Market Overview

The Malaysia Industrial Equipment Manufacturing Market is valued at USD 13.5 billion, showcasing a robust growth trajectory fueled by the nation’s industrialization efforts and rapid technological advancements. The market is primarily driven by increased demand for automation and smart manufacturing solutions, which are vital for enhancing productivity and efficiency across various sectors. Additionally, government initiatives aimed at promoting local manufacturing and the adoption of Industry 4.0 technologies provide a conducive environment for market expansion.

Key cities like Kuala Lumpur and Penang dominate the industrial equipment manufacturing landscape in Malaysia. Kuala Lumpur serves as a vital commercial hub, offering access to a skilled workforce and advanced infrastructure. Penang, known as the “Silicon Valley of the East,” drives the sector with its focus on high-tech manufacturing and electronics. Consequently, these regions attract significant investments from both local and international players, facilitating growth in the industrial equipment sector.

The Malaysian government actively supports the industrial equipment sector through various initiatives and programs. Under the Malaysia Digital Economy Blueprint, an investment of 70 billion MYR is targeted toward digital transformation of industries by end of 2025. Additionally, the National Industrial Policy 2020 aims to increase local manufacturers’ competitiveness by enhancing infrastructure, providing access to funding, and promoting research and development activities.

Market Segmentation

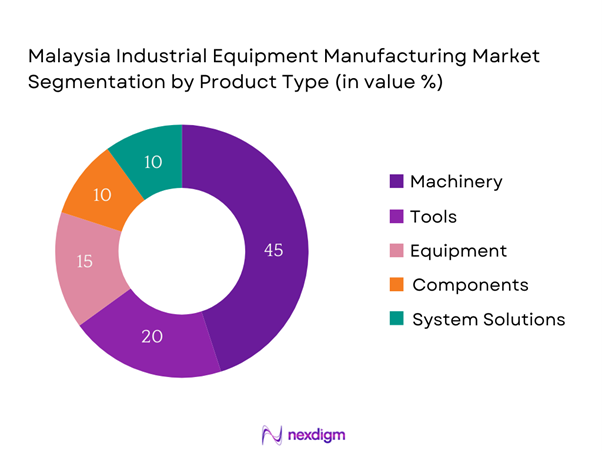

By Product Type

The Malaysia Industrial Equipment Manufacturing Market is segmented by product type into machinery, tools, equipment, components, and system solutions. Currently, machinery holds a dominant market share within this segmentation due to its critical role in enhancing production capabilities across industries. The increasing adoption of automated machinery has led to greater efficiency and productivity, which is favored by manufacturers aiming to optimize their operations. Moreover, advancements in machine technology are constantly evolving, fueling innovation and driving demand within this segment.

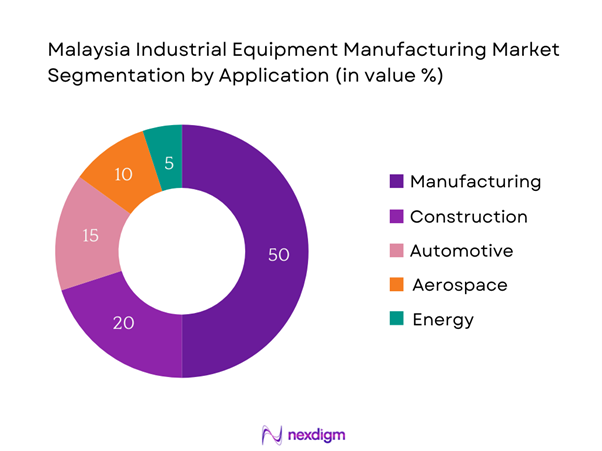

By Application

The market is further segmented by application into manufacturing, construction, automotive, aerospace, and energy. The manufacturing application is leading the market, attributed to its widespread use of industrial equipment to streamline processes and boost productivity. The ongoing industrialization in Malaysia has made manufacturing a key economic driver, bolstering the demand for diverse equipment such as assembly lines, conveyors, and robotics. The focus on modernizing manufacturing facilities to increase efficiency and reduce operational costs further cements the dominance of this segment.

