Market Overview

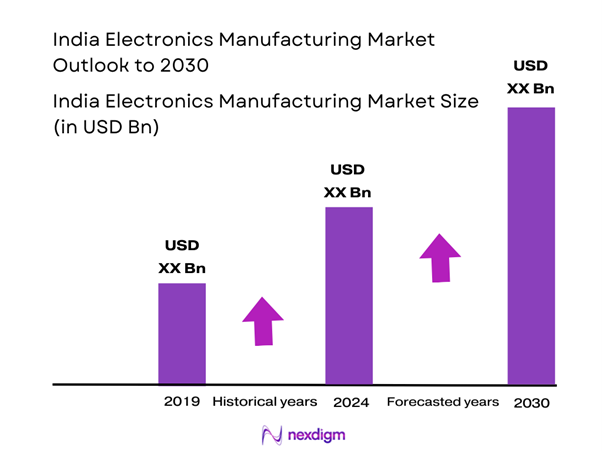

The India Electronics Manufacturing Market is valued at USD 120 billion, showcasing significant growth powered by advancements in technology and favorable government policies. The market is influenced by the ongoing shift towards electronics in various sectors, including automotive, healthcare, and consumer goods. The government’s “Make in India” initiative places strong emphasis on local manufacturing, helping to create a conducive environment for investments and innovation in the electronics sector.

Several cities and regions dominate the India Electronics Manufacturing Market, particularly Bengaluru, Hyderabad, Pune, and Noida. Bengaluru emerges as a critical hub due to its established IT sector and access to skilled labor. In contrast, Pune and Noida are pivotal for automotive and consumer electronics manufacturing. These regions benefit from favorable policies, infrastructure development, and a rich ecosystem of suppliers, which further reinforce their dominance in the market.

Government initiatives like “Make in India” and “Digital India” have notably fostered a conducive environment for the electronics manufacturing sector. The Make in India program aims to elevate the manufacturing sector’s contribution to GDP from 18% in 2022 to 25% by 2025. Furthermore, the Digital India initiative is expected to create 10 million new jobs in the IT and electronics sectors by end of 2025. These initiatives have attracted significant foreign investments, further stimulating growth in local manufacturing capabilities and technological development.

Market Segmentation

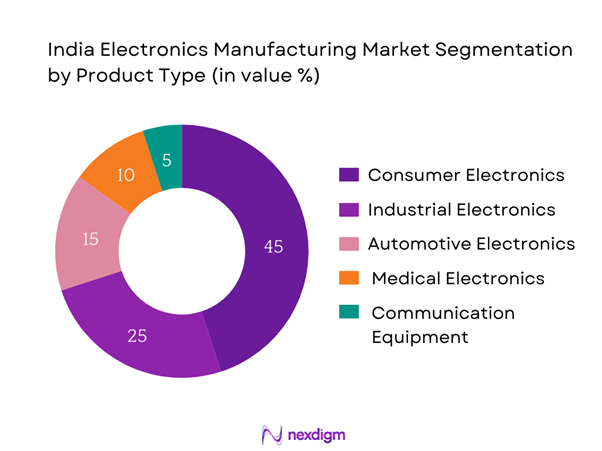

By Product Type

The India Electronics Manufacturing Market is segmented by product type into consumer electronics, industrial electronics, automotive electronics, medical electronics, and communication equipment. Consumer electronics currently dominate this segment, making up a significant portion of the market share. This is attributed to increasing disposable incomes, changing consumer preferences towards smart devices, and a growing e-commerce sector. Major brands such as Samsung, LG, and Xiaomi have built strong footholds in this space, leveraging their brand loyalty and extensive distribution networks to maintain their market positions.

