Market Overview

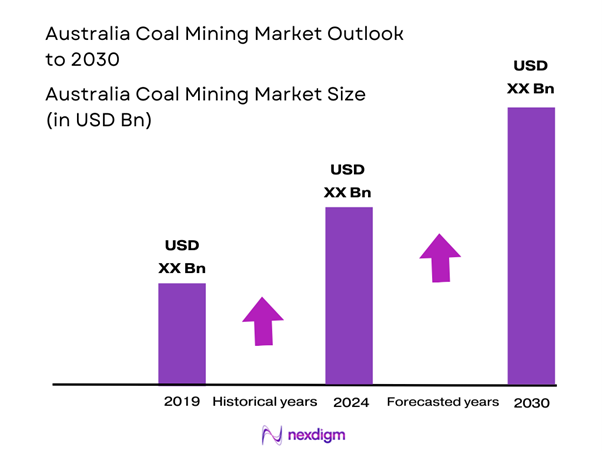

The Australia coal mining market is valued at USD 107.1 billion in 2025 with an approximated compound annual growth rate (CAGR) of 4% from 2025-2030, driven by significant contributions from both thermal and metallurgical coal production, which cater to domestic energy needs and international markets. The market has been bolstered by government policies promoting mining activities and increasing investments in the extraction sector, reflecting a robust growth trajectory from the previous year’s performance. The increasing demand for energy generation from coal remains a primary driver despite ongoing environmental concerns, with coal continuing to play a critical role in Australia’s economic landscape.

Key regions dominating the coal mining landscape include New South Wales and Queensland. These states are rich in coal resources, providing advantageous geological formations that facilitate large-scale extraction. Major cities such as Sydney and Brisbane serve not only as commercial hubs but also as critical access points for exporting coal to international markets, driving substantial economic activity.

Technological advancements are rapidly transforming the coal mining landscape in Australia, with investments in automation and digitization expected to enhance efficiency and productivity. For example, the integration of AI and machine learning in operations is projected to reduce operational costs by around AUD 1 billion over the next five years. By leveraging advanced mining technologies, companies can improve safety standards and increase output.

Market Segmentation

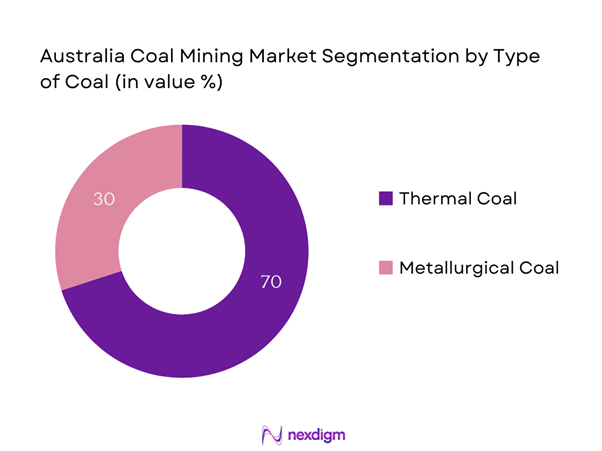

By Type of Coal

The Australia coal mining market is segmented by type of coal into thermal coal and metallurgical coal. Thermal coal is a dominant segment primarily used for electricity generation. Its significance lies in the continued reliance on coal-powered plants to fulfill the nation’s energy demands, especially as the transition to renewable sources progresses at a gradual pace. Recently, thermal coal has maintained a significant market share due to the greater demand from both domestic and international buyers. The existing infrastructure for thermal coal has been long-established, providing reliability in energy supply. Major coal-fired power stations across Australia further necessitate its production, cementing its role in the national energy mix. The current reliance on thermal coal is expected to persist, especially with developments in carbon capture technologies aimed at mitigating environmental impacts.

