Market Overview

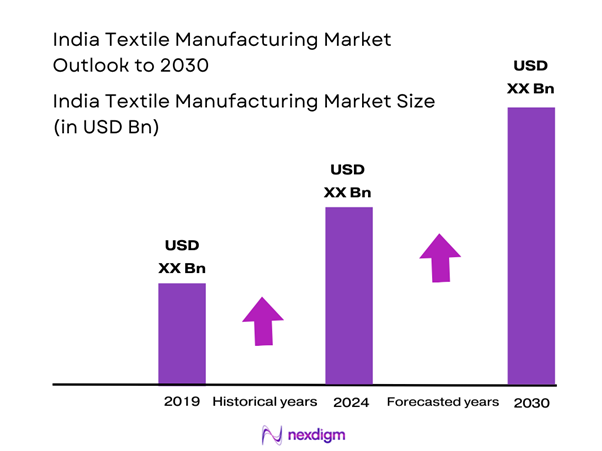

The India Textile Manufacturing Market is valued at USD 180 billion, supported by a combination of historical growth trends and the current demand for diverse textiles. Driven by factors such as rising disposable incomes, increasing population, and the growing emphasis on sustainable practices, the market is poised for continued expansion. The textile industry also benefits from government support through initiatives like the Production-Linked Incentive (PLI) scheme, which aims to make India a global manufacturing hub.

Major cities such as Mumbai, Delhi, and Ahmedabad dominate the Indian textile landscape due to their extensive manufacturing capabilities and established supply chains. These cities are home to leading textile producers and possess significant infrastructure, enabling efficient transportation and distribution of textiles. Foreign investments and the availability of skilled labor in these urban centers further contribute to their dominance, ensuring a competitive edge in the ever-evolving textile market.

Indian governmental initiatives have played a pivotal role in enhancing the textile sector’s growth. The PM Mega Integrated Textile Regions and Apparel (PM MITRA) Scheme, launched to promote investment in the textile industry, aims to establish seven mega textile parks by 2025. These parks are expected to generate approximately 25 lakh job opportunities and significantly enhance production capacity.

Market Segmentation

By Product Type

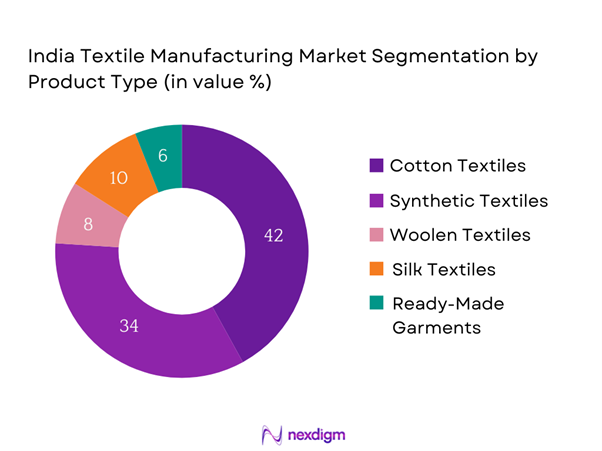

The India Textile Manufacturing Market is segmented by product type into cotton textiles, synthetic textiles, woolen textiles, silk textiles, and ready-made garments. Currently, cotton textiles hold the dominant market share due to their extensive cultivation and historical significance in Indian culture. The demand for cotton textiles remains robust as consumers increasingly favor breathable and comfortable fabrics, making them suitable for various applications, from casual wear to high-end fashion. Additionally, the presence of major cotton-producing states like Gujarat and Maharashtra further strengthens the position of cotton textiles in the market.

