Market Overview

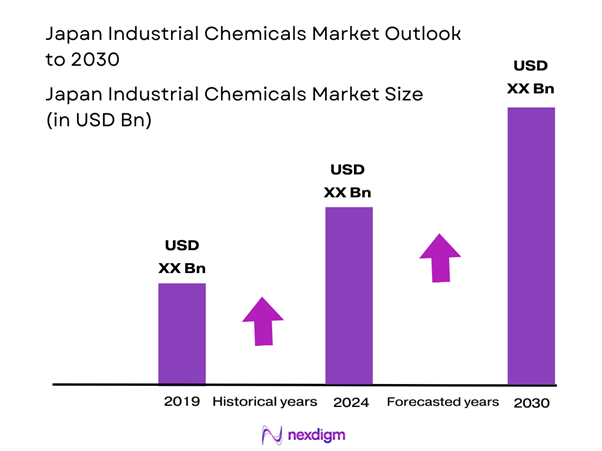

The Japan Industrial Chemicals Market is valued at USD 2,679.6 million in 2024 with an approximated compound annual growth rate (CAGR) of 2% from 2024-2030, based on a five-year historical analysis. This value has been driven by factors such as burgeoning industrial activities, technological advancements, and an increasing demand for high-performance chemicals across various sectors. Stimulated by the country’s robust manufacturing landscape and commitment to innovation, the market is set to expand significantly.

Japan serves as a regional hub for many industries, with cities like Tokyo, Osaka, and Nagoya leading the market. Tokyo, as the capital, is a primary center for research and development, drawing significant investments from both local and international firms. Meanwhile, Osaka’s historical significance in manufacturing and Nagoya’s automotive leadership solidify their positions as critical players in the industrial chemicals sector. These cities benefit from a well-established infrastructure and a skilled workforce, making them attractive locations for both domestic and foreign investments.

Sustainability is increasingly influencing the Japanese industrial chemicals landscape, driven by stringent environmental standards and growing consumer awareness. Japan aims to reduce its greenhouse gas emissions by 46% by 2030, prompting industries to adopt greener technologies. In 2022, sustainable chemistry initiatives involved investments exceeding USD 300 million in research and development for bio-based chemicals.

Market Segmentation

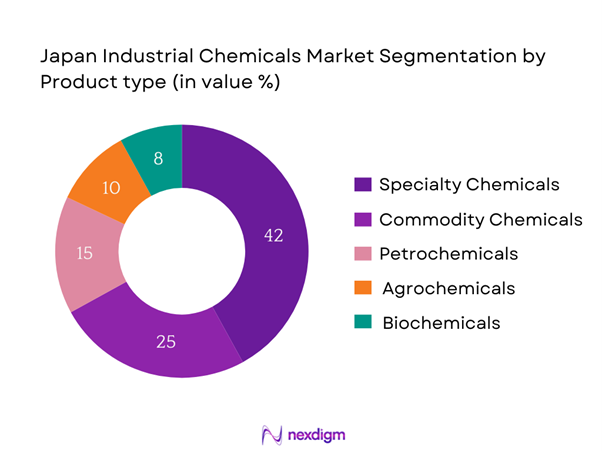

By Product Type

The Japan Industrial Chemicals Market is segmented by product type into specialty chemicals, commodity chemicals, petrochemicals, agrochemicals, and biochemicals. Specialty chemicals currently dominate the market share, driven by their extensive applications across various industries, including automotive, electronics, and pharmaceuticals. Due to their tailored formulations and higher margins, specialty chemicals are increasingly favored by manufacturers seeking to innovate and enhance product performance. Companies like Mitsubishi Chemical and Shin-Etsu Chemical leverage this trend, resulting in significant investments in research and development to fortify their positions in this high-value segment.

