Market Overview

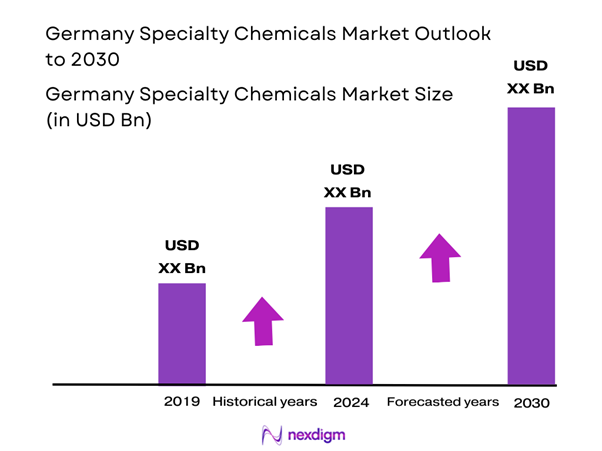

The Germany specialty chemicals market is valued at USD 30 billion in 2024 with an approximated compound annual growth rate (CAGR) of 2% from 2024-2030, showcasing robust growth driven by increasing industrial applications and innovations in sustainable solutions. The expanding automotive, electronics, and construction sectors are pivotal in this growth trajectory. Additionally, a strong emphasis on environmental regulations has propelled investments in bio-based chemicals, which contribute to a significant portion of market valuation.

Cities like Frankfurt, Stuttgart, and Düsseldorf are at the heart of the specialty chemicals market in Germany. Frankfurt serves as a major financial hub with significant investments in R&D, while Stuttgart is known for its automotive industry, creating a high demand for specialty chemicals. Düsseldorf, being a logistics center, enhances the distribution efficiency of chemical products. Together, these cities foster a competitive environment for the specialty chemicals market, leveraging their respective strengths and infrastructure.

The global trend towards sustainability is further reflected within the Germany specialty chemicals market, with companies investing in bio-based chemicals that account for approximately €17 billion in revenue in Germany as of 2023. The growing consumer preference for environmentally friendly products is prompting chemical companies to innovate bio-based alternatives. Moreover, the demand for biodegradable products in sectors such as packaging is on the rise, highlighting a robust opportunity for sustainable chemicals.

Market Segmentation

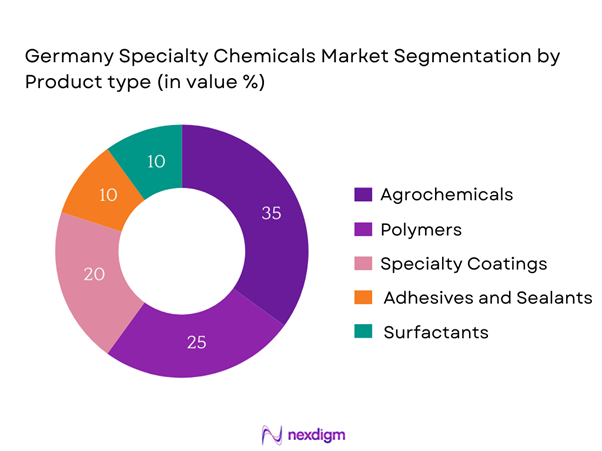

By Product Type

The Germany specialty chemicals market is segmented by product type into agrochemicals, polymers, specialty coatings, adhesives and sealants, and surfactants. Among these, agrochemicals command a dominant position due to the ongoing focus on agricultural productivity and sustainability. The demand for agrochemicals has surged, driven by the need to increase crop yields and combat pests, especially in an era of climate change. This surge is supported by research advancements in precision agriculture, leading to an upsurge in effective chemical solutions tailored to specific agricultural practices.

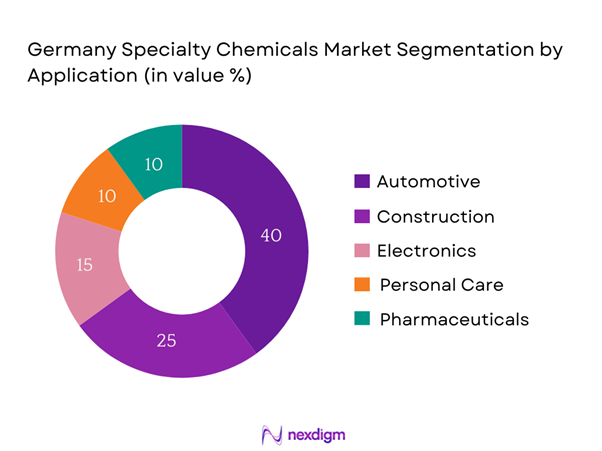

By Application

The Germany specialty chemicals market is segmented by application into automotive, construction, electronics, personal care, and pharmaceuticals. The automotive sector holds the largest share in this segmentation, largely due to Germany being home to major automotive manufacturers like BMW, Volkswagen, and Daimler. As these companies invest heavily in innovative car manufacturing, there is a parallel increase in the demand for specialty chemicals used in automotive components and finishes. The continuous focus on lightweight materials and sustainability has further accelerated the need for specialized formulations that enhance vehicle performance and safety.

