Market Overview

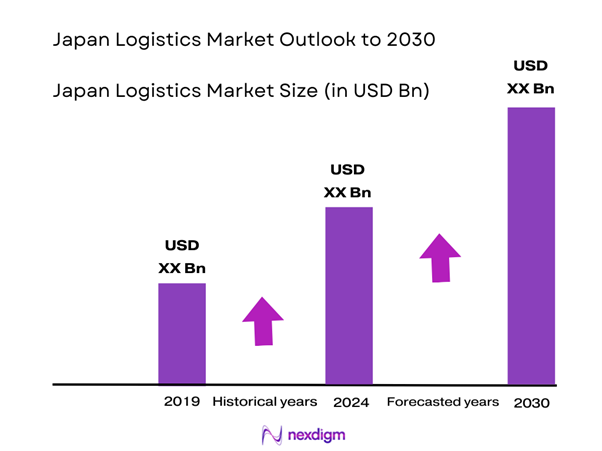

The Japan logistics market is valued at USD 278.6 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8% from 2024-2030, based on a comprehensive analysis of historical data. The growth is strongly driven by increasing e-commerce activity, advancements in technology, and government initiatives to improve infrastructure. The market is significantly influenced by the transformation towards digital logistics and automation, fostering efficiency in supply chains and operations.

Dominance in the logistics market emanates from major urban centers, particularly Tokyo, Osaka, and Nagoya. Tokyo serves as a crucial hub due to its extensive transportation networks and proximity to both domestic manufacturers and international shipping routes. Osaka boasts a strong industrial base, serving as a key logistics node for the western part of the country, while Nagoya’s strategic location enhances its appeal as a logistics hub, supporting diverse industries including automotive and manufacturing sectors.

The Japanese government has been actively investing in logistics infrastructure, allocating around JPY 2.7 trillion to enhance transportation networks and optimize supply chain operations through the 2025 fiscal budget. This investment is pivotal for modernizing ports, expanding rail networks, and improving highway conditions, which facilitate smoother logistics operations. The government’s “National Logistics Strategy” aims to streamline processes and reduce bottlenecks in the supply chain, enabling a more responsive logistics sector that aligns with the country’s growing demand for fast and efficient delivery services.

Market Segmentation

By Service Type

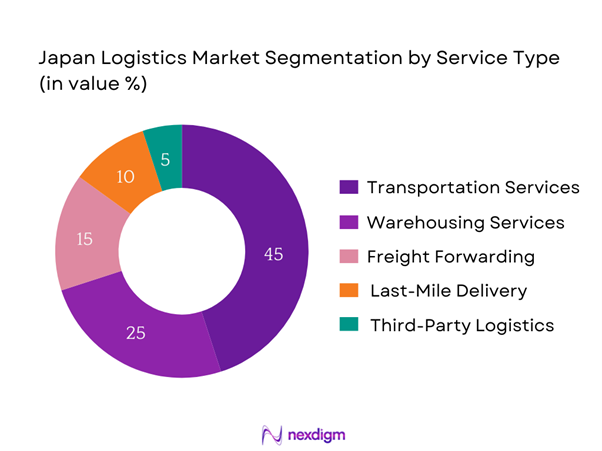

The Japan logistics market is segmented by service type into transportation services, warehousing services, freight forwarding, last-mile delivery, and third-party logistics (3PL). Within this segmentation, transportation services are expected to dominate the market. This dominance is attributed to the increasing reliance on efficient and timely delivery systems that are essential for meeting rising consumer expectations, particularly in the e-commerce sector. The growth in automotive and manufacturing industries further escalates the need for effective transportation solutions, solidifying transportation services’ market share.

By Industry Vertical

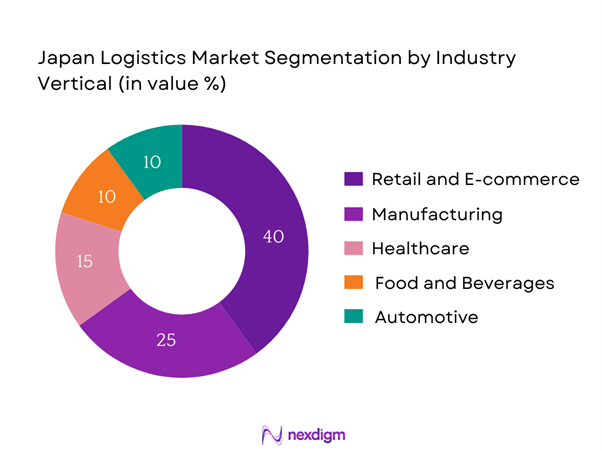

The market is further segmented by industry vertical, which includes retail and e-commerce, manufacturing, healthcare, food and beverages, and automotive. Retail and e-commerce hold a significant share, primarily driven by the explosive growth of online shopping and increased consumer demand for faster delivery times. The need for efficient warehousing and distribution networks in this segment is critical to managing inventory turnover and fulfilling online orders swiftly, showcasing its dominant role in the logistics market.

