Market Overview

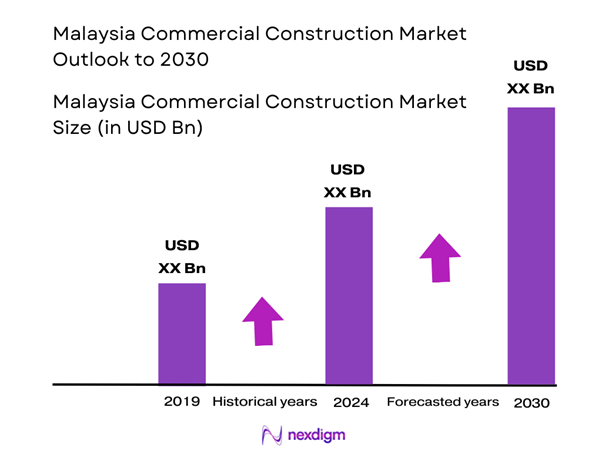

The Malaysia Commercial Construction Market is valued at approximately USD 40 billion in 2025 with an approximated compound annual growth rate (CAGR) of 8.5% from 2025-2030, based on a substantial analysis of the previous years and reported increases in infrastructure spending. The growth in this market is driven primarily by rapid urbanization, alongside the government’s initiatives aiming to boost the economy through significant investments in commercial infrastructures such as offices, retail spaces, and hospitality projects.

Key cities driving the market include Kuala Lumpur, Penang, and Johor Bahru, which are recognized for their robust infrastructure development and urban growth. Kuala Lumpur stands out as the commercial hub due to its strategic location and amenities, attracting both local and foreign investments. Similarly, Penang is experiencing significant growth in tourism and investments in hospitality projects, while Johor Bahru benefits from its proximity to Singapore, fostering cross-border commercial activities.

Infrastructure development in Malaysia is at the forefront of governmental priorities, with the government allocating RM 100 billion for various infrastructure projects from 2021 to 2025, focusing on enhancing connectivity and urban facilities. Major projects include the Mass Rapid Transit (MRT) system expansion and road upgrades expected to facilitate smoother transportation, thus driving the demand for commercial construction as businesses flock to areas with improved accessibility.

Market Segmentation

By Project Type

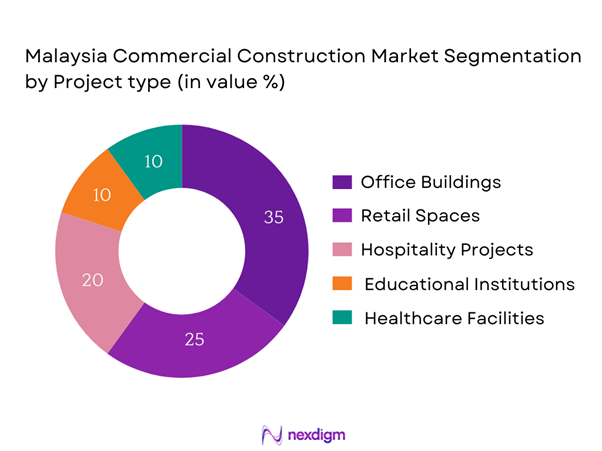

The Malaysia Commercial Construction Market is segmented by project type into office buildings, retail spaces, hospitality projects, educational institutions, and healthcare facilities. Among these, office buildings dominate the market share as businesses increasingly seek modern workspaces equipped with state-of-the-art technology and amenities. The growing trend of remote work and flexible office spaces has fueled demand for innovative office designs. Additionally, with Kuala Lumpur being the central business district, the concentration of corporate offices has significantly boosted this segment.

