Market Overview

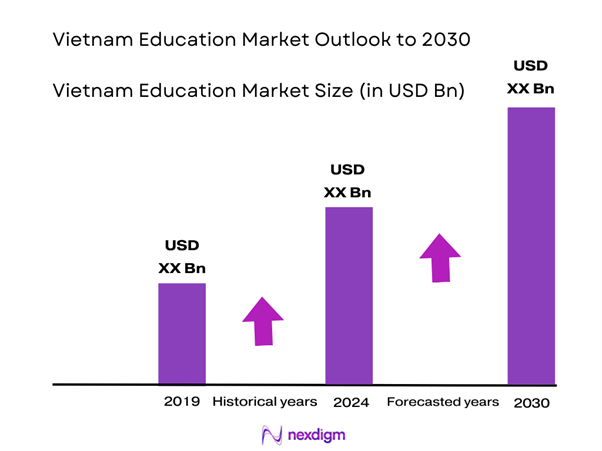

The Vietnam Education Market is valued at USD 10 billion based on a five-year historical analysis. This growth is driven by the increasing enrollment rates in primary and secondary education, along with the growing demand for higher education and vocational training. The government’s investment in education and the sophisticated integration of technology in educational institutions have further enhanced the market’s expansion, catering to a population of over 97 million individuals, with approximately 38% aged below 24.

Major cities like Ho Chi Minh City, Hanoi, and Da Nang dominate the education market due to their dense population, economic growth, and concentration of educational institutions. Ho Chi Minh City, the economic hub, showcases a high number of private and international schools, while Hanoi, the political center, hosts some of the country’s top universities. The presence of diverse educational offerings in these cities attracts both domestic and international students, boosting their dominance in the market.

Ongoing government educational reforms, backed by a commitment to improve quality and inclusivity, are radically reshaping Vietnam’s education landscape. In 2023, the Ministry of Education and Training announced a significant budget allocation of 30 trillion VND (approximately USD 1.29 billion) for the 2022-2025 period dedicated to upgrading educational facilities and resources. Additionally, revisions to the curriculum emphasize practical skills crucial for labor market integration, aiming to ensure that 50% of universities align their programs to industry standards by end of 2025.

Market Segmentation

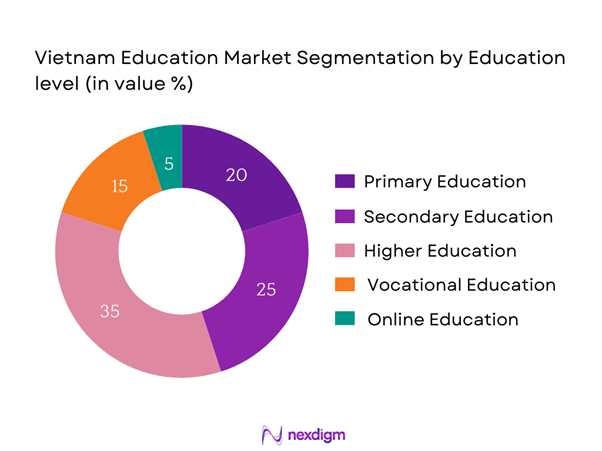

By Education Level

The Vietnam Education Market is segmented by education level into primary education, secondary education, higher education, vocational education, and online education. Higher education currently dominates the market share due to the increasing demand for skilled labor and advanced qualification among students. An emphasis on science, technology, engineering, and mathematics (STEM) education has led to the establishment of numerous universities and colleges that cater to this demand. Furthermore, government initiatives aimed at expanding access to higher education have resulted in greater enrollment and investment in this sub-segment.