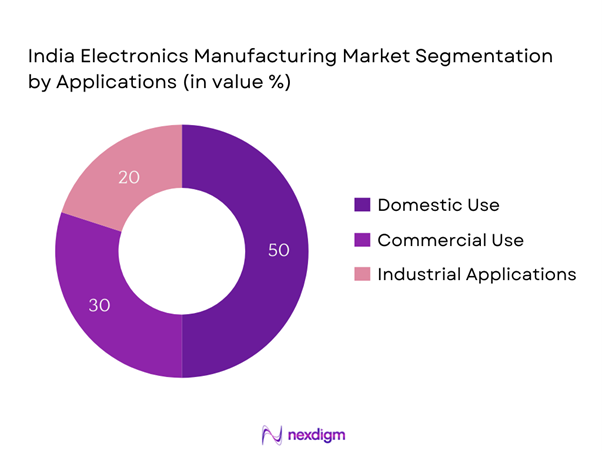

By Application

Additionally, the market is segmented by application into domestic use, commercial use, and industrial applications. The domestic use segment holds the largest share of the market. This dominance is driven by a rise in consumer gadgets and smart home technologies, including smart TVs, smartphones, and kitchen appliances. The rapid adoption of innovative technologies and increased urbanization further enhance demand within this segment, making it a focal point for manufacturers aiming to capture the lucrative consumer electronics market.

Competitive Landscape

The India Electronics Manufacturing Market is dominated by several major players, reflecting a mix of local and international brands. Key companies include Samsung, LG, and Tata Group, which have established themselves as leaders in consumer electronics, given their comprehensive product portfolios and extensive distribution networks. Additionally, companies like Wistron and Foxconn signify the influence of foreign investment in India’s manufacturing landscape, enhancing competition and innovation within the market.

| Company | Establishment Year | Headquarters | Market Focus | R&D Investment | Manufacturing Capacity | Revenue (Annual) |

| Samsung | 1938 | Seoul, South Korea | – | – | – | – |

| LG Electronics | 1958 | Seoul, South Korea | – | – | – | – |

| Tata Group | 1868 | Mumbai, India | – | – | – | – |

| Foxconn | 1974 | Taipei, Taiwan | – | – | – | – |

| Wistron | 2001 | Taipei, Taiwan | – | – | – | – |

India Electronics Manufacturing Market Analysis

Growth Drivers

Rising Demand for Smart Devices

The demand for smart devices in India is soaring, largely driven by increased internet penetration, which reached approximately 833 million users in 2022. The rise of 4G and 5G technologies continues to influence consumer habits, with smartphone shipments in India estimated to cross 180 million units in 2023. Moreover, the global smart device market is anticipated to exceed 2 billion units annually in the coming years, further enhancing local demand. This trend indicates the growing preference for connected devices and signals substantial opportunities for manufacturers in the sector.

Urbanization and Increasing Disposable Income

Urbanization is a critical driver of growth in the electronics manufacturing space, with urban population expected to increase from 35% in 2022 to 43% by end of 2025. This demographic shift comes alongside an increase in disposable incomes. As more citizens enter the urban middle class, the consumption of electronic goods will rise, driving demand. As a result, manufacturers can expect increased sales of consumer electronics, including smartphones, appliances, and other smart devices.

Market Challenges

Supply Chain Disruptions

Supply chain disruptions continue to impact the electronics manufacturing sector in India, primarily stemming from global logistical challenges. As of early 2023, approximately 60% of electronics manufacturers reported significant delays in supply chain operations due to the ongoing semiconductor shortage, which has affected production schedules across sectors. This challenge reflects the vulnerability of local manufacturers relying on just-in-time delivery systems and international suppliers, leading to increased costs and delayed product launches. Addressing these disruptions is essential for sustaining growth amid a fluctuating global landscape.

Regulatory Compliance Issues

Regulatory compliance remains a complicated issue for electronics manufacturers in India. As of 2022, almost 40% of companies reported challenges in keeping up with evolving regulatory standards, including those outlined in the Electronics and Information Technology Act. Strict regulations on product quality and safety standards can lead to costly modifications in production processes. Moreover, navigating the compliance landscape often requires additional time and resources, which can strain smaller manufacturers trying to compete effectively in the market.

Opportunities

Adoption of IoT in Electronics

The current landscape indicates a burgeoning opportunity for the adoption of IoT (Internet of Things) in electronics manufacturing. The number of IoT devices in India is expected to reach over 1.9 billion by end of 2025, significantly enhancing connectivity and automation across sectors. This trend is driven by advancements in technologies like 5G, which supports faster data transfer and connectivity. The rising demand for smart homes, wearable devices, and automated industrial solutions creates a fertile ground for manufacturers to develop innovative products tailored to consumer needs.

