Market Overview

The Germany industrial chemicals market is valued at approximately USD 4000 million in 2024 with an approximated compound annual growth rate (CAGR) of 8.5% from 2024-2030, driven by a robust manufacturing sector, a strong focus on research and development, and an increasing demand for sustainable chemical solutions. The market is propelled by technological advancements and government initiatives promoting chemical innovations that comply with environmental standards.

Countries like Germany, France, and the Netherlands dominate the industrial chemicals market in Europe due to their advanced manufacturing capabilities, strong regulatory frameworks, and established supply chains. Germany, in particular, is known for its innovation, and its leading chemical companies benefit from extensive research institutions and a skilled workforce. This infrastructure underpins the continuous development of new chemical products, ensuring Germany remains a pivotal player in the global industrial chemicals market.

Sustainability has become a significant driving force in the industrial chemicals market, with Germany’s green investment strategy targeting an increase of up to 50 billion euros by end of 2025 for clean technologies. The shift towards sustainable practices, such as renewable feedstock and energy-efficient processes, is enhancing competitiveness. Approximately 30% of all chemical companies are currently focusing on developing eco-friendly products, reflecting a strong market demand for sustainable solutions.

Market Segmentation

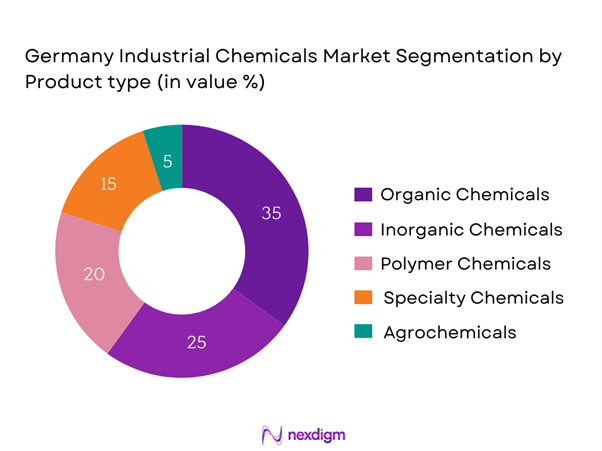

By Product Type

The Germany industrial chemicals market is segmented by product type into organic chemicals, inorganic chemicals, polymer chemicals, specialty chemicals, and agrochemicals. Among these, organic chemicals hold a dominant market share due to their extensive application across various industries, including pharmaceuticals, textiles, and food production. The versatility of organic chemicals, combined with the trend toward bio-based and sustainable products, makes them increasingly preferred. Innovations in organic chemical formulations cater to specific end-user requirements, further enhancing their market position.

By Application

The market is also segmented by application, which includes pharmaceuticals, agriculture, construction, food and beverages, and manufacturing. The pharmaceutical segment is a clear leader because of the high demand for chemical products for drug formulation and the ongoing advancements in healthcare. The consistent growth of the healthcare sector, accelerated by demographic changes and the rising prevalence of chronic diseases, keeps the pharmaceutical application at the forefront, driving significant investment in research and development.

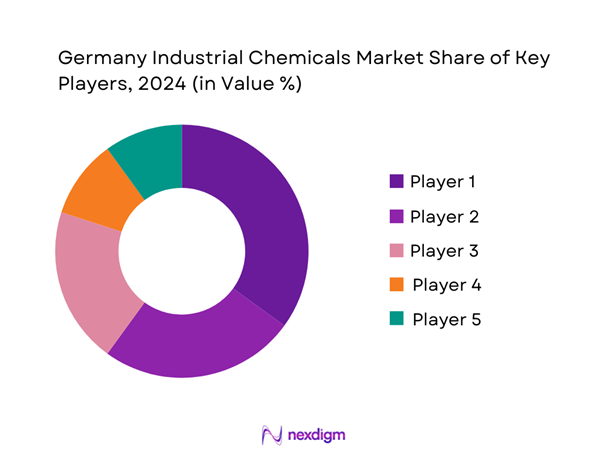

Competitive Landscape

The Germany industrial chemicals market is characterized by a number of major players, including BASF SE, Evonik Industries AG, Bayer AG, Lanxess AG, and Covestro AG. These companies leverage their established market presence, extensive research and development capabilities, and strong distribution networks to maintain competitive advantages. This consolidation underscores the significant influence of these key players in driving innovation and addressing evolving customer needs within the sector.

| Company Name | Establishment Year | Headquarters | Market Share | R&D Investment | Number of Employees | Product Portfolio | Key Markets |

| BASF SE | 1865 | Ludwigshafen, Germany | – | – | – | – | – |

| Evonik Industries AG | 2007 | Essen, Germany | – | – | – | – | – |

| Bayer AG | 1863 | Leverkusen, Germany | – | – | – | – | – |

| Lanxess AG | 2004 | Cologne, Germany | – | – | – | – | – |

| Covestro AG | 2015 | Leverkusen, Germany | – | – | – | – | – |

Germany Industrial Chemicals Market Analysis

Growth Drivers

Increasing Industrial Output

The industrial output in Germany has seen a consistent recovery post-pandemic, with production levels reaching approximately 3.7 trillion euros in 2022. This growth is underpinned by increased demand across key sectors, including automotive and machinery. Industrial production is projected to stabilize further, with the German economy expected to grow by about 1.3% in 2024, according to the German Federal Statistical Office. Such growth directly influences the demand for industrial chemicals, driving manufacturers to scale production in response to industrial requirements.