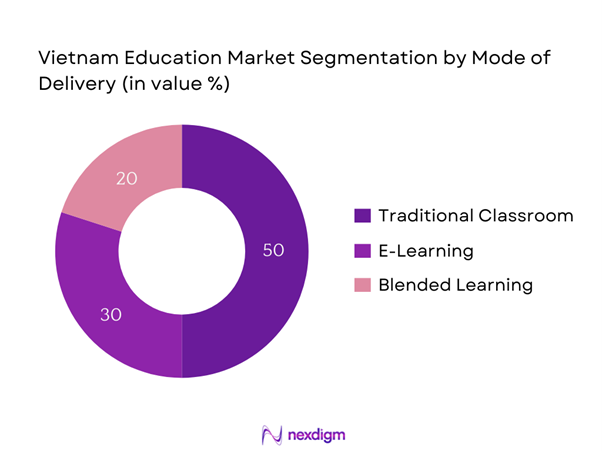

By Mode of Delivery

The Vietnam Education Market is also segmented by mode of delivery, which includes traditional classroom education, e-learning, and blended learning. E-learning is the fastest growing segment, largely due to the increasing penetration of the internet and mobile devices among the youth. The COVID-19 pandemic accelerated the adoption of e-learning solutions, leading to significant investments from both educational institutions and private companies. The flexibility and accessibility offered by e-learning platforms cater to a diverse range of learners, making it a popular choice across urban and rural areas.

Competitive Landscape

The Vietnam Education Market is dominated by a few major players, reflecting a competitive landscape that includes local institutions and international collaborations. Key players like Vietnam National University and FPT University have established themselves by providing comprehensive educational services and curricula tailored to market demands. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Student Enrollment | Courses Offered | E-Learning Services | Market Share (%) |

| Vietnam National University | 1906 | Hanoi | – | – | – | – |

| FPT University | 2006 | Hanoi | – | – | – | – |

| Hoa Sen University | 2006 | Ho Chi Minh City | – | – | – | – |

| Hanoi University | 1956 | Hanoi | – | – | – | – |

| RMIT University Vietnam | 2001 | Ho Chi Minh City | – | – | – | – |

Vietnam Education Market Analysis

Growth Drivers

Increasing Demand for Skilled Labor

The demand for skilled labor in Vietnam is escalating, driven by the rapid economic development that resulted in a GDP growth rate of 8% in 2022, according to the World Bank. As industries evolve, the requirement for a more educated workforce that can meet the challenges of advanced technology and globalization has intensified. The government has recognized this need, subsequently expanding vocational training programs, which reported a total enrollment of about 1.2 million students in 2023. This shift reflects both private and public sectors aligning education with labor market needs to enhance employability.

Rise of Technology in Education

The integration of technology in education is experiencing substantial momentum in Vietnam. The number of internet users in Vietnam reached 70 million in 2023, enabling access to digital learning platforms and resources. Government initiatives, such as implementing a “Digital Transformation Program in Education to 2025,” promote the use of technology-enhanced learning, with over 1,500 educational applications currently supporting student learning nationwide. The growing adoption of EdTech solutions serves to enhance educational accessibility, particularly in rural areas, bridging the digital divide effectively.

Market Challenges

Quality Disparities

A significant challenge facing the Vietnam Education Market is the disparity in educational quality across urban and rural regions. According to the Vietnam National Institute of Education Sciences, only 45% of rural students achieve national proficiency standards in mathematics and reading by grade 9, compared to 75% in urban areas. This quality gap is exacerbated by inadequate infrastructure, limited access to qualified teachers, and funding discrepancies, impeding overall educational equity. The need for targeted investments to remediate these disparities remains critical for holistic national development.

Funding Limitations

Funding limitations significantly hinder advancements within the Vietnam Education Market. The allocation for education still faces competition from other pressing sectors, resulting in insufficient resources. The total government expenditure on education was around 18.9% of total government expenditure in 2023, which is below the global average of 20%. This constrained funding leads to challenges in hiring qualified teachers, maintaining facilities, and providing up-to-date educational materials, thereby limiting educational outcomes and innovation. Addressing these fiscal challenges is essential for fostering long-term educational improvements.