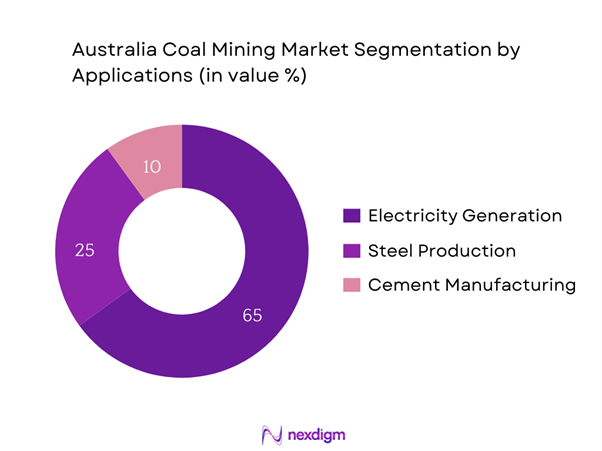

By Application

The market is also segmented based on application into electricity generation, steel production, and cement manufacturing. Electricity generation represents the largest sub-segment, highlighting the crucial dependency on coal as a reliable energy source in Australia. Electricity generation has a commanding share in the coal mining market due to Australia’s heavy reliance on coal for power. The country’s existing infrastructure supports a substantial fleet of coal-fired power plants, making coal a critical player in the electricity sector. Furthermore, while the push for renewable energy sources is strong, the transition remains gradual, maintaining coal’s dominance in the energy sector. The consistent need for energy and limited availability of cost-effective alternatives ensures that coal plays a pivotal role in Australia’s electricity generation landscape.

Competitive Landscape

The Australia coal mining market is characterized by a few major players, including BHP Group, Glencore, and Anglo American, which dominate the competition through their extensive resources and operational efficiencies. This concentration reflects the significant investments and established networks that these companies have in place, allowing them to navigate the complexities of the coal market effectively.

| Company | Establishment Year | Headquarters | Market Specific Parameter 1 | Market Specific Parameter 2 | Market Specific Parameter 3 | Market Specific Parameter 4 | Market Specific Parameter 5 | Market Specific Parameter 6 |

| BHP Group | 1885 | Melbourne, Australia | – | – | – | – | – | – |

| Glencore | 1974 | Baar, Switzerland | – | – | – | – | – | – |

| Anglo American | 1917 | London, United Kingdom | – | – | – | – | – | – |

| Yancoal Australia | 2004 | Sydney, Australia | – | – | – | – | – | – |

| Whitehaven Coal | 2000 | Sydney, Australia | – | – | – | – | – | – |

Australia Coal Mining Market Analysis

Growth Drivers

Rising Global Energy Demand

Global energy demand is projected to reach approximately 6,342 million tons of oil equivalent (Mtoe) in 2024, marking a significant increase as economies rebound from the pandemic’s impact. This uptick is driven primarily by Asia-Pacific countries, including China and India, where energy consumption is expected to surge due to rapid industrialization and urbanization. In Australia, coal exports to these nations continue to thrive, with coal playing a crucial role in meeting energy needs. The International Energy Agency (IEA) also indicates that coal will maintain its position as a preferred energy source in the energy mix, driving production levels in Australia.

Expanding Industrial Sector

The industrial sector in Australia is expected to grow markedly, driven by a forecasted GDP increase of 3.3% in 2024. This growth is reflective of enhanced manufacturing output, particularly in steel and cement production, both of which heavily rely on coal as a raw material. As industrial activities ramp up, the demand for metallurgical coal is projected to remain strong, especially given that Australia’s steel production is set to reach approximately 10 million tons in the coming years. This demand underscores the critical importance of coal in facilitating industrial growth and economic recovery.

Market Challenges

Environmental Regulations

The Australian coal industry faces increasing scrutiny from environmental regulations aimed at reducing carbon emissions. The Federal Government’s strategy aims to cut greenhouse gas emissions by 50% by 2030, with current carbon emissions from coal-fired power generation accounting for about 30% of Australia’s total emissions, translating to approximately 145 million tons annually. Compliance costs and regulatory hurdles are expected to escalate, leading to potential production delays and increased operational costs as companies adapt to stricter environmental standards to operate within legal confines.

Market Volatility and Price Fluctuations

The coal market experiences significant volatility, with prices influenced by geopolitical tensions, global demand, and competitive energy resources. For instance, as of early 2024, the price of thermal coal has fluctuated between AUD 200 to AUD 300 per ton due to supply chain issues and tensions from major coal-exporting countries. Furthermore, the ongoing adjustments in international energy trade patterns complicate the market landscape. Such price fluctuations can lead to unstable revenues for mining operations and complicate long-term planning for investments in the sector.

Opportunities

Shift Towards Cleaner Coal Technologies

The evolving energy landscape offers profound opportunities for the Australian coal sector through investments in cleaner coal technologies. The Australian Government allocated AUD 50 million to research and develop carbon capture and storage (CCS) technologies as part of its wider energy transition strategy. Current advancements aim to reduce the carbon footprint of coal-fired plants, thus enhancing their operational viability amidst rising emissions targets. As global constituencies increasingly push for sustainable energy options, such innovations reflect a dual approach to preserving coal’s role while addressing environmental concerns.