By Region

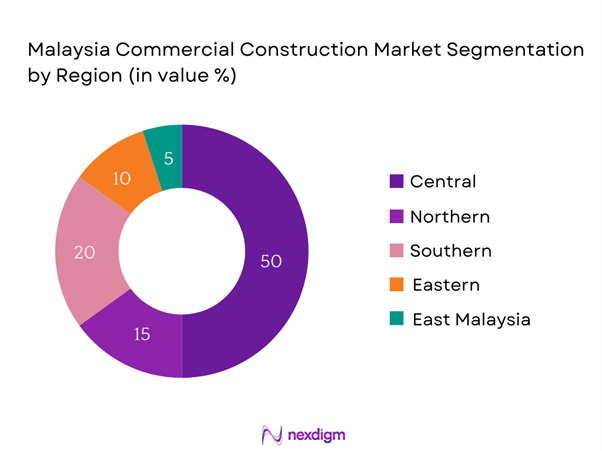

The Malaysia Commercial Construction Market is also segmented by region into Central, Northern, Southern, Eastern, and East Malaysia. The Central region, primarily comprising Kuala Lumpur, is the most dominant due to its high density of urbanization and commercial activity. Significant investment in infrastructure and economic development in Kuala Lumpur has led to a substantial increase in construction projects, making it the focal point for commercial development in Malaysia. Such a concentration of economic activities attracts further investment, ensuring continued growth in this region.

Competitive Landscape

The Malaysia Commercial Construction Market is characterized by a competitive landscape featuring several major players. The consolidation of these companies is significantly shaping market dynamics, with strong influence exerted by both local and multinational enterprises. Companies such as Gamuda Berhad and IJM Corporation Berhad have established a dominant position through their extensive project portfolios and execution capabilities.

| Company | Established Year | Headquarters | Market Share | Project Types | Regional Presence | Notable Achievements |

| Gamuda Berhad | 1976 | Selangor | – | – | – | – |

| IJM Corporation Berhad | 1983 | Kuala Lumpur | – | – | – | – |

| Sunway Construction Group | 1981 | Selangor | – | – | – | – |

| WCT Holdings Berhad | 1981 | Kuala Lumpur | – | – | – | – |

| SP Setia Berhad | 1974 | Kuala Lumpur | – | – | – | – |

Malaysia Commercial Construction Market Analysis

Growth Drivers

Urbanization Trends

Urbanization in Malaysia is a significant growth driver for the commercial construction market, as over 77% of the population now resides in urban areas. This number is projected to increase, leading to heightened demand for commercial spaces. Areas such as Kuala Lumpur are experiencing rapid population increases, with urban areas expected to house around 80% of the population by end of 2025. This growing concentration of inhabitants stimulates infrastructure projects, including commercial facilities, transportation links, and housing developments, creating a fertile environment for construction firms.

Economic Growth Initiatives

Malaysia has launched several initiatives aimed at boosting economic growth, which positively impact the commercial construction market. The government aims for a GDP growth rate of approximately 5.5% in 2024, driven largely by infrastructure spending and manufacturing activities. The Economic and Trade Ministry targets investments of RM 70 billion in various projects as part of the National Investment Aspirations policy to enhance economic resilience. These initiatives focus on fostering a competitive environment, thereby increasing public and private sector investments in commercial projects that contribute to the overall economic landscape.

Market Challenges

Rising Material Costs

The construction sector in Malaysia is facing challenges due to the rising costs of building materials, particularly steel, timber, and cement. Reports indicate that global steel prices reached USD 950 per metric ton in early 2023, a significant increase from the previous year. This upward trend in material costs creates strain on profit margins for construction firms, potentially leading to increased project costs and delaying the timelines for new developments. Furthermore, fluctuating material prices make budgeting and project planning more complex, posing challenges that hinder growth in the commercial construction market.

Labor Shortages

Labor shortages represent a formidable challenge for the commercial construction sector in Malaysia, with a current shortfall of approximately 120,000 skilled workers as reported in early 2023. This shortage has been exacerbated by the COVID-19 pandemic and ongoing recovery efforts, which have restricted the influx of foreign labor. The labor constraint affects project timelines and overall productivity, contributing to delays and escalating costs. The government is focused on investigating policies to attract and retain talent within the construction workforce; however, the skills gap remains a critical hurdle for immediate growth.

Opportunities

Sustainable Construction Practices

Sustainable construction practices are becoming increasingly vital for growth in the Malaysia Commercial Construction market, as demand for eco-friendly construction practices rises. Projects complying with sustainability standards are gaining popularity and recognition, leading to higher market demand. In response to global climate change initiatives, the Malaysian government aims to achieve a reduction of greenhouse gas emissions from construction activities by 45% by 2030 under the 11th Malaysia Plan. This significant target pushes developers to invest in sustainable practices, ensuring future growth opportunities as both clients and investors prioritize environmentally conscious projects.