Opportunities

Growth in EdTech Solutions

The current landscape suggests strong growth potential in EdTech solutions, as the demand for innovative learning methods rises. The number of EdTech startups in Vietnam reached over 200 in 2023, exemplifying a burgeoning sector poised to redefine education delivery through technology. The increasing popularity of blended learning approaches indicates that educational providers are increasingly seeking to invest in digital platforms, enhancing accessibility and engagement. Moreover, the prevalence of mobile devices among students presents significant opportunities for the development and scaling of mobile-based educational applications, catering to diverse learning needs.

International Collaboration

International collaboration presents a vital opportunity for Vietnam’s educational institutions to enhance curriculum quality and teaching methodologies. In 2023, over 30 foreign universities partnered with Vietnamese institutions to offer joint programs, providing students with a global perspective and access to advanced learning resources. The government has actively pursued international educational partnerships, recognizing that such collaboration can contribute to raising the standards of education. Increased exchange programs and dual degree offerings are expected to enhance learning experiences and improve graduate employability in the global job market.

Future Outlook

Over the next five years, the Vietnam Education Market is expected to exhibit significant growth driven by government support for educational expansion, technological advancements in e-learning, and the increasing demand for high-quality education. As the labor market evolves, the emphasis on vocational and technical training will also rise, aligning educational outcomes with industry needs. The surge in private educational institutions and public-private partnerships will further propel market development.

Major Players

- Vietnam National University

- FPT University

- Hoa Sen University

- Hanoi University

- RMIT University Vietnam

- International University

- University of Danang

- British International School

- Smart Kids International School

- University of Economics Ho Chi Minh City

- University of Social Sciences and Humanities

- Ton Duc Thang University

- Hanoi University of Science and Technology

- Vietnam National Academy of Music

- Saigon International University

Key Target Audience

- Investments and Venture Capitalist Firms

- Ministry of Education and Training

- Local Education Authorities (Department of Education and Training)

- Educational Technology Companies

- Non-Governmental Organizations (NGOs) focused on education

- Corporate Training Providers

- Private Educational Institutions

- International Schools and Institutes

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Education Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam Education Market. This includes assessing enrollment rates, the ratio of educational institutions to student populations, and the resultant revenue generation. A thorough examination of service quality statistics will also be conducted to verify the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of educational institutions and stakeholders. These consultations will yield valuable operational insights and financial data directly from market practitioners, contributing to a more nuanced understanding of market conditions.

Step 4: Research Synthesis and Final Output

The final phase involves direct collaboration with multiple educational organizations to acquire detailed insights into program offerings, student demographics, market trends, and consumer preferences. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam Education Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Historical Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Skilled Labor

Government Educational Reforms

Rise of Technology in Education - Market Challenges

Quality Disparities

Funding Limitations - Opportunities

Growth in EdTech Solutions

International Collaboration - Trends

Shift Towards STEM Education

Emphasis on Soft Skills Development - Regulatory Framework

Government Policies

Accreditation Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Enrollment Numbers, 2019-2024

- By Average Tuition Fees, 2019-2024

- By Education Level (In Value %)

Primary Education

Secondary Education

Higher Education

Vocational Education

Online Education - By Mode of Delivery (In Value %)

Traditional Classroom

E-Learning

Blended Learning - By Subject (In Value %)

Science

Humanities

Technology

Business Education - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Governance Type (In Value %)

Public Education

Private Education

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Streams, Market Penetration, Customer Base, Technological Advancements, and others)

- SWOT Analysis of Major Players

- Pricing Analysis by Type of Education

- Detailed Profiles of Major Companies

Vietnam National University

FPT University

Hoa Sen University

Hanoi University

University of Danang

RMIT University Vietnam

International University

British International School

Smart Kids International School

University of Economics Ho Chi Minh City

University of Social Sciences and Humanities

Ton Duc Thang University

Hanoi University of Science and Technology

Vietnam National Academy of Music

Saigon International University

- Student Demographics

- Enrollment Trends

- Parental Involvement and Decision Making

- Institutional Preferences and Pain Points

- By Value, 2025-2030

- By Enrollment Numbers, 2025-2030

- By Average Tuition Fees, 2025-2030