Market Overview

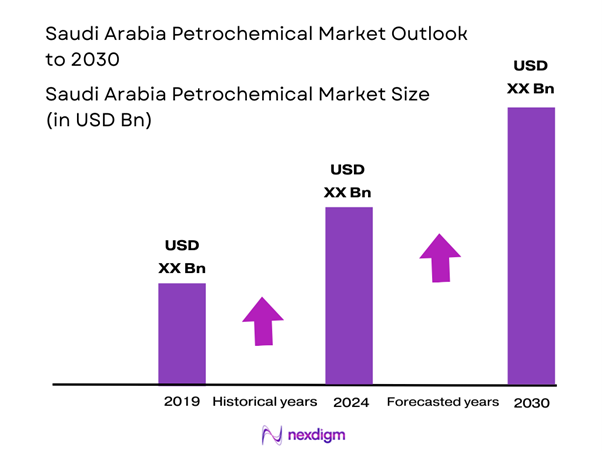

The Saudi Arabia petrochemical market is valued at USD 52.6 billion, reflecting sustained growth driven by increasing demand across various sectors, including plastics, textiles, and automotive. The market’s expansion is predominantly influenced by the strong production capacity and investments in state-of-the-art manufacturing facilities, enabling the country to produce a wide array of petrochemical products that meet both domestic and international demand. Major players in the market, supported by advanced technology and substantial governmental backing, enhance the country’s competitive advantage.

The Saudi Arabia petrochemical market is dominated by key cities such as Jubail and Yanbu, which are centered around large industrial complexes and strategically located near ports for seamless export. These cities are pivotal due to their proximity to essential resources, including natural gas, which is the primary feedstock for petrochemical production. Additionally, supportive government policies and investments reinforce their role as major hubs of production, making them essential to the global petrochemical supply chain.

The Saudi government has committed to substantial investments in the petrochemical sector, with over SAR 75 billion allocated for new initiatives in 2024. These investments are aligned with supporting industries essential to the Kingdom’s Vision 2030 framework, focusing on diversification and economic resilience. Additionally, the government plans to enhance infrastructure, including transportation and logistics networks, to further solidify Saudi Arabia’s position as a leader in petrochemical production and export.

Market Segmentation

By Product Type

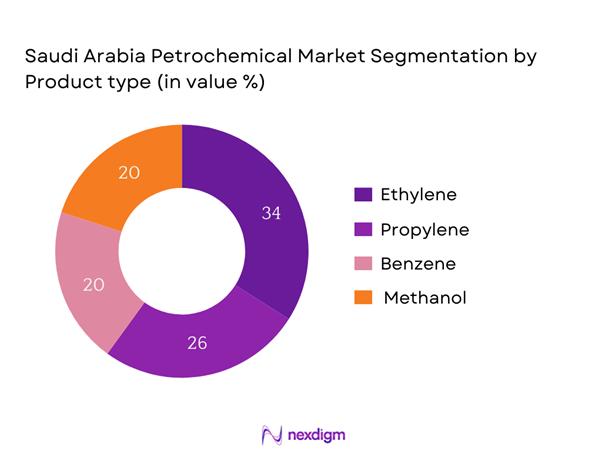

The Saudi Arabia petrochemical market is segmented by product type into ethylene, propylene, benzene, and methanol. Among these, ethylene holds a dominant market share due to its role as a key building block in the production of various chemicals and plastics, which are crucial across industries. Ethylene’s versatility in applications, from packaging to automotive parts, highlights its significance in the manufacturing sector. Moreover, the continuous investment in the expansion and enhancement of ethylene production facilities has solidified its presence in the market.