By End-Use Industry

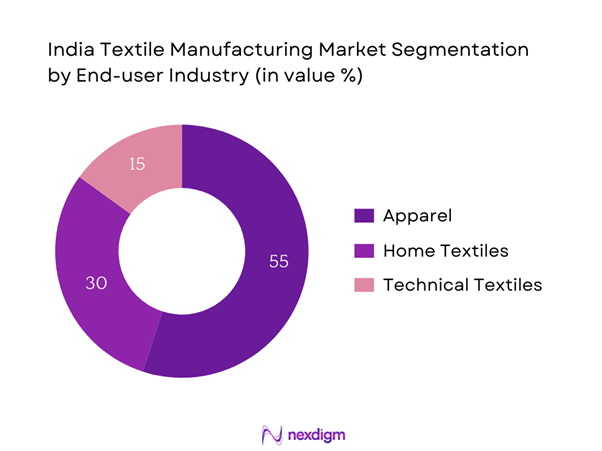

The market is also segmented by end-use industry into apparel, home textiles, and technical textiles. The apparel segment continues to dominate the market share due to the growing consumer preference for fashion and lifestyle products. Rising disposable incomes in urban areas and the influence of global fashion trends have significantly increased the demand for diverse clothing options. Additionally, an upsurge in e-commerce platforms focusing on apparel sales has further amplified this growth, making it a vital segment in the textile manufacturing market.

Competitive Landscape

The India Textile Manufacturing Market is characterized by the presence of several major players, indicating a competitive landscape shaped by both local manufacturers and global firms. Notable companies include Arvind Limited, Welspun India, and Vardhman Textiles, which command substantial market presence due to their innovative product offerings and extensive distribution networks. This competitive environment underscores the importance of brand loyalty, sustainable practices, and consumer engagement strategies.

| Company | Establishment Year | Headquarters | Market Position | Product Variety | Focus on Sustainability | Technological Innovation |

| Arvind Limited | 1931 | Ahmedabad, India | – | – | – | – |

| Welspun India | 1985 | Mumbai, India | – | – | – | – |

| Vardhman Textiles | 1965 | Ludhiana, India | – | – | – | – |

| Aditya Birla Group | 1857 | Mumbai, India | – | – | – | – |

| Raymond Limited | 1925 | Thane, India | – | – | – | – |

India Textile Manufacturing Market Analysis

Growth Drivers

Increasing Demand for Sustainable Textiles

The demand for sustainable textiles is increasingly shaping the India Textile Manufacturing Market, driven by consumer preference for eco-friendly products. Reports indicate that the Indian textile waste is expected to reach approximately 1.4 million tonnes by end of 2025, emphasizing the urgent need for sustainable solutions. Furthermore, the Government of India’s push towards sustainable practices has led to a significant rise in initiatives supporting organic cotton production, which is projected to grow boosting the market for eco-friendly textiles, reaching approximately USD 4 billion in the organic cotton sector by 2024.

Rise of E-Commerce and Online Retail

The rapid expansion of e-commerce in India has transformed the textile industry landscape. As of 2023, online retail sales accounted for USD 66 billion in revenue, contributing to over 10% of total retail sales in India. This boom enables textile manufacturers to reach a broader consumer base, thereby increasing overall demand. With over 800 million internet users as of early 2024, the potential consumer market continues to expand, positioning e-commerce as a crucial growth driver for the textile industry and facilitating a significant shift in consumer purchasing behavior towards online channels.

Market Challenges

Raw Material Price Fluctuations

India’s textile manufacturing is significantly impacted by the volatility in raw material prices. Cotton prices have faced increases, with the cost per quintal rising from INR 5,600 in 2022 to approximately INR 6,800 in 2023, driven by climatic challenges and supply chain disruptions. This volatility can compress manufacturers’ margins and disrupt pricing structures. Additionally, the increased costs of synthetic fibers, which underwent a price rise of around 20% in 2023 due to rising crude oil prices, continue to challenge the sustainability of profit margins within the textile sector, complicating operational strategies.

Compliance with Environmental Regulations

Manufacturers face increasing pressure to adhere to evolving environmental regulations aimed at sustainability. By 2024, compliance costs for textile manufacturers are anticipated to escalate due to stringent norms imposed by the Central Pollution Control Board, which reportedly penalized over 200 textile units for non-compliance in emissions and wastewater management in 2023 alone. These regulations are crucial for reducing the industry’s environmental footprint but can significantly increase operational costs and affect overall profitability if not managed effectively. Adhering to these standards requires substantial investment in modern technology and sustainable practices, further straining resources.

Opportunities

Growth in Emerging Markets

Emerging markets present a significant opportunity for growth within the Indian textile sector. In 2023, textile exports to regions like Africa and the Middle East grew by over 15%, reflecting the rising demand for Indian textiles in these growing economies. With increasing disposable incomes and urbanization in these regions, India’s textile producers are strategically positioned to leverage the demand for affordable yet stylish clothing. Furthermore, the implementation of the African Continental Free Trade Area (AfCFTA) is expected to create significant export opportunities, encouraging manufacturers to adapt their products to suit the tastes of these new consumers.