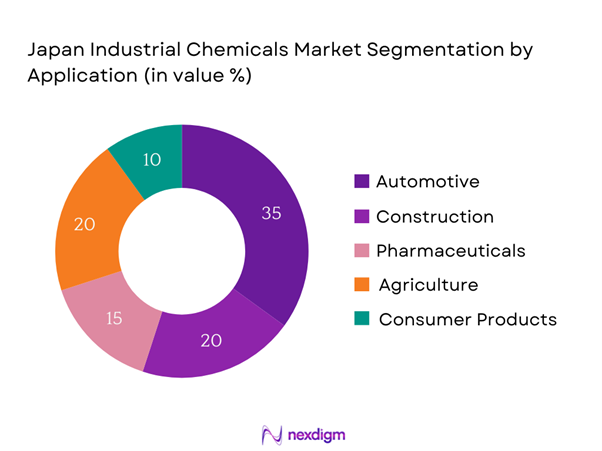

By Application

This market is also segmented by application into construction, automotive, pharmaceuticals, agriculture, and consumer products. The automotive sector holds a leading position within the market due to its substantial demand for chemicals used in manufacturing parts, coatings, and advanced materials. As the automotive industry pivots towards electric vehicles and lightweight materials, there is a tremendous need for innovative industrial chemicals that enhance efficiency and sustainability. Japan’s automotive giants like Toyota and Honda are investing heavily in advanced materials, which positively impacts the industrial chemicals market by creating a demand for specialized and high-performance chemical solutions.

Competitive Landscape

The Japan Industrial Chemicals Market is dominated by several key players, including both domestic and international manufacturers. This consolidation highlights the significant influence of these major companies, which invest in technology and innovation to maintain their competitive edge. Companies with established reputations such as Mitsubishi Chemical, Toray Industries, and Sumitomo Chemical shape market dynamics through strategic collaborations, acquisitions, and sustainable practices. Their focus on R&D enables them to offer diverse and high-quality chemical products, establishing strong positions in specialized segments.

| Company | Establishment Year | Headquarters | Market Focus | Brand Reputation | R&D Investment | Sustainability Initiatives |

| Mitsubishi Chemical | 1933 | Tokyo | – | – | – | – |

| Toray Industries | 1926 | Tokyo | – | – | – | – |

| Sumitomo Chemical | 1913 | Osaka | – | – | – | – |

| Asahi Kasei Corporation | 1931 | Tokyo | – | – | – | – |

| Shin-Etsu Chemical | 1926 | Nagaoka | – | – | – | – |

Japan Industrial Chemicals Market Analysis

Growth Drivers

Increasing Industrial Demand

Increasing industrial demand is a significant driver for the Japan Industrial Chemicals Market, underpinned by robust growth in manufacturing sectors. Japan’s industrial production rose by 2.1% in 2022, highlighting a resurgence post-pandemic. The manufacturing sector is projected to grow further as the global economy recovers, with the OECD projecting a global economic growth rate of 4.6% in 2024. This industrial expansion leads to heightened demand for chemicals used in various applications, including automotive, electronics, and construction. As these industries scale operations, the need for specialized industrial chemicals intensifies, creating a favorable market landscape.

Technological Advancements

Technological advancements are transforming the Japan Industrial Chemicals Market by enhancing production efficiency and product quality. In 2023, Japan moved forward with its Industry 4.0 initiative, which emphasizes automation and data exchange in manufacturing technologies. This led to an increase in R&D spending in the chemical sector, which reached USD 2 billion in 2022. Innovations such as advanced materials and chemical processes are streamlining operations and reducing environmental impact. The growing integration of AI and IoT in chemical manufacturing also enables firms to optimize resource management, thereby driving productivity.

Market Challenges

Price Volatility of Raw Materials

Price volatility of raw materials is a critical challenge affecting the Japan Industrial Chemicals Market, primarily driven by global supply chain disruptions and geopolitical tensions. For example, the price of crude oil fluctuated from around USD 70 to USD 100 per barrel between 2022 and 2023, impacting production costs across the chemical sector. Similarly, key raw materials like polyethylene and polypropylene saw price changes exceeding 20% in 2022. Such cost fluctuations strain margins for manufacturers, necessitating efficient resource management and strategic sourcing to mitigate risks associated with volatile inputs.

Stringent Regulatory Compliance

Stringent regulatory compliance poses significant challenges for companies operating within Japan’s industrial chemicals market. The country’s chemical regulations enforce strict safety and environmental standards, with penalties for non-compliance reaching up to JPY 10 million (approximately USD 93,000). Furthermore, the Chemical Substances Control Law (CSCL) mandates that companies report exposure risks and implement safety measures. With the increasing enforcement of these regulations and the requirement for comprehensive safety data sheets, organizations face rising operational costs and complexities in compliance management.

