Market Overview

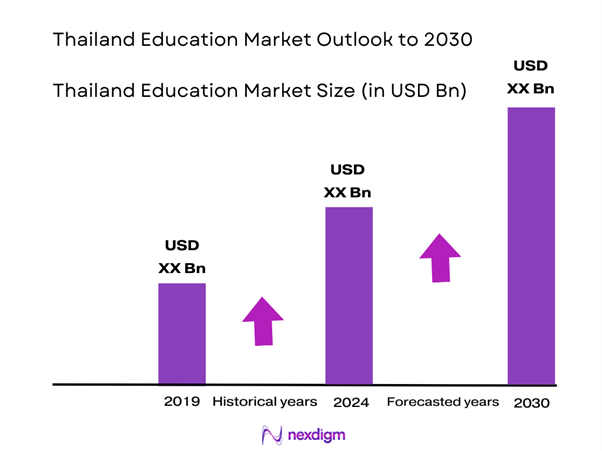

The Thailand education market is valued at USD 22 billion, based on a five-year historical analysis. The market is driven by significant government investments aimed at improving educational infrastructure, along with a rising demand for quality educational services among the population. Furthermore, the growing urban middle-class demographic is increasingly prioritizing education, leading to higher spending on private schooling and supplemental educational services.

The major cities dominating the Thailand education market include Bangkok, Chiang Mai, and Phuket. Bangkok serves as the educational hub due to the concentration of top universities and international schools, attracting both local and expatriate students. Chiang Mai is recognized for its unique cultural educational offerings while Phuket’s growing expatriate community drives demand for international education options.

In recent years, the Thai government has increased its investment in education, allocating approximately USD 5.9 billion in the fiscal budget for education for 2023. This funding is aimed at improving the quality of educational infrastructure and promoting access to education, particularly in rural areas. Additionally, the government initiated the “Education 4.0” policy to enhance the education system’s alignment with the demands of the 21st century workforce. This initiative includes budgeting for updated technology and teacher training programs to foster a modern educational environment conducive to learning.

Market Segmentation

By Education Level

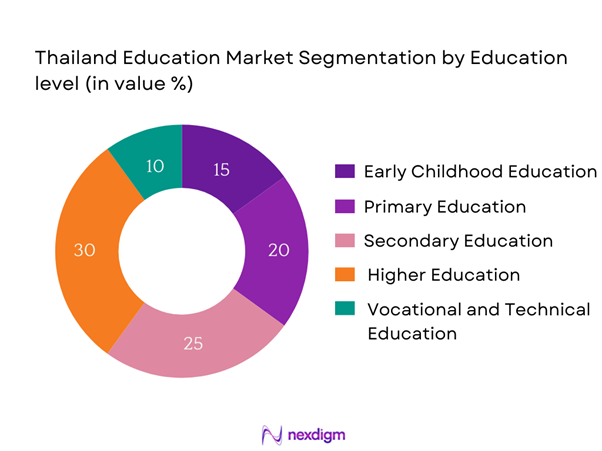

The Thailand education market is segmented by education level into early childhood education, primary education, secondary education, higher education, and vocational and technical education. Among these, higher education holds a dominant market share due to the increasing emphasis on obtaining advanced degrees in a competitive job market. Institutions such as Chulalongkorn University and Mahidol University have established high reputations, which attract both local and international students. The trend of pursuing higher education is further supported by government initiatives aimed at increasing accessibility and affordability, contributing to robust enrollment figures.