Innovations in Fabric Technology

Advancements in fabric technology offer substantial opportunities for the Indian textile market to innovate and diversify. For example, the growth of smart textiles, which integrate technology such as moisture control and temperature regulation, has seen a surge in interest from various sectors including healthcare and athletics. The current value of the smart textile market was reported at USD 3 billion in 2023 and is anticipated to grow as manufacturers incorporate these innovations into their offerings

Future Outlook

Over the coming years, the India Textile Manufacturing Market is expected to witness significant growth fueled by rising domestic demand, advances in textile technology, and the push toward sustainable manufacturing practices. Government initiatives aimed at enhancing production capabilities, coupled with a surge in e-commerce sales for textiles, are likely to sustain this momentum. Furthermore, increased emphasis on eco-friendly materials may pave the way for innovation and diversification within the sector.

Major Players

- Arvind Limited

- Welspun India

- Vardhman Textiles

- Aditya Birla Group

- Raymond Limited

- Bombay Dyeing

- Trident Group

- Indo Count Industries

- Alok Industries

- Grasim Industries

- Jain Irrigation Systems

- Shahi Exports

- LNJ Bhilwara Group

- Vedanta Limited

- Punit Commercials

Key Target Audience

- Manufacturers in the textile industry

- Investors and venture capital firms

- Government and regulatory bodies (Ministry of Textiles, Ministry of Commerce)

- Retail chains and distributors focusing on textiles

- E-commerce platforms specializing in apparel and home textiles

- Importers and exporters involved in the textile trade

- Fashion designers and brands leveraging textile innovations

- Raw material suppliers and fabric manufacturers

- Textile machinery and technology providers

- Non-Governmental Organizations (NGOs) advocating for sustainable practices in the textile industry

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India Textile Manufacturing Market. This step is underpinned by extensive desk research utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including demand trends, pricing strategies, and production capacities.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Textile Manufacturing Market. This includes assessing market penetration, the ratio of textiles produced to consumed, and the resultant revenue generation across various segments. Furthermore, an evaluation of service quality statistics, such as production rates and employee productivity, will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies in the textile sector. These consultations will provide valuable operational and financial insights directly from practitioners, which will be instrumental in refining and corroborating the market data. The feedback from experts will help address any discrepancies and provide a robust framework for understanding market potential.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with various textile manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Textile Manufacturing Market. The culmination of the research will be presented in a structured format tailored to meet the needs of stakeholders.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Landscape

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Sustainable Textiles

Rise of E-Commerce and Online Retail

Government Initiatives and Support - Market Challenges

Raw Material Price Fluctuations

Compliance with Environmental Regulations - Opportunities

Growth in Emerging Markets

Innovations in Fabric Technology - Trends

Shift Towards Eco-Friendly Fabrics

Adoption of Automation in Manufacturing - Government Regulation

Industrial Standards and Compliance

Export Import Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Cotton Textiles

Synthetic Textiles

Woolen Textiles

Silk Textiles

Ready-Made Garments - By End-Use Industry (In Value %)

Apparel

Home Textiles

Technical Textiles - By Distribution Channel (In Value %)

Online Retail

Department Stores

Specialty Stores - By Region (In Value %)

North India

South India

East India

West India - By Manufacturing Process (In Value %)

Spinning

Weaving

Knitting

Finishing

- Market Share of Major Players on the Basis of Value, 2024

Market Share by Product Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Number of Manufacturing Plants, Distribution Channels, Product Innovation, Market Reach, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Competitors

- Detailed Profiles of Major Companies

Arvind Limited

Welspun India

Vardhman Textiles

Aditya Birla Group

Raymond Limited

Bombay Dyeing

Trident Group

Indo Count Industries

Alok Industries

Grasim Industries

Jain Irrigation Systems

Shahi Exports

LNJ Bhilwara Group

Vedanta Limited

Punit Commercials

- Market Demand and Utilization

- Consumer Preferences

- Regulatory Considerations

- User Experience and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030