Competitive Landscape

The Japanese logistics market features a competitive landscape dominated by a few major players, including Nippon Express, Yamato Holdings, and Seino Holdings. This consolidation illustrates the significant influence of these key companies in shaping market trends and service standards, ensuring they remain at the forefront of innovation and operational excellence.

| Company | Establishment Year | Headquarters | Revenue (USD) | Market Share (%) | Employee Count | Key Service Focus |

| Nippon Express | 1872 | Tokyo, Japan | – | – | – | – |

| Yamato Holdings | 1919 | Tokyo, Japan | – | – | – | – |

| Seino Holdings | 1946 | Gifu, Japan | – | – | – | – |

| Kintetsu World Express | 1950 | Osaka, Japan | – | – | – | – |

| Japan Post Holdings | 2006 | Tokyo, Japan | – | – | – | – |

Japan Logistics Market Analysis

Growth Drivers

Increasing E-commerce Adoption

E-commerce in Japan has shown robust growth, propelled by a significant increase in online retail sales, which reached JPY 22 trillion in 2022. This growth is supported by a larger consumer base that increasingly turns to online shopping as a convenient alternative, particularly in urban areas. The share of e-commerce in total retail sales was approximately 9.8% in 2023, with projections to rise as more consumers engage with digital shopping platforms. The rise in mobile commerce also plays a role, with mobile sales expected to account for over 20% of all retail sales, underscoring the critical need for efficient logistics and delivery services.

Technological Advancements in Logistics

Innovations in technology continue to revolutionize the logistics landscape in Japan, with a notable increase in the use of automation and artificial intelligence (AI) in warehousing operations. The logistics technology market is estimated to surpass JPY 1 trillion by end of 2025, driven by the adoption of AI-powered inventory management systems and robotics for order fulfillment. These technologies significantly enhance operational efficiency, reducing labor costs and speeding up delivery times. Furthermore, the integration of big data analytics is aiding logistics firms in optimizing routes and supply chains, reflecting the vital role of modern technology in driving market growth.

Market Challenges

Rising Fuel Costs

The logistics sector in Japan is facing substantial pressure from rising fuel costs, with average prices for diesel fuel projected to remain around JPY 170 per liter in 2024. This increase, influenced by global oil price fluctuations, is impacting transportation costs and, subsequently, freight charges. The higher fuel prices pose significant challenges for logistics operators who must absorb or pass on these costs to consumers, thereby affecting profit margins and operational strategies. Furthermore, this scenario highlights the urgency for logistics firms to explore alternative fuels and energy-efficient vehicles to mitigate the financial impact on their operations.

Regulatory and Compliance Requirements

Compliance with evolving regulatory standards poses a challenge for the logistics sector in Japan, particularly concerning environmental regulations. The government has set stringent emissions targets, aiming for a reduction in logistics-related greenhouse gas emissions by 26% from 2013 levels by 2030. Adhering to these regulations involves significant investment in sustainable practices and technologies, including the adoption of electric vehicles and the implementation of carbon offset programs. As firms adapt to these regulations, the need for enhanced compliance strategies and operational adjustments becomes paramount, which can strain resources and increase operational complexity.

Opportunities

Growth of Smart Logistics

The ongoing growth in smart logistics presents significant opportunities for advancement in Japan’s logistics market. Currently, the market is experiencing a heightened interest in Internet of Things (IoT) solutions, with over 70% of logistics companies planning to implement IoT technologies by end of 2025. This shift towards advanced analytics and real-time tracking enables logistics firms to optimize supply chain management while enhancing visibility and responsiveness to customer demands. The increasing focus on smart logistics solutions is indicative of the market’s potential to harness technology for improved efficiency and cost savings, setting the stage for further growth in the upcoming years.