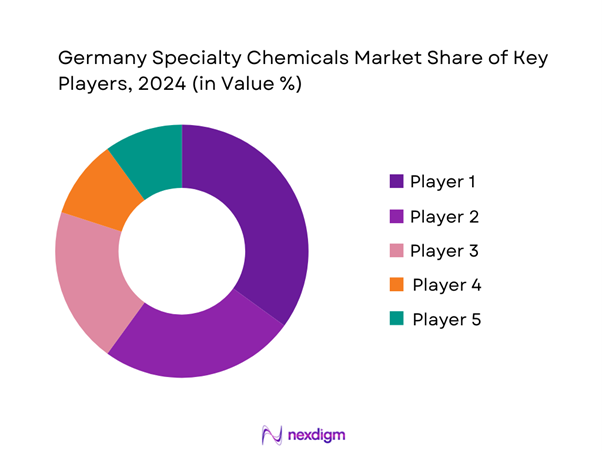

Competitive Landscape

The Germany specialty chemicals market is characterized by a few key players which shape the competitive landscape. Major brands such as BASF, Evonik Industries, and Clariant dominate the market. BASF, established in 1865 and headquartered in Ludwigshafen, is renowned for its advanced chemical solutions across various sectors, holding a significant market share. The streamlined operations and continued investment in research and innovation of these companies highlight their strong influence in the market.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Types | Strategic Partnerships | Innovation Focus |

| BASF | 1865 | Ludwigshafen | – | – | – | – |

| Evonik Industries | 2002 | Essen | – | – | – | – |

| Clariant | 1995 | Muttenz | – | – | – | – |

| Lanxess | 2004 | Cologne | – | – | – | – |

| Wacker Chemie | 1914 | Munich | – | – | – | – |

Germany Specialty Chemicals Market Analysis

Growth Drivers

Increasing Environmental Regulations

Germany has established itself as a leader in environmental regulations, with the government committing to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. This commitment extends to the specialty chemicals industry, driving investments in eco-friendly production methods. The European Union’s Green Deal aims to make Europe climate-neutral by 2050, affecting various sectors including chemicals. As of 2023, Germany’s renewable energy consumption was approximately 42%, encouraging companies to adopt sustainable practices to comply with strict environmental standards. Such regulations contribute directly to the growth of eco-friendly specialty chemical solutions.

Innovation in Products

Innovation remains a pivotal growth driver for the specialty chemicals market in Germany. Investment in research and development reached €130 billion in 2022, according to the Federal Ministry of Education and Research. This focus on innovative solutions paves the way for new product applications—such as lightweight materials for the automotive and aerospace sectors. In turn, innovation in specialty chemicals has been crucial to adapting to the increasing demand for advanced materials capable of high performance and sustainability. Additionally, regions such as North Rhine-Westphalia are heavily focused on fostering innovation ecosystems, further enhancing competitiveness.

Market Challenges

Raw Material Price Volatility

The specialty chemicals sector is grappling with significant challenges related to raw material price volatility, driven by geopolitical issues and supply chain disruptions. In 2022, prices for key chemicals surged by an average of 20% due to disruptions caused by the pandemic and the conflict in Ukraine. Furthermore, as global oil prices fluctuate and the EU attempts to phase out dependency on imports, raw materials remain expensive. Such volatility erodes profit margins for manufacturers and necessitates greater operational efficiency to counteract heightened costs in the supply chain and raw material procurement.

Regulatory Compliance Barriers

Navigating the labyrinth of regulatory compliance is a foremost challenge for the Germany specialty chemicals market. Companies are obligated to adhere to multiple regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), which applies stringent reporting and compliance measures to chemical substances. Non-compliance can lead to substantial fines and legal repercussions. In 2022 alone, more than 5,000 substances were registered under REACH, highlighting the complexities faced by companies in ensuring conformity while maintaining productivity. The rigorous regulatory environment necessitates sustained investment in compliance infrastructure.