Growing Market for Renewable Energy Electronics

There is an increasing market opportunity for electronics associated with renewable energy. The Indian government has set a target of achieving 500 GW of renewable energy capacity by 2030, necessitating the development of energy-efficient electronic devices and systems. Currently, over 300 million households rely on renewable energy sources for power, creating a robust demand for solar panels, energy storage systems, and smart meters. This drive for cleaner energy solutions is prompting electronics manufacturers to innovate and meet new market needs.

Future Outlook

Over the next five years, the India Electronics Manufacturing Market is projected to experience substantial growth propelled by continuous government support for local manufacturing, advancements in electronics technology, and rising consumer demand for electronic devices. The “Make in India” initiative further enhances the prospects for domestic manufacturers, ultimately leading to increased investments and innovations in the sector. As consumer preferences shift towards smart technologies and sustainable solutions, a significant transformation in the market landscape is expected.

Major Players

- Samsung

- LG Electronics

- Tata Group

- Foxconn

- Wistron

- Bharat Electronics Limited

- Tata Elxsi

- Siemens

- Panasonic

- Infosys Electronics Manufacturing Services

- Hero MotoCorp

- Bajaj Auto

- Videocon Industries

- Jabil Circuit

- Alcatel-Lucent

Key Target Audience

- Manufacturers and Suppliers

- Retailers and Distributors

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Electronics and Information Technology, Department of Telecommunications)

- Trade Associations and Industry Groups

- Environmental Regulatory Agencies (Central Pollution Control Board, Ministry of Environment and Forests)

- OEM

- Research and Development Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India Electronics Manufacturing Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technological advancements, consumer preferences, and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Electronics Manufacturing Market will be compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation from various segments. Additionally, an evaluation of product quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates. This thorough analysis will provide insight into the market’s current landscape.

Step 3: Hypothesis Validation and Expert Consultation

Emerging market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the electronics manufacturing sphere. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data gathered in earlier steps.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple electronics manufacturers and industry stakeholders to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will help verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Electronics Manufacturing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Key Trends

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand for Smart Devices

Government Initiatives (Make in India, Digital India)

Urbanization and Increasing Disposable Income - Market Challenges

Supply Chain Disruptions

Regulatory Compliance Issues - Opportunities

Adoption of IoT in Electronics

Growing Market for Renewable Energy Electronics - Trends

Shift Towards Sustainable Manufacturing

Customization and Personalization Trends - Government Regulations

Import Duties and Tariffs

Quality Control Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Market Size by Value, 2019-2024

- Market Size by Volume, 2019-2024

- Average Price Trends, 2019-2024

- By Product Type (In Value %)

Consumer Electronics

Industrial Electronics

Automotive Electronics

Medical Electronics

Communication Equipment - By Application (In Value %)

Domestic Use

Commercial Use

Industrial Applications - By Distribution Channel (In Value %)

Online Retail

Offline Retail

Direct Sales - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Analog Electronics

Digital Electronics

Hybrid Electronics

- Market Share of Major Players on the basis of Value/Volume, 2024

Market Share by Product Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Financial Performance, Market Positioning, Product Portfolio, Distribution Network, Innovation Index, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Product Categories

- Detailed Company Profiles

Tata Group

Wistron India

Foxconn India

Samsung India Electronics

LG Electronics India

Flextronics

Bharat Electronics Limited

Siemens India

Panasonic India

Infosys Electronics Manufacturing Services

Jabil Circuit

Videocon Industries

Munjal Showa

Hindustan Aeronautics Limited (HAL)

Samsung R&D Institute India

- Market Demand and Utilization Patterns

- Purchasing Behavior and Budget Allocations

- Regulatory Considerations

- Customer Needs and Pain Points

- B2B Decision-Making Process

- Projected Market Size by Value, 2025-2030

- Projected Market Size by Volume, 2025-2030

- Projected Average Price Trends, 2025-2030