Market Overview

The India Agrochemical Market is valued at USD 33,000 million in 2024, based on a five-year historical analysis. The growth is primarily driven by increasing agricultural production, government initiatives for sustainable farming, and the rising adoption of advanced agrochemical products among farmers. The demand for effective crop protection measures and high-yield solutions has significantly boosted the market growth, reflecting the importance of agrochemicals in enhancing crop productivity to meet the growing food requirements of a burgeoning population.

Dominant regions in the India Agrochemical Market include Maharashtra, Punjab, and Uttar Pradesh due to their extensive agricultural activities and favorable climatic conditions. These states contribute significantly to crop yields, making them key markets for agrochemical providers. Factors such as government support programs, advanced farming techniques, and increased awareness of crop protection solutions play a crucial role in driving the market presence in these regions.

The Indian government has implemented various initiatives to support the agrochemical sector and overall agricultural growth. The PM-KISAN scheme provides direct cash benefits to farmers, amounting to USD 7.7 billion in 2022, facilitating their access to necessary inputs like fertilizers and pesticides. Additionally, the government is focused on providing training and resources through the Agricultural Technology Management Agency (ATMA) to improve farm productivity.

Market Segmentation

By Product Type

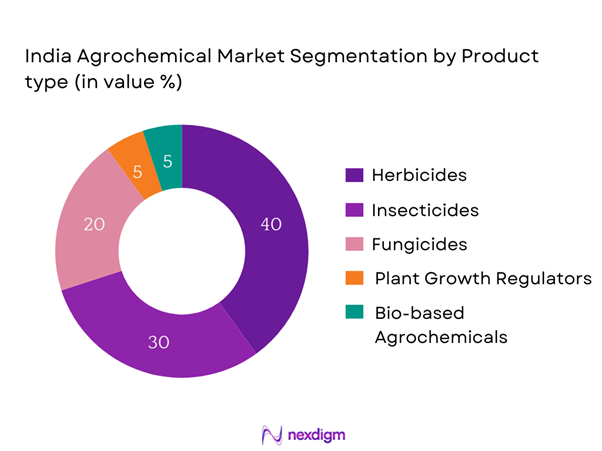

The India Agrochemical market is segmented by product type into herbicides, insecticides, fungicides, plant growth regulators, and bio-based agrochemicals. Among these, herbicides occupy a dominant market share, primarily due to the rapid adoption of modern farming practices aimed at optimizing crop yield. Herbicides help in effective weed control, reducing competition for nutrients, and enhancing overall productivity. The increasing use of genetically modified crops tailored for herbicide resistance has propelled demand within this sub-segment, making it a vital component of modern agricultural practices.

By Application

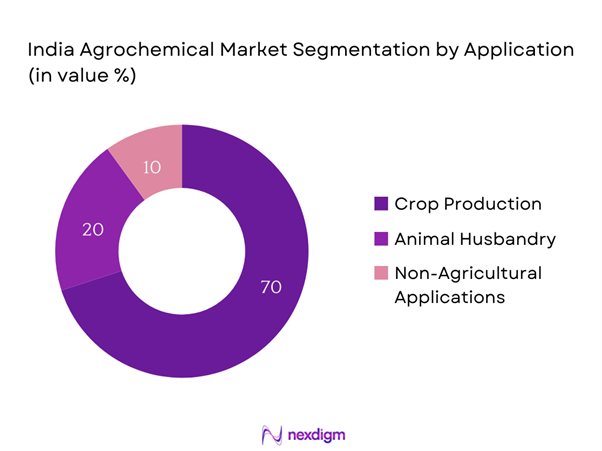

The market is further segmented by application into crop production, animal husbandry, and non-agricultural applications. Crop production is the leading segment, driven by the necessity to enhance yield and quality through effective agrochemical use. With the escalating demands for food coupled with the strategic focus on organic farming, the application of agrochemicals in crop production is witnessing substantial growth. This is attributed to the increasing adoption of integrated pest management practices, which incorporate agrochemicals to provide robust crop protection solutions.

Competitive Landscape

The India Agrochemical Market is dominated by a few major players, including global giants such as Bayer Crop Science, Syngenta, and BASF, alongside strong local entities like UPL Limited and Rallis India Limited. This consolidation highlights the significant influence and resources that these key companies bring into the market, allowing them to shape innovation and respond effectively to market demands.

| Company Name | Establishment Year | Headquarters | Market Focus | Product Portfolio | R&D Investment | Distribution Channels |

| Bayer Crop Science | 1863 | Monheim, Germany | – | – | – | – |

| Syngenta | 2000 | Basel, Switzerland | – | – | – | – |

| BASF | 1865 | Ludwigshafen, Germany | – | – | – | – |

| UPL Limited | 1969 | Mumbai, India | – | – | – | – |

| Rallis India Limited | 1948 | Mumbai, India | – | – | – | – |

India Agrochemical Market Analysis

Growth Drivers

Increasing Demand for Food Production

As India’s population continues to rise, reaching approximately 1.4 billion in 2023, there is an escalating demand for food production to ensure food security. The Food and Agriculture Organization (FAO) projects that the country needs to increase its food grain production to around 300 million tons by end of 2025 to meet the nutritional needs of its population. This demand is exacerbated by urbanization, which is expected to result in 600 million people living in urban areas by 2031, thereby increasing the need for efficient agricultural practices and technologies to maximize yields.