Opportunities

Expansion of Bio-Based Chemicals

The increasing emphasis on sustainability presents substantial growth opportunities for bio-based chemicals. Current statistics indicate that bio-based products accounted for approximately €350 billion in value globally, with Germany aiming to significantly boost its production share in this segment. The German government has implemented favorable policies and funding to support the development of bio-refineries, which can process biomass into chemicals. This indicates a future trajectory favoring investment and research in bio-based alternatives, which can address both ecological concerns and market demand for sustainable products.

Advanced Applications in Emerging Markets

The rapid industrialization in emerging markets presents substantial opportunities for specialty chemicals, especially in sectors such as construction and automotive. In 2022, emerging economies accounted for approximately 50% of the global chemicals market growth, primarily driven by urban expansion and infrastructure development. The demand for high-performance materials, including lightweight and durable chemicals, in these regions is forecasted to escalate as they seek to modernize their industries. Specifications for stringent environmental norms and performance criteria also create a pivotal space for German companies well-versed in specialty chemicals.

Future Outlook

Over the next five years, the Germany specialty chemicals market is expected to witness substantial growth driven by advancements in sustainable chemical production, increased demand for innovative materials across various industries, and stringent government regulations promoting eco-friendly practices. The anticipated rise in investments and R&D initiatives in the chemicals sector will further bolster market dynamics, positioning Germany as a leader in the global specialty chemicals landscape.

Major Players

- BASF

- Evonik Industries

- Clariant

- Lanxess

- Wacker Chemie

- Solvay

- Croda International

- Huntsman Corporation

- Eastman Chemical

- Arkema

- AkzoNobel

- Covestro

- Mitsubishi Chemical

- SABIC

- Air Products

Key Target Audience

- Manufacturers (Chemicals and Related Industries)

- Purchasing Managers (Aberdeen and Major Chemical Firms)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Federal Ministry for Economic Affairs and Energy, German Environment Agency)

- Product Development Teams (Industrial Applications)

- Logistics and Supply Chain Companies (Specialty Chemical Distribution)

- End-use Industry Executives (Automotive, Electronics, Construction)

- Industry Associations (German Chemical Industry Association – VCI)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of stakeholders within the Germany specialty chemicals market. This step is reinforced by extensive desk research, employing a combination of secondary and proprietary databases to gather comprehensive data on industry-level information. The primary focus is on identifying and defining critical variables that significantly influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data relevant to the Germany specialty chemicals market will be compiled and analyzed. This includes assessing market penetration rates, relationships between product categories, and resultant revenue generation. An evaluation of consumer preferences and application statistics will further validate revenue estimates, ensuring accuracy in market size calculations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics and trends will be developed and validated through consultations conducted via computer-assisted telephone interviews (CATIs) with industry experts. These experts will represent a variety of companies and functions, providing operational insights and empirical data that are crucial in refining and corroborating the compiled market data.

Step 4: Research Synthesis and Final Output

The final stage will involve engaging with multiple manufacturers of specialty chemicals to gather in-depth insights into product segments, sales performance, and consumer preferences. This interaction aims to verify and complement the statistics derived from the bottom-up approach, resulting in a comprehensive, accurate, and validated analysis of the Germany specialty chemicals market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary and Secondary Research Methods, Analytical Framework, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Development Timeline

- Business Cycle Dynamics

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Environmental Regulations

Innovation in Products

Emergence of Sustainable Chemicals - Market Challenges

Raw Material Price Volatility

Regulatory Compliance Barriers - Opportunities

Expansion of Bio-Based Chemicals

Advanced Applications in Emerging Markets - Trends

Shift Towards Eco-Friendly Products

Digital Transformation in Supply Chains - Government Regulation

Health and Safety Standards

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Agrochemicals

Polymers

Specialty Coatings

Adhesives and Sealants

Surfactants - By Application (In Value %)

Automotive

Construction

Electronics

Personal Care

Pharmaceutical - By End-user Industry (In Value %)

Food and Beverage

Agriculture

Textile

Oil and Gas

Consumer Goods - By Region (In Value %)

North Germany

South Germany

West Germany

East Germany - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Platforms

- Market Share Analysis of Key Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Positioning, Distribution Network, Revenue Streams, R&D Investments, Sustainability Practices, Customer Engagement Strategies, and others)

- SWOT Analysis of Major Market Participants

- Pricing Strategy Analysis of Key Competitors

- Profiles of Major Companies

BASF

Evonik Industries

Clariant

Lanxess

Wacker Chemie

Henkel

Air Products

Merck KGaA

Solvay

Eastman Chemical

Croda International

Arkema

Huntsman Corporation

Ashland Global Holdings

DSM

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocation Insights

- Compliance and Regulatory Impact

- Needs and Pain Points of End Users

- Decision-Making Process Overview

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030