By Application

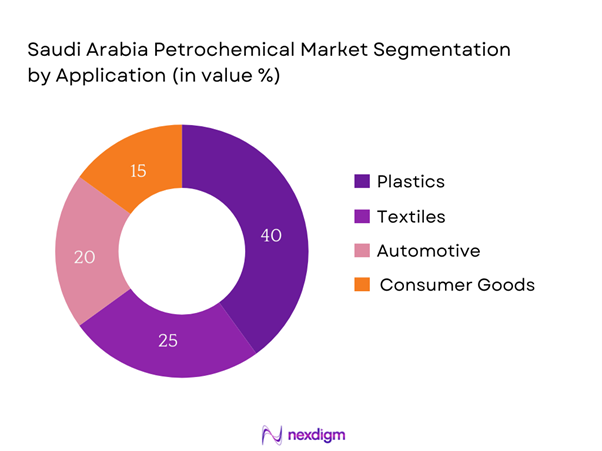

The market is also segmented by application into plastics, textiles, automotive, and consumer goods. The plastics segment has emerged as a leader in terms of market share, owing to the growing demand for packaging materials and consumer products. The versatility of plastics in various forms, such as PET and HDPE, complements their application across multiple sectors. The increasing shift towards sustainable and recyclable plastics further boosts this sub-segment’s dominance and aligns with global environmental trends.

Competitive Landscape

The Saudi Arabia petrochemical market is highly competitive, characterized by several major players that dominate the landscape. Prominent entities such as SABIC, Saudi Aramco, and Dow Chemical have established substantial operational bases and enjoy significant influence in the market. These companies leverage efficient manufacturing processes, robust supply chains, and strategic partnerships to maintain their competitive edge.

| Company | Establishment Year | Headquarters | Production Capacity | Revenue (USD) | Key Products | Market Strategy |

| Saudi Basic Industries Corporation (SABIC) | 1976 | Riyadh | – | – | – | – |

| Saudi Aramco | 1933 | Dhahran | – | – | – | – |

| Dow Chemical | 1897 | Midland, USA | – | – | – | – |

| Advanced Petrochemical Company | 2000 | Al-Jubail | – | – | – | – |

| Petro Rabigh | 2005 | Rabigh | – | – | – | – |

Saudi Arabia Petrochemical Market Analysis

Growth Drivers

Urbanization and Industrialization

Saudi Arabia is experiencing rapid urbanization, with the urban population projected to reach 36 million by end of 2025, reflecting an increase of about 1.5 million from 2023. This growth is driving demand for petrochemical products, especially in construction materials, packaging, and consumer goods. Alongside urbanization, industrialization initiatives led by Vision 2030 focus on enhancing manufacturing capabilities and diversifying the economy. The government aims to establish 1,100 factories under its industrial strategy, further bolstering the need for petrochemical inputs to support urban development and infrastructure projects.

Increased Demand for Specialty Chemicals

The demand for specialty chemicals in Saudi Arabia is growing significantly, driven by increasing applications in various industries such as automotive, healthcare, and electronics. Reports indicate that the specialty chemicals market is anticipated to exceed SAR 26 billion by end of 2025, reflecting increased usage in advanced manufacturing and high-value products. The automotive and construction sectors specifically showcase robust growth, fueled by the rising population and urbanization trends, which necessitate specialized chemical applications for durability and performance. This trend presents a strong impetus for the local petrochemical industry to expand its specialty chemical offerings.

Market Challenges

Environmental Regulations

As global environmental concerns intensify, Saudi Arabia is implementing stringent regulations to mitigate the impact of petrochemical production on the environment. In 2023, the Kingdom announced a comprehensive framework to reduce carbon emissions by 30 million tons annually by 2030. This aligns with the rising international pressure for sustainability, necessitating local petrochemical companies to invest in cleaner technologies. Compliance with these regulations requires significant capital and operational adjustments, posing a challenge to existing production methodologies while striving to meet international standards.

Volatile Crude Oil Prices

Fluctuations in crude oil prices present ongoing challenges for Saudi Arabia’s petrochemical industry. In early 2024, oil prices have been volatile, averaging around USD 80 per barrel, significantly impacting production costs and profit margins for petrochemical manufacturers. This unpredictability can lead to difficulties in planning and investment, creating liquidity pressures that could hinder growth initiatives. Companies must adopt robust risk management strategies to withstand market fluctuations and maintain competitive pricing for their products.

Opportunities

Expansion in Renewable Petrochemicals

The Kingdom is focusing on transitioning towards renewable petrochemicals, driven by both economic diversification goals and environmental sustainability. Current investments in this field are set to exceed SAR 20 billion, aimed at developing bio-based processes and materials. Companies like SABIC are already exploring bio-ethylene production as part of their increasingly sustainable practices. The global push for greener solutions enhances the growth potential for renewable petrochemicals, placing Saudi Arabia in a position to capitalize on emerging market trends that target eco-friendly products.

