Market Overview

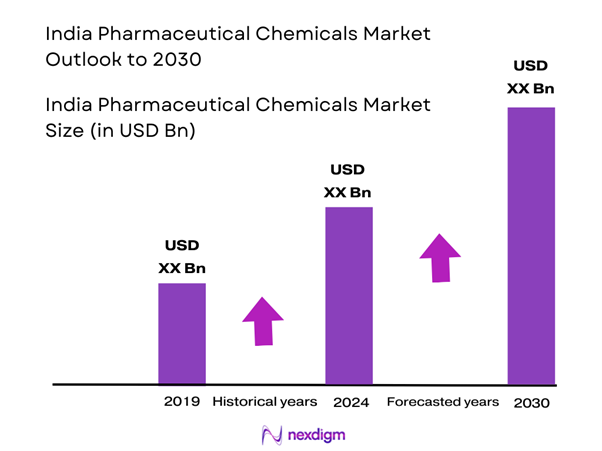

The India Pharmaceutical Chemicals Market is valued at USD 27 billion, reflecting strong growth driven by the rising demands for pharmaceuticals and healthcare products. This market benefits significantly from domestic production capabilities and an expanding export base. The increasing prevalence of chronic diseases and a growing emphasis on generic medicines catalyze market growth, bolstered by government initiatives oriented toward enhancing healthcare services.

Dominating regions in the India Pharmaceutical Chemicals Market include states like Maharashtra, Gujarat, and Andhra Pradesh. These areas host a concentration of pharmaceutical manufacturing units due to their established chemical infrastructure, proximity to key markets, and favorable government policies. Furthermore, cities like Hyderabad and Bengaluru play critical roles as hubs for research and development, given their strong educational institutions and burgeoning healthcare sectors which attract investments.

Investment in pharmaceutical research and development in India has surged, with spending reaching an estimated USD 4 billion in 2022. The Indian pharmaceutical industry rigorously invests in innovative drug discovery and clinical trials, contributing to advancements in treatments and therapies. Coupled with government incentives to promote research, such as the “Make in India” initiative, which encourages local manufacturing and research, this growth signals the potential for new pharmaceutical chemicals to enter the market.

Market Segmentation

By Product Type

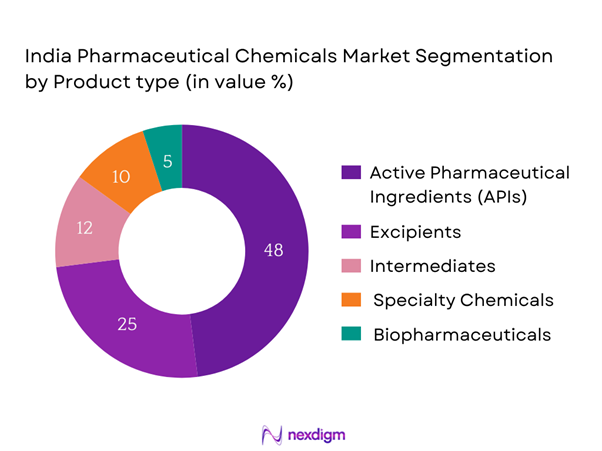

The India Pharmaceutical Chemicals Market is segmented by product type into Active Pharmaceutical Ingredients (APIs), Excipients, Intermediates, Specialty Chemicals, and Biopharmaceuticals. Within this segmentation, Active Pharmaceutical Ingredients (APIs) hold a dominant share. The strong demand for APIs is attributed to their crucial role in the pharmaceutical supply chain, compounded by the rising global demand for generic drugs and the increasing number of new drug approvals by regulators. The rise of contract manufacturing organizations (CMOs) also bolsters the API sector, thereby driving this segment’s expansion significantly.