By Type of Institution

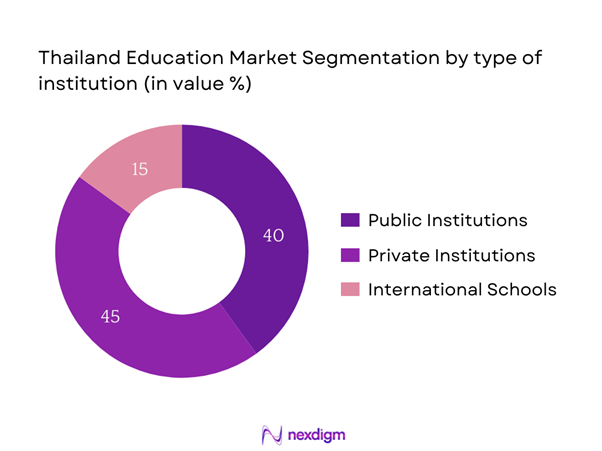

The market segmentation in Thailand’s education sector is categorized by type of institution, including public institutions, private institutions, and international schools. The private institutions segment is leading the market due to their ability to offer tailored, English-based curricula that appeal to both local families and expatriates. Private schools often provide smaller class sizes and additional resources, enhancing educational quality. Additionally, international schools attract a diverse student population, further driving the demand for specialized educational offerings.

Competitive Landscape

The Thailand education market is dominated by a mixture of influential local institutions and international players. Major companies, including Bangkok University and Chulalongkorn University, set the educational standards and cater to a diverse range of learners. The concentration of these educational institutions highlights their influence in shaping educational policies and practices within the country.

| Company Name | Establishment Year | Headquarters | Number of Students | Programs Offered | Academic Reputation | Partnerships |

| Bangkok University | 1962 | Bangkok | – | – | – | – |

| Chulalongkorn University | 1917 | Bangkok | – | – | – | – |

| Mahidol University | 1888 | Nakhon Pathom | – | – | – | – |

| Assumption University | 1969 | Bangkok | – | – | – | – |

| Thammasat University | 1934 | Bangkok | – | – | – | – |

Thailand Education Market Analysis

Growth Drivers

Increasing Demand for Skilled Workforce

Thailand’s labor market is undergoing significant transformation, with the World Bank projecting that the demand for skilled workers will rise sharply as the nation shifts towards more knowledge-based industries. By end of 2025, it anticipates that nearly 70% of employment opportunities will require specialized skills, increasing the focus on higher education and vocational training. As such, educational institutions are responding by expanding their curricula to include more STEM (Science, Technology, Engineering, and Mathematics) courses, as these fields are considered essential for future job growth.

Growth in EdTech Sector

The EdTech sector in Thailand has experienced remarkable growth, with market revenues estimated at over USD 1 billion in 2023. This growth is largely driven by the widespread adoption of digital learning tools and platforms, accelerated by the pandemic. Government policies are supporting this shift, with initiatives that aim to integrate ICT (Information and Communication Technology) into education. The Ministry of Education’s “Smart Classroom” initiative aims to establish 1,500 smart classrooms across the country by the end of 2025, facilitating more interactive and engaging learning experiences.

Market Challenges

Infrastructure Limitations

Despite the positive developments in the educational sector, infrastructure limitations persist, particularly in rural regions. The Ministry of Education reports that around 25% of schools in rural areas lack adequate facilities, including access to clean water and functioning restrooms. Moreover, approximately 20% of educational institutions still do not have reliable internet access, which hampers the effective implementation of digital learning resources. Addressing these infrastructural challenges is crucial for ensuring equitable access to education across Thailand.

Disparities in Educational Access

There are notable disparities in educational access across Thailand, heavily influenced by geographic and socioeconomic factors. The National Economic and Social Development Council indicates that children from low-income families in rural regions are significantly less likely to complete their education, with dropout rates reaching 15% at the secondary level. This inequality poses challenges for achieving national educational goals, as it limits opportunities for socio-economic mobility among disadvantaged groups.

Opportunities

Expansion of Online Learning Platforms

The demand for online learning platforms is growing rapidly in Thailand, driven by the increasing digital literacy of the population. As of 2023, over 50% of Thai students are reported to use online resources for their studies, reflecting a shift towards flexible and accessible learning solutions. The government’s support in fostering an e-learning environment is evidenced by the recent roll-out of training programs for teachers to enhance their digital teaching skills. Consequently, the expansion of online learning presents a significant opportunity for entrepreneurs and companies looking to invest in the EdTech sector.