Technological Advancements

Technological innovation is crucial for the sustainable growth of the Saudi petrochemical market. With an increase in government and private sector investments in research and development reaching SAR 10 billion in recent years, significant strides are being made in process optimization and efficiency improvements. These technologies encompass advancements in catalysts, production processes, and carbon capture solutions, which enhance output while minimizing environmental impact. These technological advancements not only improve productivity and cost-efficiency but position Saudi Arabia to lead in the competitive global petrochemical landscape.

Future Outlook

Over the next five years, the Saudi Arabia petrochemical market is anticipated to undergo significant growth driven by increased global demand for petrochemical products, substantial investments in production facilities, and a continuous push towards technological advancements. The emphasis on sustainable practices and renewable petrochemicals is likely to shape market dynamics, allowing Saudi Arabia to potentially expand its share in the global market further.

Major Players

- Saudi Basic Industries Corporation (SABIC)

- Saudi Aramco

- Advanced Petrochemical Company

- Petro Rabigh

- Dow Chemical

- National Petrochemical Company (NATPET)

- Royal Dutch Shell

- LyondellBasell Industries

- Indorama Ventures Public Company Limited

- Sahara International Petrochemical Company (SIPCHEM)

- Alujain Corporation

- Gulf Petrochemical Industries Company (GPIC)

- Qatofin Company

- Kayan

- Petronas Chemicals Group Berhad

Key Target Audience

- Manufacturers in the Petrochemical Sector

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Energy, Saudi Arabian General Investment Authority)

- Raw Material Suppliers

- End-user Industries (Plastics, Textiles, Automotive)

- Environment and Sustainability Agencies

- Industry Analysts and Consultants

- Distributors and Wholesalers in Petrochemical Products

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map encompassing all major stakeholders within the Saudi Arabia petrochemical market. This includes extensive desk research and a combination of secondary sources and proprietary databases to gather detailed industry-level information. The primary objective is to identify and define critical variables influencing market dynamics, such as supply-chain attributes and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Saudi Arabia petrochemical market. This involves assessing production levels, market penetration rates, price fluctuations, and revenue generation across different segments. Additionally, we evaluate service quality statistics to ensure reliability and accuracy in revenue estimates and market size calculations.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through qualitative consultations conducted with industry experts, including stakeholders from key companies and associations. These consultations provide valuable insights into operational challenges, financial performance, and the broader economic conditions impacting the petrochemical industry, assisting in the refinement and corroboration of the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase engages directly with several prominent petrochemical manufacturers to gain insights on production capabilities, technological advancements, and market trends. This interaction helps confirm and complement the information gathered through the bottom-up approach, ensuring a comprehensive and validated analysis of the Saudi Arabia petrochemical market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization and Industrialization

Increased Demand for Specialty Chemicals

Government Initiatives and Investments - Market Challenges

Environmental Regulations

Volatile Crude Oil Prices - Opportunities

Expansion in Renewable Petrochemicals

Technological Advancements - Trends

Shift Towards Sustainable Petrochemicals

Innovations in Waste Management - Government Regulation

Compliance with Industry Standards

Trade Policies

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Ethylene

Propylene

Benzene

Toluene

Xylene

Methanol - By Application (In Value %)

Plastics

Textiles

Automotive

Construction

Consumer Goods - By Distribution Channel (In Value %)

Direct Sales

Distributors

Trading Companies - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Manufacturing Process (In Value %)

Steam Cracking

Catalytic Cracking

Fischer-Tropsch Process

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Saudi Basic Industries Corporation (SABIC)

Saudi Aramco

Advanced Petrochemical Company

Saudi Kayan Petrochemical Company

Yanbu National Petrochemical Company (Yansab)

National Petrochemical Company (NATPET)

Rabigh Refining and Petrochemical Company (Petro Rabigh)

Alujain Corporation

Sahara International Petrochemical Company (SIPCHEM)

Tasnee

Gulf Petrochemical Industries Company (GPIC)

Mubadala Investment Company

Qatar Chemical Company (Q-Chem)

LyondellBasell Industries

Indorama Ventures Public Company Limited

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030