Digitalization in Construction

Digitalization in the construction industry presents substantial opportunities for growth in the Malaysia Commercial Construction Market, as technology adoption can enhance project efficiency, reduce costs, and streamline operations. The integration of Building Information Modeling (BIM), project management software, and automation tools has become increasingly prevalent in recent years. For instance, the usage of BIM in the construction sector can improve collaboration among various stakeholders and minimize rework, thus saving time and resources.

Future Outlook

Over the coming years, the Malaysia Commercial Construction Market is anticipated to experience significant growth driven by sustained government investments, urbanization trends, and an increase in consumer spending. As Malaysia strengthens its economic foundations through infrastructure development, the commercial construction landscape will continue to evolve. Factors such as technological advancements in construction methods, coupled with a growing demand for green buildings, will further support industry expansion.

Major Players

- Gamuda Berhad

- IJM Corporation Berhad

- Sunway Construction Group

- WCT Holdings Berhad

- SP Setia Berhad

- Perak Corporation Berhad

- YTL Corporation Berhad

- Mah Sing Group Berhad

- EcoWorld Development Group

- Bina Puri Holdings Berhad

- UEM Sunrise Berhad

- Lendlease Corporation Limited

- PNB Merdeka Ventures

- Boustead Holdings Berhad

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Works, Jabatan Perancang Bandar dan Desa)

- Real Estate Developers

- Financial Institutions and Banks

- Construction Material Suppliers

- Commercial Property Managers

- Urban Planning Consultants

- Engineering and Construction Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia Commercial Construction Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including economic indicators, construction trends, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Malaysia Commercial Construction Market. This includes assessing market penetration, the ratio of projects to service providers, and resultant revenue generation. Additionally, we evaluate service quality statistics to ensure the reliability and accuracy of the revenue estimates, which will portray an informed picture of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction firms and stakeholders to acquire detailed insights into project segments, market trends, pricing strategies, consumer preferences, and competitive dynamics. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Malaysia Commercial Construction Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization Trends

Economic Growth Initiatives

Infrastructure Development - Market Challenges

Rising Material Costs

Labor Shortages

Regulatory Compliance - Opportunities

Sustainable Construction Practices

Digitalization in Construction - Trends

Green Building Initiatives

Prefabrication and Modular Construction - Government Regulation

Development Planning Policies

Building Codes and Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value (in RM), 2019-2024

- By Volume (in sqm), 2019-2024

- By Average Price (per sqm), 2019-2024

- By Project Type (in Value %)

Office Buildings

Retail Spaces

Hospitality Projects

Educational Institutions

Healthcare Facilities - By Region (in Value %)

Central Region

Northern Region

Southern Region

Eastern Region

East Malaysia - By Construction Type (in Value %)

New Construction

Renovation

Demolition - By Funding Source (in Value %)

Private Sector

Government Initiatives

Foreign Direct Investment (FDI) - By Building Materials Used (in Value %)

Steel

Concrete

Wood

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share by Project Type, 2024 - Cross Comparison Parameters (Company Overview, Project Portfolio, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Geographic Presence, Number of Projects Completed, Capacity, Unique Service Offerings, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis for Key Market Segments

- Detailed Profiles of Major Companies

Gamuda Berhad

IJM Corporation Berhad

Sunway Construction Group

WCT Holdings Berhad

Perak Corporation Berhad

YTL Corporation Berhad

SP Setia Berhad

Ranhill Holdings Berhad

Bina Puri Holdings Berhad

coWorld Development Group

Mah Sing Group Berhad

PNB Merdeka Ventures

Lendlease Corporation Limited

Boustead Holdings Berhad

UEM Sunrise Berhad

- Market Demand and Utilization

- Purchasing Power of Clients

- Regulatory and Compliance Frameworks

- Decision-Making Process

- Needs and Pain Point Analysis

- By Value (in RM), 2025-2030

- By Volume (in sqm), 2025-2030

- By Average Price (per sqm), 2025-2030