market is segmented by application into food and beverage, pharmaceuticals, chemicals, and agriculture. The food and beverage segment dominates the market, driven by an increasing consumption of fresh foods and processed items. With growing urbanization and changing dietary preferences, this segment requires robust cold chain solutions to maintain product quality and safety. The rising trend of online grocery shopping further fuels demand as consumers seek fresh produce delivered directly to their homes. As a result, food and beverage applications are essential for industry growth and innovation.

Competitive Landscape

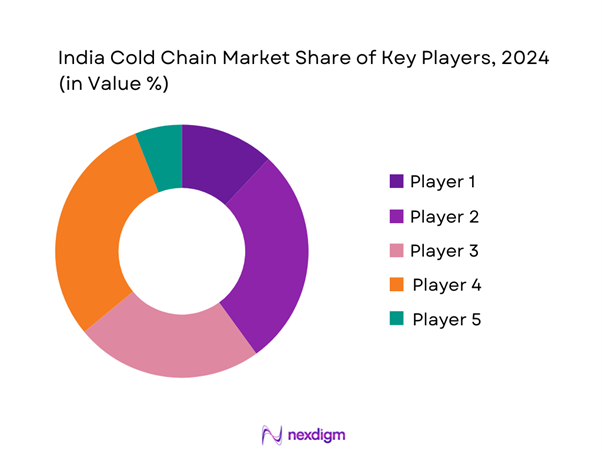

The India Cold Chain Market is dominated by a few major players, including established logistics and cold storage companies. The competitive landscape emphasizes the significant influence these companies have in driving market standards, technological advancement, and service efficiency.

| Company | Establishment Year | Headquarters | Revenue (Estimated) | Market Strategy | Key Offerings |

| Snowman Logistics | 1993 | Mumbai | – | – | – |

| Gati | 1989 | Gurgaon | – | – | – |

| ColdEx | 2005 | Delhi | – | – | – |

| XPS Cargo | 2009 | Bangalore | – | – | – |

| TCI Cold Chain | 2006 | New Delhi | – | – | – |

India Cold Chain Market Analysis

Growth Drivers

Increasing Demand for Perishables

The demand for perishable goods in India is surging due to a growing population and changing consumer preferences. The urban population is expected to reach 600 million by 2031, leading to increased consumption of fresh foods. According to the Food and Agriculture Organization (FAO), the volume of perishable goods in India is projected to grow by 40% over the next few years, driven by rising disposable incomes and health-conscious consumers. The increasing emphasis on nutritional foods necessitates substantial cold chain facilities to ensure quality maintenance from farm to consumer.

Rise in Organized Retail Sector

The organized retail sector in India is rapidly expanding, with the market projected to grow to USD 1 trillion by end of 2025. As per the Ministry of Commerce and Industry, the share of organized retail in total retail will rise from 8-10% in 2022 to nearly 30% in the next few years. This boom in organized retail is accompanied by growing consumer demand for fresh and high-quality perishable products, necessitating efficient cold chain solutions. Improved supply chain practices ensure that fresh products are delivered swiftly and safely, highlighting the essential role of cold chain logistics.

Market Challenges

High Capital Investment

The cold chain industry in India faces significant financial barriers, as establishing cold storage and transportation infrastructure requires substantial capital investment. An estimated INR 25,000 crores (approximately USD 3 billion) is needed annually to develop a complete cold chain infrastructure capable of minimizing food wastage and enhancing supply chain efficiency. Unfortunately, many smaller operators struggle to secure the funding necessary for such investments, thus limiting the overall development and scalability of the cold chain market in India.

Lack of Infrastructure

Infrastructure shortcomings remain a critical challenge for the cold chain sector in India, with only 12% of total produce being stored in cold storage facilities. The World Bank reports that India requires an additional 30 million tons of cold storage capacity to meet current demand effectively. This infrastructure gap results in significant post-harvest losses, especially in the horticulture sector, where losses can reach 40% due to inadequate cold chain facilities. Addressing this gap is essential for managing perishability and ensuring food security.