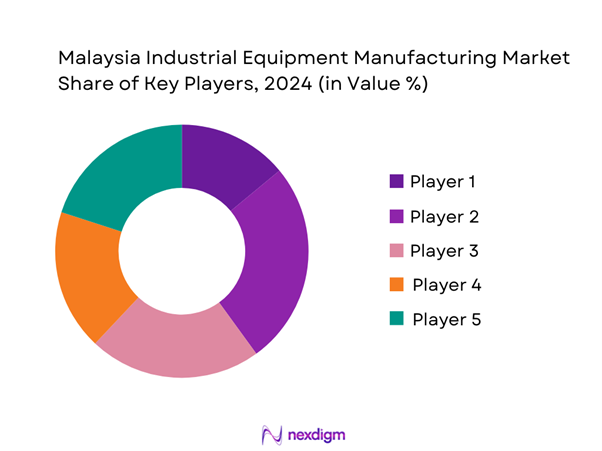

Competitive Landscape

The Malaysia Industrial Equipment Manufacturing Market is characterized by the presence of several major players, including both domestic companies and large international corporations. This competitive dynamic is evident as key companies utilize advanced technology, strategic partnerships, and effective marketing strategies to maintain their market positions. Leaders in this sector are continuously innovating to meet the evolving needs of the market, enhancing their product functionalities, and adapting to technological changes.

| Company Name | Establishment Year | Headquarters | Market Focus | Innovation Strategy | Global Reach | Sustainability Practices |

| Yinson Holdings | 1983 | Kuala Lumpur | – | – | – | – |

| UMW Holdings | 1930 | Kuala Lumpur | – | – | – | – |

| Perodua | 1992 | Selangor | – | – | – | – |

| Puncak Niaga | 1995 | Selangor | – | – | – | – |

| AirAsia Engineering | 2003 | Selangor | – | – | – | – |

Malaysia Industrial Equipment Manufacturing Market Analysis

Growth Drivers

Economic Development and Industrialization

Malaysia’s economy has shown resilience, with the World Bank forecasting a GDP growth of 4.5% in 2024, reflecting steady economic development. The industrial sector remains a crucial component of this growth, contributing 22.8% of the nation’s GDP in 2022. Urbanization rates also support this surge, with cities like Kuala Lumpur and Penang driving industrial activities. The growing propensity for Malaysian manufacturers to enhance their production capacity and capabilities further supports investment in industrial equipment, positioning the sector for continued expansion. Policies aimed at nurturing SMEs under the 12th Malaysia Plan (2021-2025) facilitate this trend.

Technological Advancements

Technological advancements significantly propel growth within the Malaysia Industrial Equipment Manufacturing Market, with an estimated 600 million MYR invested in emerging technologies in 2023. The adoption of advanced manufacturing technologies, such as Robotics Process Automation and IoT, has increased efficiency and effectiveness within production facilities. In addition, Malaysia’s emphasis on upgrading manufacturing capabilities aligns with broader regional trends, evidenced by a forecasted 60% rise in automation adoption among Malaysian manufacturers by end of 2025. Such investments ensure that Malaysian firms remain competitive on global platforms.

Market Challenges

High Initial Investment Costs

A significant challenge facing the Malaysia Industrial Equipment Manufacturing Market is the high initial investment costs associated with purchasing advanced manufacturing equipment. In 2023, the average capital expenditure for new manufacturing plants was approximately 10 million MYR, which poses entry barriers for small and medium-sized enterprises. Additionally, ongoing maintenance costs for high-tech machines can average around 20% of the initial investment annually, complicating fiscal planning for businesses. These financial considerations often lead to hesitation in adopting cutting-edge technologies, stymying growth potential.

Supply Chain Disruptions

Supply chain disruptions remain a critical challenge for Malaysia’s industrial equipment manufacturers. Events such as the COVID-19 pandemic highlighted vulnerabilities, which resulted in significant delays and increased costs for raw materials—average lead times for industrial machinery components rose by 30% between 2022 and 2023. Furthermore, recent geopolitical tensions have exacerbated these issues, causing a 40% increase in logistics costs since 2022. The dependencies on global supply chains underline the importance of resilience-building strategies among local manufacturers.