By Application

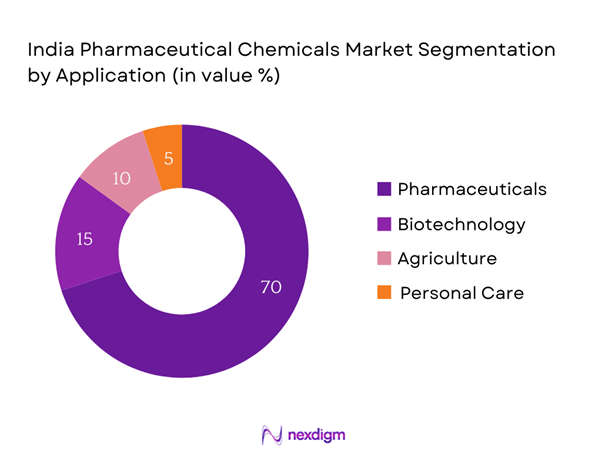

The market is also categorized by application into Pharmaceuticals, Biotechnology, Agriculture, and Personal Care. The Pharmaceuticals application segment dominates the share primarily due to the surge in pharmaceutical production driven by ongoing innovations in drug development. The demand within this sector is heightened by a growing awareness of health issues, increasing chronic disease prevalence, and the drive towards self-medication. Furthermore, government support for local drug manufacturing further strengthens the impetus for pharmaceuticals, enhancing this segment’s significance in the market.

Competitive Landscape

The India Pharmaceutical Chemicals Market is dominated by major players such as Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, and Aurobindo Pharma among others. This concentration reflects the significant influence of these firms due to their extensive resources, strong brand recognition, and established operational footprints within the country.

| Company | Establishment Year | Headquarters | Active Product Range | Market Reach | R&D Investment | Regulatory Compliance Standards |

| Sun Pharmaceutical Industries | 1983 | Mumbai, India | – | – | – | – |

| Dr. Reddy’s Laboratories | 1984 | Hyderabad, India | – | – | – | – |

| Aurobindo Pharma | 1986 | Hyderabad, India | – | – | – | – |

| Cipla | 1935 | Mumbai, India | – | – | – | – |

| Lupin Pharmaceuticals | 1968 | Mumbai, India | – | – | – | – |

India Pharmaceutical Chemicals Market Analysis

Growth Drivers

Increasing Healthcare Expenditure

India’s healthcare expenditure has significantly increased, reaching USD 156 billion in 2023, and is projected to exceed USD 200 billion by end of 2025. This surge indicates a growing commitment to enhance healthcare infrastructure and services. The Indian government has initiated numerous programs to boost health spending, including the National Health Mission, which aims to improve healthcare accessibility and affordability. The increase in healthcare expenditure is expected to drive demand for pharmaceutical chemicals, as a healthier population necessitates a broader range of medications and treatments.

Rise in Chronic Diseases

India is witnessing a marked rise in chronic disease prevalence, with estimates indicating that over 50% of deaths in 2023 are attributed to non-communicable diseases (NCDs), including heart disease, diabetes, and cancer. Reports from the World Health Organization indicate that approximately 30 million people in India are living with diabetes. This increase drives the demand for pharmaceutical chemicals, as more chronic conditions necessitate advanced and sustained medication regimens. As the population ages, the burden of chronic diseases continues to increase, generating higher demand for effective pharmaceutical treatments.

Market Challenges

Regulatory Compliances

The Indian pharmaceutical chemicals market faces stringent regulatory compliances, which can impede operational efficiency. The Central Drugs Standard Control Organization (CDSCO) in India mandates a complex framework to ensure drug safety and efficacy, requiring compliance with numerous local and international guidelines. As of 2023, over 300 new pharmaceutical regulations were introduced to enhance transparency and safety within the industry. These regulations necessitate extensive documentation and approval processes, leading to increased operational costs and delays in product launches, thereby presenting a significant challenge for manufacturers in the rapidly evolving pharmaceutical sector.

Supply Chain Disruptions

The pharmaceutical chemicals market in India is currently experiencing significant supply chain disruptions, exacerbated by global logistical challenges and geopolitical tensions. In 2023, delays in shipping have led to over 20% of pharmaceutical shipments being delayed, with associated costs rising by approximately 30% due to increased freight rates. Moreover, scarcity of raw materials essential for chemical production, such as APIs sourced from other countries, highlights vulnerabilities in the supply chain. These disruptions can impact manufacturers’ ability to meet demand and maintain production schedules, thus posing a considerable challenge to the market’s stability.

Opportunities

Expansion in Emerging Markets

The Indian pharmaceutical chemicals market is well-positioned for expansion into emerging markets, driven by increasing accessibility to healthcare in regions like Africa and Southeast Asia. As of 2023, India accounted for approximately 60% of global vaccine supply and is a key player in generic pharmaceuticals. With the global healthcare market projected to grow to USD 12 trillion by end of 2025, Indian companies can leverage their manufacturing capabilities and cost advantages to penetrate these markets, fulfilling the rising demand for affordable medicines while increasing their export volume. This expansion represents a significant opportunity for the Indian pharmaceutical chemicals sector.