Opportunities

Growth in E-commerce

The rapid growth of e-commerce in India is presenting substantial opportunities for the cold chain market. With the e-commerce food delivery market expected to surpass USD 28 billion by end of 2025, logistics companies are scaling their cold chain capabilities to cater to consumer demands for fresh produce and temperature-sensitive items. Major players are adopting innovative technology to enhance efficiency and reduce delivery time, positioning themselves to capitalize on this growing e-commerce trend. Thus, the cold chain market is set to expand significantly, driven by increased reliance on e-commerce platforms by consumers.

Sustainability Trends

Sustainability trends are reshaping the cold chain landscape in India, presenting unique growth opportunities. With an increasing focus on eco-friendliness, companies are investing in energy-efficient refrigeration systems and sustainable packaging solutions. The government encourages sustainable practices by incentivizing investments in green technology, estimated at INR 10,000 crores (approximately USD 1.2 billion) allocated towards renewable energy in logistics by end of 2025. Industry players who embrace sustainability are expected to outperform traditional methods as demand for responsibly sourced products rises, fostering long-term growth in the cold chain market.

Future Outlook

Over the next five years, the India Cold Chain Market is expected to exhibit substantial growth driven by continuous government support, rising investments in infrastructure, and increasing consumer demand for perishable products. The advancement of cold chain technologies, such as automated storage systems and IoT for monitoring conditions, will enhance operational efficiency. Additionally, the growth of e-commerce platforms for food delivery will further bolster market expansion, creating opportunities for innovative solutions in logistics and storage.

Major Players

- Snowman Logistics

- Gati

- ColdEx

- XPS Cargo

- TCI Cold Chain

- Mahindra Logistics

- Future Supply Chain

- M. Logistics

- Delhivery

- Bansal Group

- Sheel Group

- Shree Malani Foams Pvt. Ltd.

- APL Logistics

- Blue Star

- Inlogic

Key Target Audience

- Retailers

- Food and Beverage Manufacturers

- Pharmaceuticals Companies

- Logistics Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Food Processing Industries, Food Safety and Standards Authority of India)

- Agricultural Producers

- Supply Chain Management Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Cold Chain Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Cold Chain Market is compiled and analyzed. This includes assessing market penetration, the ratio of cold chain service providers, and resultant revenue generation. Furthermore, a detailed evaluation of service quality indicators will be conducted to ensure both the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a broad spectrum of companies within the cold chain logistics sector. These consultations offer valuable operational and financial insights directly from practitioners, which is instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cold chain service providers to gain detailed insights into product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Cold Chain Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Perishables

Government Initiatives and Investments

Rise in Organized Retail Sector - Market Challenges

High Capital Investment

Lack of Infrastructure - Opportunities

Growth in E-commerce

Sustainability Trends - Trends

Advancements in Refrigeration Technologies

Shift Towards Automated Warehousing - Government Regulation

Standards Compliance

Policies Supporting Cold Chain Development - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Cold Chain (In Value %)

Refrigerated Transport

Cold Storage

Refrigeration Equipment - By Application (In Value %)

Food and Beverage

Pharmaceuticals

Chemicals

Agriculture - By Distribution Channel (In Value %)

Direct Sales

Online Platforms

Third-Party Logistics - By Region (In Value %)

Northern India

Southern India

Western India

Eastern India - By Technology Adoption (In Value %)

IoT-Enabled Solutions

Automated Systems

Conventional Methods

- Market Share of Major Players Based on Value/Volume

Market Share of Major Players by Type of Cold Chain Segment - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Segment, Distribution Channels, Number of Touchpoints, Production Capacity, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Arctic Refrigeration

ColdEx

Gati

Snowman Logistics

XPS Cargo

Udaan

Vishal Cold Storage

Delhivery

F&F Transportation

SRS Logistics

Agility

FR8-COOL

TCI Cold Chain

Mahindra Logistics

Allcargo Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030