Market Overview

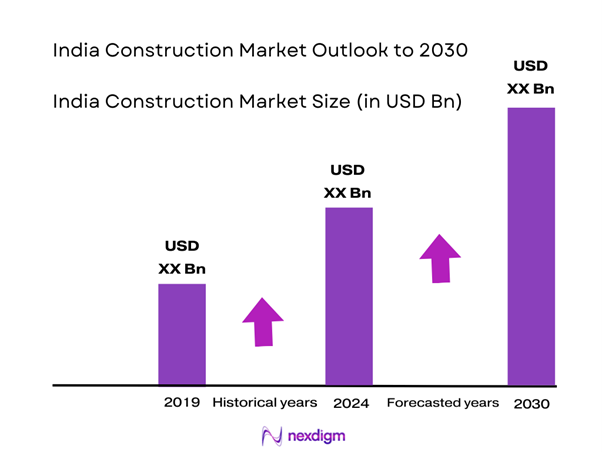

The India construction market is projected to reach a valuation of USD 290 billion, driven predominantly by the rapid urbanization and infrastructural development initiatives undertaken by the government. Factors such as increased investments in the housing sector, significant government spending on infrastructure projects, and urban housing demand play crucial roles in fueling market growth

Major cities like Mumbai, Delhi, and Bengaluru dominate the India construction market thanks to their extensive urbanization efforts and ongoing infrastructure projects. Mumbai, as the financial capital, witnesses high demand for commercial real estate. Delhi benefits from government initiatives such as the Delhi Metro project, enhancing connectivity. Bengaluru’s booming IT sector is driving residential and commercial construction, solidifying its standing in the market.

The Indian government’s initiatives, such as the Pradhan Mantri Awas Yojana (PMAY), aim to provide affordable housing for all by 2022, which has led to the construction of nearly 12 million homes. By end of 2025, the government has set goals to invest around USD 1.4 trillion in infrastructure development, focusing on transport and urban infrastructure. Additionally, the National Infrastructure Pipeline project is anticipated to mobilize approximately USD 1.5 trillion in investments, reinforcing the construction sector’s growth prospects as infrastructure development becomes a national priority.

Market Segmentation

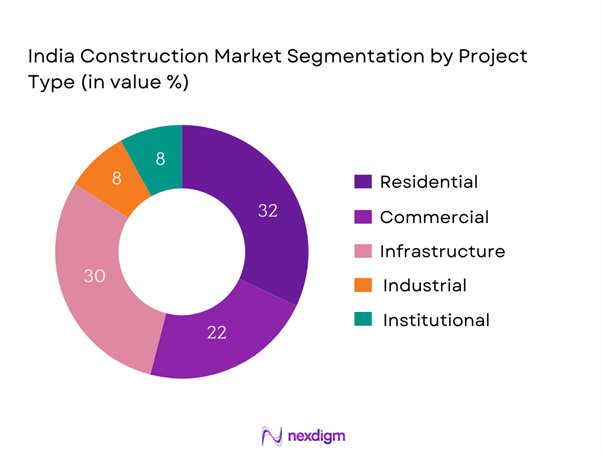

By Project Type

The India construction market is segmented by project type into residential construction, commercial construction, infrastructure construction, industrial construction, and institutional construction. Among these, infrastructure construction holds the dominant market share due to the government’s focus on developing roadways, rail networks, and urban transit systems. With significant allocations from the national budget towards infrastructure projects like the Bharatmala and Sagarmala initiatives, this segment is experiencing unprecedented growth. The rising need for efficient transportation networks and smart city projects further boosts investment, making infrastructure construction a cornerstone of the country’s growth strategy.