Expansion in Emerging Markets

Japanese logistics companies are exploring expansion opportunities in emerging markets, which are showcasing rapid growth in demand for logistics services. For example, Southeast Asia is projected to experience a logistics market boom, with market valuations expected to rise to USD 220 billion by end of 2025, driven by increasing consumer spending and the growth of e-commerce platforms. This trend presents an opportunity for Japanese logistics companies to leverage their expertise in efficient supply chain management and technology to establish a foothold in these lucrative markets. By expanding their operations into regions with less mature logistics infrastructure, Japanese firms can capitalize on new growth avenues while diversifying their service offerings and enhancing global competitiveness.

Future Outlook

Over the next five years, the Japan logistics market is expected to show significant growth driven by continuous advancements in logistic technologies, heightened e-commerce activities, and a growing emphasis on sustainability. The focus on automation and digital solutions will enhance operational efficiencies, meeting the increasing demand for logistics services while optimizing costs. Additionally, the government’s support for infrastructure development, coupled with the rise in health-conscious consumer behavior, will fuel the demand for advanced logistics solutions that cater to shifting marketplace dynamics.

Major Players

- Nippon Express

- Yamato Holdings

- Seino Holdings

- Kintetsu World Express

- Japan Post Holdings

- Hitachi Transport System

- Logitem Co., Ltd.

- BHT Co., Ltd.

- Maersk Line

- Geodis Japan K.K.

- Deutsche Post DHL Group

- Nippon Yusen Kabushiki Kaisha (NYK Line)

- Panasonic Logistics Company

- JFE Logistics Corporation

- SCS

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Land, Infrastructure, Transport and Tourism)

- Logistics and Supply Chain Management Professionals

- E-commerce Retailers

- Manufacturers with Supply Chain Operations

- Transport and Fleet Management Companies

- Retail and Wholesale Distribution Networks

- Industry Associations in Logistics and Transportation

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of key stakeholders within the Japan logistics market. This is achieved through extensive desk research that leverages a combination of secondary and proprietary databases for comprehensive industry-level information. The primary goal is to identify and define the critical variables that influence market dynamics, including economic factors, technological advancements, and consumer trends.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Japan logistics market is compiled and analyzed. This includes examining market penetration rates, the ratio of logistics service providers to market demand, and revenue generation statistics. Additionally, an assessment of service quality metrics will be conducted to ensure reliability and accuracy in revenue projections, facilitating an in-depth understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of logistics companies. These consultations yield valuable insights regarding operational practices, market trends, and financial performance, which play a crucial role in refining and corroborating the market data collected thus far.

Step 4: Research Synthesis and Final Output

The final phase of the methodology entails engaging with multiple logistics service providers to gather detailed insights into product offerings, sales performance, consumer preferences, and relevant factors affecting the Japan logistics market. This direct interaction aids in verifying and complementing the statistics derived from the bottom-up approach, ensuring a comprehensive and validated analysis of market conditions and future trajectories.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-commerce Adoption

Government Initiatives for Infrastructure Development

Technological Advancements in Logistics - Market Challenges

Rising Fuel Costs

Regulatory and Compliance Requirements - Opportunities

Growth of Smart Logistics

Expansion in Emerging Markets - Trends

Automation and Robotics in Warehousing

Sustainability Initiatives - Government Regulation

Transportation Safety Regulations

Environmental Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Transportation Services

Warehousing Services

Freight Forwarding

Last-Mile Delivery

Third-Party Logistics (3PL) - By Industry Vertical (In Value %)

Retail and E-commerce

Manufacturing

Healthcare

Food and Beverages

Automotive - By Region (In Value %)

Kanto Region

Kansai Region

Chubu Region

Kyushu Region - By Mode of Transport (In Value %)

Road

Rail

Air

Sea - By Customer Segment (In Value %)

Large Enterprises

SMEs

Individual Consumers

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Logistics Service Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Service Type, Number of Touchpoints, Distribution Channels, Capacity, Unique Value Offering, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Services for Major Players

- Detailed Profiles of Major Companies

Nippon Express Co., Ltd.

Yamato Holdings Co., Ltd.

Seino Holdings Co., Ltd.

SCSK Corporation

Kintetsu World Express, Inc.

Japan Post Holdings Co., Ltd.

Hitachi Transport System, Ltd.

Logitem Co., Ltd.

BHT Co., Ltd.

Maersk Line

Geodis Japan K.K.

Deutsche Post DHL Group

Nippon Yusen Kabushiki Kaisha (NYK Line)

Panasonic Logistics Company

JFE Logistics Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030