Technological Advancements

Technological advancements in agriculture are vital to enhance productivity and sustainability. By end of 2025, it is expected that 50% of farmers in India will adopt precision agriculture technologies, driven by the need to optimize inputs like fertilizers and pesticides. The government supports these innovations through initiatives such as the Pradhan Mantri Krishi Sinchai Yojana, which aims to improve irrigation efficiency and increase crop yields. In 2022, investments in agricultural technology reached USD 4 billion, signaling a shift towards tech-based solutions in farming, fostering sustainable growth.

Market Challenges

Environmental Concerns

Environmental concerns surrounding agrochemical usage have gained traction, presenting a challenge to the sector. Recent studies indicate that excessive pesticide use has led to soil and water contamination, with nearly 50% of Indian rivers affected by agricultural runoff. The government and environmental agencies are now focusing on sustainable farming practices, highlighting the need for reduced chemical dependency. Furthermore, increasing public awareness concerning the side effects of traditional agrochemicals has led to greater scrutiny on their use, pushing towards more eco-friendly alternatives.

Regulatory Compliance

Adhering to regulatory compliance poses significant challenges for agrochemical manufacturers. The Indian government has stringent regulations regarding pesticide registration, requiring robust evidence of safety and effectiveness before market entry. As of 2023, there were over 1,000 registered pesticides in India, but numerous applications faced delays due to complex approval processes. This can hinder the pace of innovation and disrupt supply chains, negatively impacting the availability of necessary agrochemicals for farmers who rely on timely access to these resources to maximize their crop yields.

Opportunities

Expansion of Organic Farming

The organic farming sector in India presents significant growth opportunities, with the market expected to reach USD 1.5 billion by end of 2025. As of 2022, India had over 1.5 million hectares of organic farmland and 1.5 million certified organic farmers, reflecting a 20% increase from the previous year. This expansion is fueled by the rising consumer preference for organic products, which are perceived as safer and healthier. The government’s support through the National Programme for Organic Production (NPOP) further enhances this growth potential by promoting sustainable agricultural practices.

Development of Sustainable Agrochemicals

There is a pressing need for the development of sustainable agrochemicals, creating significant market opportunities for innovation. The global bio-pesticide market is currently valued at USD 6.4 billion in 2023 and is driven by increasing demand for eco-friendly alternatives to chemical pesticides. Indian companies are responding to this demand by investing USD 1 billion in research and development to create sustainable agrochemical solutions that meet both environmental standards and farmer needs, ensuring future growth in this segment.

Future Outlook

Over the next several years, the India Agrochemical Market is anticipated to experience substantial growth driven by continuous advancements in agrochemical technologies, rising awareness regarding sustainable agriculture, and increasing government support for agricultural productivity. As the agricultural sector adapts to climate change challenges, the demand for innovative and efficient agrochemical solutions is expected to rise significantly, positioning the industry for robust growth.

Major Players

- Bayer Crop Science

- Syngenta

- BASF

- UPL Limited

- Rallis India Limited

- Adama Agricultural Solutions

- Corteva Agriscience

- FMC Corporation

- Godrej Agrovet

- Nuziveedu Seeds

- Krishak Bharati Cooperative

- Jain Irrigation Systems

- Mahyco

- Shree Ram Fertilizers

- Anant Chemicals

Key Target Audience

- Agricultural Producers

- Agribusiness Firms

- Crop Consultants

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Agriculture and Farmers’ Welfare, Agricultural and Processed Food Products Export Development Authority)

- Agrochemical Distributors

- Farmers’ Cooperatives

- Agricultural NGOs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India Agrochemical Market. This step is underpinned by extensive desk research, including a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the India Agrochemical Market. This includes assessing market penetration, the ratio of agrochemical inputs to agricultural yield, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple agrochemical manufacturers and suppliers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Agrochemical Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Food Production

Technological Advancements

Government Initiatives and Support - Market Challenges

Environmental Concerns

Regulatory Compliance - Opportunities

Expansion of Organic Farming

Development of Sustainable Agrochemicals - Trends

Precision Agriculture

Digital Agriculture Solutions - Government Regulation

Pesticide Control Laws

Environmental Protection Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Herbicides

Insecticides

Fungicides

Plant Growth Regulators

Bio-based Agrochemicals - By Application (In Value %)

Crop Production

Animal Husbandry

Non-Agricultural Applications - By Distribution Channel (In Value %)

Direct Sales

Distributors

Retail Outlets - By Crop Type (In Value %)

Food Crops

Cash Crops

Horticultural Crops - By Formulation Type (In Value %)

Liquid

Solid

Granular

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Agrochemical Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Market Reach, Distribution Channels, Product Portfolio, R&D Investments, and Customer Engagement Strategies, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Bayer Crop Science

Syngenta AG

BASF SE

Dow AgroSciences

Adama Agricultural Solutions

UPL Limited

Rallis India Limited

Corteva Agriscience

FMC Corporation

Escorts Limited

Godrej Agrovet

Shree Ram Fertilizers

Krishak Bharati Cooperative

NutriAg

Anant Chemicals

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030