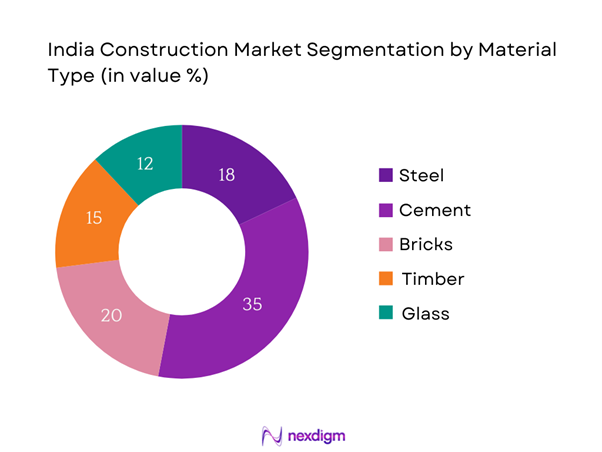

By Material Type

The market segmentation also reflects by material type, including steel, cement, bricks, timber, and glass. Cement dominates the market share primarily due to its fundamental role in construction, being the primary binding material used in buildings, road infrastructure, and various construction applications. With the emergence of mega infrastructure projects and residential developments, the demand for cement remains robust. Additionally, ongoing innovations in cement manufacturing processes aim to increase efficiency and reduce costs, establishing cement as a linchpin for the market.

Competitive Landscape

The India construction market is characterized by a consolidated landscape with a few key players exerting significant influence. Major companies such as Larsen & Toubro, Shapoorji Pallonji, and DLF dominate due to their substantial operational scale, vast project portfolios, and strong brand reputation. These players benefit from established relationships with government bodies and access to resources that facilitate the completion of large-scale construction projects efficiently.

| Company | Establishment Year | Headquarters | Market Share (%) | Key Project Focus | Notable Achievements |

| Larsen & Toubro | 1938 | Mumbai | – | – | – |

| Shapoorji Pallonji | 1865 | Mumbai | – | – | – |

| DLF | 1946 | Gurugram | – | – | – |

| GMR Group | 1978 | Bengaluru | – | – | – |

| Adani Group | 1988 | Ahmedabad | – | – | – |

India Construction Market Analysis

Growth Drivers

Rising Urbanization

Rising urbanization in India is a key growth driver for the construction market, with urban areas projected to account for about 600 million people by 2031. Urban population as of 2021 was approximately 471 million, reflecting a considerable shift toward city living. The growth of megacities like Mumbai, Delhi, and Bengaluru indicates a formidable demand for housing and infrastructure. The World Bank estimates that urbanization will significantly contribute to the GDP, with urban areas expected to generate around 70% of India’s economic output by 2031, leading to increased construction activity.

Increased Infrastructure Spending

Increased infrastructure spending bolstered the construction market, with the government earmarking USD 142 billion for the infrastructure sector in the national budget for the fiscal year, reflecting a 23% increase from the previous year. This allocation supports projects in roads, railways, and urban transit, essential for promoting economic growth. As per the National View on Infrastructure Investment, investment in infrastructure in India is projected to reach USD 5 trillion by 2030, paving the way for enhanced connectivity and growth opportunities in the construction market.

Market Challenges

Regulatory Hurdles

Regulatory hurdles pose significant challenges to the construction market, including compliance with complex zoning laws and procurement regulations. In India, as of 2021, it typically takes approximately 142 days to secure necessary permits for construction, a delay that can hamper project timelines. Moreover, the Bureau of Indian Standards regularly updates regulations to incorporate safety and environmental standards, which can impose additional compliance costs on companies aiming to meet contemporary regulations while maintaining project schedules.

Fluctuations in Material Prices

Fluctuations in material prices, particularly steel and cement, have emerged as a challenge for the construction market. In early 2023, steel prices surged to around INR 75,000 per ton, reflecting a growth of 26% year-on-year, while cement prices reached an all-time high of INR 450 per bag. This volatility in pricing is attributed to global supply chain disruptions and increased demand for construction materials. Such price increases can squeeze profit margins for construction firms and potentially delay project launches, impacting overall market growth.