Emerging Export Markets

Australia’s coal export dynamics are shifting towards emerging markets in Southeast Asia and India, where demand for both thermal and metallurgical coal is climbing. In particular, India’s coal imports are projected to increase to 170 million tons in 2024 as its industrial sectors expand. Australian coal producers stand to benefit significantly, given the country’s established relationships and logistical capabilities in supplying coal. The increase in export potential significantly positions Australia as a reliable coal provider in a rapidly evolving global market.

Future Outlook

Over the next five years, the Australia coal mining market is projected to experience steady growth, bolstered by continual demand for energy generation and the use of coal in critical industrial applications. Increasing investments in coal mining infrastructure, coupled with technological advancements in extraction and processing, will further enhance productivity and operational efficiencies. While the global push for greener energy sources is shaping the market dynamics, coal remains integral to Australia’s economic framework, particularly in terms of job creation and energy security. Moreover, as the international demand for metallurgical coal for steel production persists, Australia remains well-positioned to capitalize on its rich mineral resources.

Major Players

- BHP Group

- Glencore

- Anglo American

- Yancoal Australia

- Whitehaven Coal

- South32

- New Hope Group

- Stanmore Coal

- Bowen Coking Coal

- Peabody Energy

- Macarthur Coal

- Atrum Coal

- Orion Mining

- Mitrelli Group

- Australian Pacific Coal

Key Target Audience

- Mining corporations and operators

- Energy companies (electricity providers and utilities)

- Investments and venture capitalist firms

- Government and regulatory bodies (Department of Industry, Science, Energy and Resources)

- Environmental NGOs and advocacy groups

- Construction and infrastructure development firms

- Export-import companies focusing on mining resources

- Industrial manufacturers relying on coal for production

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves building a comprehensive ecosystem map that encapsulates all major stakeholders within the Australia coal mining market. This step is underpinned by extensive desk research leveraging a combination of secondary data sources, including industry reports and government publications, to synthesize relevant information that influences market dynamics.

Step 2: Market Analysis and Construction

During this phase, we compile and analyze historical market data related to the Australia coal mining landscape. This includes evaluations of coal production volumes, market demand by application sector, and the identified revenue generation streams from key players. The analysis aims to ensure reliability and accuracy in the forecasting of market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through direct interactions with industry experts representing various sectors of the coal mining ecosystem. These consultations will offer critical insights regarding operational practices, competitive strategies, and evolving consumer demands, assisting in refining and validating the collected data.

Step 4: Research Synthesis and Final Output

The last phase focuses on direct engagements with prominent coal mining companies to acquire in-depth understandings of production practices, market trends, and technological innovations. This engagement serves to complement the insights derived from previous methodologies, delivering a robust and validated analysis of the Australia coal mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview and Market Genesis

- Timeline of Major Players in the Market

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Global Energy Demand

Expanding Industrial Sector

Technological Advancements in Mining - Market Challenges

Environmental Regulations

Market Volatility and Price Fluctuations - Opportunities

Shift Towards Cleaner Coal Technologies

Emerging Export Markets - Market Trends

Automation in Mining Operations

Sustainability Initiatives - Government Regulations

Mining Licenses and Permits

Environmental Compliance Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Coal (In Value %)

Thermal Coal

Metallurgical Coal - By Application (In Value %)

Electricity Generation

Steel Production

Cement Manufacturing - By Region (In Value %)

New South Wales

Queensland

Western Australia - By Depth of Mining (In Value %)

Open-Cut Mining

Underground Mining - By Ownership Type (In Value %)

Publicly Owned

Privately Owned

- Market Share of Major Players (By Value/Volume), 2024

Market Share by Type of Coal Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Market Positioning, Strength, Weakness, Product Offering, Revenue, Production Capacity, Technological Advancements)

- SWOT Analysis of Major Competitors

- Pricing Strategies for Major Players

- Detailed Profiles of Major Companies

BHP Group

Glencore

Anglo American

Yancoal Australia

South32

Whitehaven Coal

New Hope Group

Peabody Energy

Stanmore Coal

Bowen Coking Coal

Metallurgical Coal

Macarthur Coal

Orion Mining

Atrum Coal

Dakota Mining

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Regulatory Compliance Factors

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process of End Users

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030