Opportunities

Emergence of Green Chemistry

The emergence of green chemistry presents significant opportunities for growth within the Japan Industrial Chemicals Market, as industries increasingly seek environmentally friendly alternatives. The global market for green chemistry is projected to witness substantial growth, with current investments in Japan’s renewable feedstocks exceeding USD 500 million as of 2023. Companies that integrate green chemistry practices benefit from not only streamlining their production processes but also aligning with consumer preferences for sustainable products. The push for eco-friendly chemicals enhances competitiveness in the market, enabling firms to capture new customer segments focused on sustainability.

Expansion into Emerging Markets

The expansion into emerging markets offers a lucrative opportunity for Japanese chemical manufacturers to diversify their portfolios and enhance profitability. In particular, Southeast Asia has seen rapid industrialization, with GDP growth reaching 5.2% in 2022. As these countries develop their own manufacturing capabilities, the demand for industrial chemicals is surging, representing opportunities for exporters. Strategic partnerships and collaborations with local firms can facilitate entry into these markets, enabling Japanese companies to leverage their expertise and address the growing need for high-quality industrial chemicals tailored to regional specifications.

Future Outlook

Over the next five years, the Japan Industrial Chemicals Market is projected to witness robust growth driven by continuous technological innovations and heightened demand for sustainable chemical solutions. As industries increasingly prioritize reducing their environmental impact, the adoption of green chemistry practices and bio-based chemicals is expected to rise. Furthermore, government incentives aimed at enhancing manufacturing efficiency and promoting sustainability will also contribute to market expansion. Enhanced collaboration between government and private sectors will facilitate advancements in production technologies and new product development.

Major Players

- Mitsubishi Chemical

- Toray Industries

- Sumitomo Chemical

- Asahi Kasei Corporation

- Shin-Etsu Chemical

- Mitsui Chemicals

- Daikin Industries

- Ube Industries

- Chuo Kagaku

- Kikkoman Corporation

- Showa Denko K.K.

- Nippon Shokubai

- JNC Corporation

- Tokyo Seika Co., Ltd.

- Kuraray Co., Ltd.

Key Target Audience

- Manufacturers of Industrial Chemicals

- Investments and Venture Capitalist Firms

- Distributors and Wholesalers

- Government and Regulatory Bodies (Ministry of Economy, Trade and Industry)

- End-user Industries (Automotive, Construction)

- Research and Development Entities

- Environmental Regulation Agencies (Japan Environmental Agency)

- Industry Associations and Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Japan Industrial Chemicals Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including supply chain factors and key consumer segments.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Japan Industrial Chemicals Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates. This analytical approach aids in delineating trends and shifts in consumer preferences within the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. Input from experts from manufacturing, regulatory, and product development backgrounds will validate assumptions about growth trajectories and challenges.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple industrial chemical manufacturers to obtain detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Japan Industrial Chemicals Market. Gathering feedback from key stakeholders will also facilitate the identification of market opportunities and emerging trends.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Industrial Demand

Technological Advancements

Sustainability Trends - Market Challenges

Price Volatility of Raw Materials

Stringent Regulatory Compliance - Opportunities

Emergence of Green Chemistry

Expansion into Emerging Markets - Trends

Digital Transformation in Manufacturing

Innovations in Sustainable Products - Government Regulation

Environmental Regulations

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Specialty Chemicals

Commodity Chemicals

Petrochemicals

Agrochemicals

Biochemicals - By Application (In Value %)

Construction

Automotive

Pharmaceuticals

Agriculture

Consumer Products - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Sales - By Region (In Value %)

Kanto Region

Kansai Region

Chubu Region

Kyushu Region

Hokkaido Region - By End-User Industry (In Value %)

Automotive Industry

Electronics Industry

Consumer Goods Industry

Healthcare Industry

Textile Industry

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Chemical Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Mitsubishi Chemical

Toray Industries

Sumitomo Chemical

Asahi Kasei Corporation

Shin-Etsu Chemical

Mitsui Chemicals

KAO Corporation

Tokuyama Corporation

Daikin Industries

Ube Industries

Chuo Kagaku

Kikk

Kikkoman Corporation

Showa Denko K.K.

Nippon Shokubai

JNC Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030