Opportunities

Digital Transformation in Construction

The advancement of digital technologies presents substantial opportunities for the construction market, with current investments in construction technology predicted to reach USD 10 billion by end of 2025. Technologies such as Building Information Modeling (BIM) and drone surveying are gaining traction, allowing for improved project planning and efficiency. The digital transformation agenda delineated by the government encourages companies to adopt innovative solutions, ultimately leading to a significant reduction in project timelines and costs while enhancing productivity and safety standards. Such investments reflect a positive trajectory for the construction sector’s future.

Sustainable Construction Practices

The growing emphasis on sustainable construction practices offers current opportunities that will shape the future of the construction industry. In 2023, the Indian green building market was valued at approximately USD 36 billion, indicating a robust increase driven by heightened awareness regarding energy efficiency and sustainability among developers and consumers. The push for renewable resources in construction methods, coupled with government incentives for green certifications, catalyzes the shift toward sustainable practices, paving the way for future growth in eco-friendly construction initiatives.

Future Outlook

The India construction market is poised for substantial growth, driven by accelerated urbanization, government infrastructure initiatives, and private sector participation. Continued investments in smart city projects and public transport solutions will enhance connectivity and living standards. The increasing trend of sustainable construction practices, coupled with innovations in building materials and techniques, will also contribute to market resilience. As the Indian economy strengthens, this sector is set to become a significant contributor to the overall economic development.

Major Players

- Larsen & Toubro

- Shapoorji Pallonji

- DLF

- GMR Group

- Adani Group

- Hindustan Construction Company (HCC)

- Tata Projects

- Godrej Properties

- JCB India

- Bajaj Finserv

- Bhilai Steel Plant

- Punj Lloyd

- Sobha Ltd.

- IRB Infrastructure Developers

- NCC Ltd.

Key Target Audience

- Construction Firms

- Real Estate Developers

- Government and Regulatory Bodies (Ministry of Housing and Urban Affairs, National Highways Authority of India)

- Urban Planners

- Engineering Consultants

- Investments and Venture Capitalist Firms

- Material Suppliers

- Infrastructure Financing Institutions

- Public-Private Partnerships (PPPs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India construction market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including trends, regulatory frameworks, and economic indicators.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India construction market. This includes assessing market penetration, the ratio of construction projects to overall construction firms, and the resultant revenue generation from key segments. Furthermore, an evaluation of project completion rates and expenditure statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. Insights from these experts will be critical in shaping our understanding of current market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction firms and stakeholders to acquire detailed insights into project segments, market demand forecasts, material utilization, and consumer preferences. This interaction will verify and complement the statistics derived from the bottom-up and top-down approaches, thereby ensuring a comprehensive, accurate, and validated analysis of the India construction market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Urbanization

Government Initiatives and Investments

Increased Infrastructure Spending - Market Challenges

Regulatory Hurdles

Fluctuations in Material Prices - Opportunities

Digital Transformation in Construction

Sustainable Construction Practices - Trends

Adoption of Smart Construction Technologies

Modular and Prefabricated Construction - Government Regulation

Building Codes and Standards

Environmental Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Project Type (In Value %)

Residential Construction

Commercial Construction

Infrastructure Construction

Industrial Construction

Institutional Construction - By Material Type (In Value %)

Steel

Cement

Bricks

Timber

Glass - By Equipment Type (In Value %)

Earthmoving Equipment

Concrete Mixers

Lifting Equipment

Construction Vehicles

Others - By End-User Industry (In Value %)

Government

Private Sector

Realty Developers

Public Sector Undertakings

Foreign Enterprises - By Region (In Value %)

North India

South India

West India

East India

Central India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Project Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Project Type, Number of Projects, Distribution Channels, Number of Contractual Partnerships, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Larsen & Toubro

Shapoorji Pallonji

DLF

GMR Group

Adani Group

HCC (Hindustan Construction Company)

Tata Projects

Godrej Properties

JCB India

Bajaj Finserv

Bhilai Steel Plant

Punj Lloyd

Sobha Ltd.

IRB Infrastructure Developers

NCC Ltd.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030