Collaboration with International Institutions

International partnerships in education are becoming increasingly prevalent in Thailand, as local institutions seek to enhance their global standing. For instance, over 150 Thai universities are currently collaborating with foreign institutions, providing programs that promote international standards. Such collaborations not only improve educational quality but also attract international students, fueling the growth of the education market. Furthermore, the Ministry of Education is actively encouraging more joint programs and scholarships to facilitate knowledge exchange and capacity building.

Future Outlook

Over the coming years, the Thailand education market is expected to experience significant growth driven by ongoing government policy reforms, increased demand for skill development in alignment with labor market needs, and an expansion of EdTech solutions. Advancements in technology will continue to transform traditional educational paradigms, fostering greater accessibility and quality in learning experiences across diverse segments.

Major Players

- Bangkok University

- Chulalongkorn University

- Mahidol University

- Thammasat University

- Assumption University

- King Mongkut’s Institute of Technology

- International School of Bangkok

- Rangsit University

- Chiang Mai University

- Naresuan University

- Khon Kaen University

- Srinakharinwirot University

- Dhurakij Pundit University

- Burapha University

- Assumption College

Key Target Audience

- Government and Regulatory Bodies (Ministry of Education, Office of the Education Council)

- Investment and Venture Capitalist Firms

- Private Education Sector Investors

- Non-Governmental Organizations (NGOs) in Education

- Educational Technology Providers

- Corporate Training and Development Firms

- Educational Publishers and Content Providers

- International Accreditation Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all significant stakeholders within the Thailand education market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The goal is to identify and define the critical variables that influence market dynamics such as education levels, institutional types, and government policies.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Thailand education market will be compiled and analyzed. This includes evaluating enrollment figures, program offerings, revenue generation, and the landscape of educational service providers. An assessment of service quality statistics will also be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts. These experts will represent a diverse array of educational institutions and organizations. Their insights will provide valuable operational and financial perspectives, which are instrumental in refining and corroborating the market data collected.

Step 4: Research Synthesis and Final Output

The final phase will involve engaging with multiple educational institutions to acquire detailed insights into their program offerings, enrollment performance, and consumer preferences. This interaction will serve to verify and complement the information derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Thailand education market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Context and Evolution

- Significant Milestones in the Education Sector

- Current Macroeconomic Environment

- Education System Structure and Governance

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Investment in Education

Increasing Demand for Skilled Workforce

Growth in EdTech Sector - Market Challenges

Infrastructure Limitations

Disparities in Educational Access - Opportunities

Expansion of Online Learning Platforms

Collaboration with International Institutions - Trends

Emphasis on Global Competitiveness

Adoption of Innovative Teaching Methods - Government Regulation

Standardization and Quality Assurance

Policies Supporting Lifelong Learning - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Enrollment Numbers, 2019-2024

- By Average Cost per Student, 2019-2024

- By Education Level (In Value %)

Early Childhood Education

Primary Education

Secondary Education

Higher Education

Vocational and Technical Education - By Type of Institution (In Value %)

Public Institutions

Private Institutions

International Schools - By Mode of Delivery (In Value %)

Traditional Classroom-Based

Online Learning

Blended Learning - By Region (In Value %)

Northern Thailand

Northeastern Thailand

Central Thailand

Southern Thailand - By Subject Area (In Value %)

STEM Education

Humanities and Social Sciences

Arts and Physical Education

- Market Share of Major Players on the Basis of Value/Volume

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Revenue Metrics, Distribution Channels, Technological Adoption, Institutional Collaborations, Market Presence, and other)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Educational Offerings

- Detailed Profiles of Major Companies

Bangkok University

Chulalongkorn University

Mahidol University

Kasetsart University

Thammasat University

Assumption University

King Mongkut’s Institute of Technology Ladkrabang

International School of Bangkok

Ramkhamhaeng University

Siam University

Khon Kaen University

Chiang Mai University

Naresuan University

Srinakharinwirot University

Dhurakij Pundit University

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Enrollment Numbers, 2025-2030

- By Average Cost per Student, 2025-2030