Growing Investment in R&D

There is a notable increase in investments in research and development within the Indian pharmaceutical sector, with current spending on R&D approaching USD 5.2 billion as of 2023. The government and private sector have recognized the necessity for innovation in drug development, resulting in substantial financial commitments. Additionally, initiatives such as the Pharmaceutical Industry Development Program aim to bolster R&D capabilities by providing grants and incentives to companies engaging in innovative research. With a growing emphasis on biotechnology and personalized medicine, this investment in research and development is expected to create new avenues for pharmaceutical chemicals, enhancing their market presence and leading to groundbreaking treatments for various diseases.

Future Outlook

Over the next several years, the India Pharmaceutical Chemicals Market is poised to observe significant growth, mainly driven by increased government support for local manufacturing, advancements in pharmaceutical technologies, and the ever-increasing consumer demand for healthcare solutions. The market is expected to capitalize on the growing trend towards outsourcing pharmaceutical production, which simplifies costs while ensuring timely delivery of products to global markets. Additionally, positive regulatory changes aimed at accelerating drug approval processes will further augment market dynamics.

Major Players

- Sun Pharmaceutical Industries

- Reddy’s Laboratories

- Aurobindo Pharma

- Cipla

- Lupin Pharmaceuticals

- Zydus Cadila

- Biocon

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals

- Wockhardt

- Alkem Laboratories

- Divi’s Laboratories

- IPCA Laboratories

- Jubilant Life Sciences

- Natco Pharma

Key Target Audience

- Pharmaceutical Manufacturers

- Biotechnology Firms

- Contract Manufacturing Organizations (CMOs)

- Regulatory and Compliance Bodies (CDSCO, DCGI)

- Hospitals and Healthcare

- Research and Development Institutions

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Pharmaceuticals, Ministry of Health and Family Welfare)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the India Pharmaceutical Chemicals Market. This process is anchored in extensive desk research, utilizing a blend of secondary data from reputable sources and proprietary databases to gather a complete view of industry-level information. The primary goal is to identify and define critical variables that influence market dynamics, such as key players, regulatory frameworks, and market drivers.

Step 2: Market Analysis and Construction

Following the identification of key variables, this phase focuses on compiling and analyzing historical data regarding the India Pharmaceutical Chemicals Market. This includes assessing market penetration rates, the landscape of suppliers versus demanders, and the resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, forming the foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses will be developed and validated through in-depth interviews and consultations with industry experts representing various companies and sectors within the pharmaceutical industry. This insight is invaluable, providing operational and financial perspectives directly from practitioners involved in the market. The consultations will serve to refine and corroborate the market data collected, ensuring a comprehensive understanding of the landscape.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with multiple pharmaceutical manufacturers and distributors to gather detailed insights regarding their product segments, sales performance, consumer preferences, and other relevant factors. This interaction aims to validate and enhance statistics derived from previous steps, ensuring an exhaustive and accurate analysis of the India Pharmaceutical Chemicals Market, paving the way for informed decision-making by stakeholders.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations, and Future Conclusions)

- Definition and Scope

- Market Genesis

- Major Players Timeline

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Healthcare Expenditure

Rise in Chronic Diseases

Advancements in Pharmaceutical Research - Market Challenges

Regulatory Compliances

Supply Chain Disruptions - Opportunities

Expansion in Emerging Markets

Growing Investment in R&D - Trends

Shift Towards Green Chemistry

Innovations in Drug Delivery Systems - Government Regulation

Quality Standards

Intellectual Property Rights - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Active Pharmaceutical Ingredients (APIs)

Excipients

Intermediates

Specialty Chemicals

Biopharmaceuticals - By Application (In Value %)

Pharmaceuticals

Biotechnology

Agriculture

Personal Care - By Distribution Channel (In Value %)

Direct Sales

Wholesalers/Distributors

Online Retail - By Region (In Value %)

North India

West India

East India

South India - By End-User (In Value %)

Contract Manufacturing Organizations (CMOs)

Research Institutions

Pharmaceutical Companies

Universities

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Dealers and Distributors, Production Plant Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Sun Pharmaceutical Industries

Dr. Reddy’s Laboratories

Cipla

Aurobindo Pharma

Lupin Pharmaceuticals

Zydus Cadila

Alkem Laboratories

Glenmark Pharmaceuticals

Torrent Pharmaceuticals

Wockhardt

Biocon

IPCA Laboratories

Divi’s Laboratories

Jubilant Life Sciences

Natco Pharma

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030