Technological Advancements

Germany has long been a leader in innovation, with over 100 billion euros invested in research and development in 2022 alone. This commitment to innovation has fostered advancements in chemical processing methods, such as the increased use of automation and AI in manufacturing processes. The adoption of Industry 4.0 principles is estimated to enhance efficiency by 25% across the chemical sector, thus attracting investment and improving production capabilities. This technological advancement contributes to the overall growth of the industrial chemicals market by enabling companies to produce a wider array of high-quality products efficiently.

Market Challenges

Regulatory Compliance

The regulatory landscape for industrial chemicals in Germany is governed by stringent EU regulations, including REACH and CLP regulations aimed at protecting human health and the environment. In 2022 alone, businesses incurred compliance costs exceeding 1.5 billion euros, significantly impacting operational budgets. These regulations require companies to invest in safety data sheets and frequently update submissions to ensure compliance, thus complicating production procedures and potentially limiting market entry for smaller firms. As the landscape evolves, companies must continuously adapt to new regulations to avoid penalties and ensure competitiveness.

Raw Material Availability

The availability of raw materials for the industrial chemicals sector has been a persistent challenge, exacerbated by global supply chain disruptions. In 2022, a reported 25% of companies faced difficulties sourcing essential chemicals, with the supply of key materials such as propylene and ethylene experiencing tightness. The geopolitical tensions and trade restrictions have led to increased prices and scarcity, complicating long-term planning for manufacturers. This shortage of raw materials has significant implications for production volumes and costs, thus affecting overall market stability.

Opportunities

Emerging Green Chemicals Sector

The shift towards green chemistry is gaining momentum, with Germany’s market for bioplastics projected to reach 0.5 million tons by end of 2025. Current advancements in biopolymer technologies and the European Union’s commitment to a greener future are fueling investments in research and development of sustainable product lines. As consumers demand environmentally friendly options, companies that invest in this sector are positioned for significant growth, potentially capturing a larger share of the

Demand for Custom Chemical Solutions

With industries increasingly seeking tailored solutions to meet specific needs, the demand for custom chemical solutions is rising. In 2022, approximately 60% of industrial clients reported looking for bespoke products, driven by the necessity for increased efficiency and specialized applications in sectors such as pharmaceuticals and electronics. This trend presents a lucrative opportunity for chemical manufacturers to develop niche products that meet localized demands, thereby enhancing profit margins and securing customer loyalty through deeper collaboration.

Future Outlook

Over the next six years, the Germany industrial chemicals market is expected to experience significant growth driven by an increase in sustainable practices, government regulations favoring green chemicals, and the ongoing technological advancements in chemical manufacturing processes. The transition towards more environmentally friendly products will further enhance market opportunities and encourage innovation within the sector, responding to heightened consumer and regulatory demands.

Major Players

- BASF SE

- Evonik Industries AG

- Bayer AG

- Lanxess AG

- Covestro AG

- Wacker Chemie AG

- Clariant AG

- Henkel AG & Co. K

- Linde AG

- Solvay S.A.

- Huntsman Corporation

- Arkema S.A.

- Eastman Chemical Company

- Chemtura Corporation

- Mitsubishi Chemical Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Federal Ministry for Economic Affairs and Energy, European Chemicals Agency)

- Major Manufacturing Firms

- Distributors and Wholesalers of Industrial Chemicals

- End-User Industries (e.g., Automotive, Pharmaceuticals)

- Research and Development Institutions

- Trade Associations and Industry Bodies

- Environmental NGOs and Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Germany industrial chemicals market. Extensive desk research is conducted utilizing a blend of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Germany industrial chemicals market is compiled and analyzed. This includes assessments of market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Additionally, evaluations of service quality statistics will be performed to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts representing diverse companies. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple industrial chemical manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. These interactions will serve to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Germany industrial chemicals market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Industrial Output

Technological Advancements

Sustainable Practices Adoption - Market Challenges

Regulatory Compliance

Raw Material Availability - Opportunities

Emerging Green Chemicals Sector

Demand for Custom Chemical Solutions - Trends

Digitization in Chemical Manufacturing

Rising Usage of Biodegradable Chemicals - Government Regulations

Environmental Policies

Safety Standards Compliance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Organic Chemicals

Inorganic Chemicals

Polymer Chemicals

Specialty Chemicals

Agrochemicals - By Application (In Value %)

Pharmaceuticals

Agriculture

Construction

Food and Beverages

Manufacturing - By Distribution Channel (In Value %)

Direct Sales

Distributors/Wholesalers

Online Retail - By Region (In Value %)

Northern Germany

Southern Germany

Western Germany

Eastern Germany - By End-User Industry (In Value %)

Automotive

Electronics

Textile

Oil and Gas

Personal Care

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Industrial Chemicals Segment, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Industrial Chemicals, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

BASF SE

Evonik Industries AG

Bayer AG

Lanxess AG

Wacker Chemie AG

Covestro AG

Clariant AG

Henkel AG & Co. KGaA

Linde AG

Solvay S.A.

Huntsman Corporation

Arkema S.A.

Eastman Chemical Company

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030