Opportunities

Adoption of Industry 4.0

The current shift toward Industry 4.0 presents a significant opportunity for growth in Malaysia’s industrial equipment manufacturing sector. Malaysia has committed to increasing its Industry 4.0 readiness score to 30% by end of 2025, harnessing technologies such as AI and big data analytics. As of 2023, only 15% of manufacturers had progressed towards full digital transformation. The potential for growth is immense, as companies adopting these technologies can expect operational improvements, enhanced productivity, and lower costs, driving future investment in advanced equipment and tools.

Demand for Automation Solutions

The rising demand for automation solutions in various sectors, including automotive and electronics, is reshaping Malaysia’s industrial landscape. The automation market in Malaysia was valued at 5.2 billion MYR in 2023. Companies are increasingly recognizing the need for automated systems to improve efficiency and reduce labor costs. The push for automation is further catalyzed by labor shortages, with the workforce expected to decrease to approximately 15 million by end of 2025.

Future Outlook

Over the next several years, the Malaysia Industrial Equipment Manufacturing Market is expected to experience substantial growth, driven by ongoing technological advancements, increasing automation, and continued government support for industrialization. As manufacturers strive to improve operational efficiencies and reduce costs, the demand for innovative industrial solutions will rise. Additionally, the transition towards Industry 4.0 technologies, such as IoT and AI integration, will further enhance the competitive edge of Malaysian manufacturers in the global market.

Major Players

- Yinson Holdings

- UMW Holdings

- Perodua

- Puncak Niaga

- AirAsia Engineering

- AEM Holdings

- Ajiya Berhad

- AOS Orwell

- Harsco Infrastructure

- Sarawak Energy

- Vitro Group

- Minda Global

- Sime Darby Industrial

- Jengkala Group

- Engtex Group

Key Target Audience

- Investments and Venture Capitalist Firms

- Ministry of International Trade and Industry (MITI)

- Malaysian Investment Development Authority (MIDA)

- Economic Planning Unit (EPU)

- Department of Statistics Malaysia

- Large Manufacturing Enterprises

- Construction Firms

- Automotive Manufacturers

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves developing a comprehensive ecosystem map that encompasses all significant stakeholders within the Malaysia Industrial Equipment Manufacturing Market. Extensive desk research is conducted using a combination of secondary and proprietary databases to gather comprehensive industry-level information. The objective is to identify and define the critical variables influencing market dynamics, ensuring a solid foundation for the subsequent analysis.

Step 2: Market Analysis and Construction

During this phase, historical data relevant to the Malaysia Industrial Equipment Manufacturing Market is compiled and analyzed. This includes evaluating market penetration rates, the balance between marketplace participants and service providers, and the resulting revenue generation. An assessment of service quality statistics is also undertaken to guarantee the accuracy and reliability of the revenue estimates, ensuring a well-rounded analysis.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse range of companies. These consultations offer valuable operational and financial insights that help refine and corroborate the market data. Input from experienced practitioners is pivotal for confirming and enhancing the validity of the research findings.

Step 4: Research Synthesis and Final Output

The final phase involves engaging directly with multiple industrial equipment manufacturers to acquire detailed insights into product segments, sales performances, consumer preferences, and other essential factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a thorough, accurate, and validated analysis of the Malaysia Industrial Equipment Manufacturing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Economic Development and Industrialization

Technological Advancements

Government Initiatives - Market Challenges

High Initial Investment Costs

Supply Chain Disruptions - Opportunities

Adoption of Industry 4.0

Demand for Automation Solutions - Trends

Sustainable Manufacturing Practices

Rising Demand for Customized Solutions - Government Regulation

Compliance Standards

Employment Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Machinery

Tools

Equipment

Components

System Solutions - By Application (In Value %)

Manufacturing

Construction

Automotive

Aerospace

Energy - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Platforms - By Region (In Value %)

Northern Region

Southern Region

Eastern Region

Western Region - By Customer Type (In Value %)

OEMs (Original Equipment Manufacturers)

SMEs (Small and Medium Enterprises)

Large Enterprises

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Position, Revenue, Distribution Channels, Production Capabilities, Unique Value Offerings, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Yinson Holdings

UMW Holdings

Perodua

Puncak Niaga

AirAsia Engineering

AEM Holdings

Ajiya Berhad

AOS Orwell

Harsco Infrastructure

Sarawak Energy

Vitro Group

Minda Global

Sime Darby Industrial

Jengkala Group

Engtex Group

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030