Market Overview

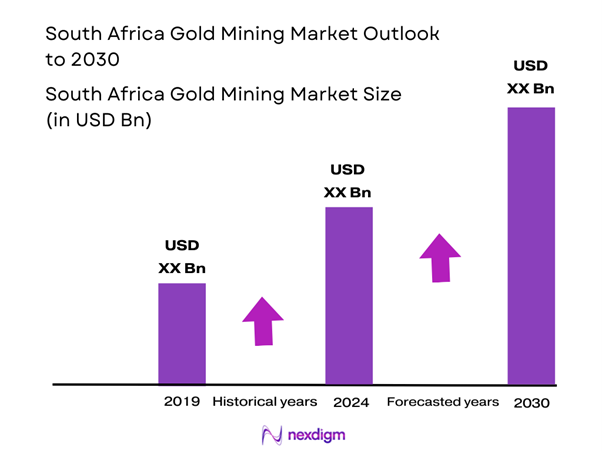

The South Africa gold mining market is valued at USD 14.4 billion in 2024 with an approximated compound annual growth rate (CAGR) of 3% from 2024-2030, as per the latest industry analysis which highlights a steady recovery in demand fueled by global economic conditions. The market is primarily driven by the increasing reliance on gold as a hedge against inflation, along with growth in jewelry demand and significant investment from both local and international firms. The improvements in mining technologies have also enhanced extraction efficiencies, reinforcing the market’s growth trajectory.

South Africa remains a leading player in the gold mining industry, with key regions such as the Witwatersrand Basin and the Free State known for their rich deposits. These areas dominate due to their historical significance in gold extraction, notwithstanding escalating operational costs and regulatory challenges. Mining activities in cities like Johannesburg and the surrounding provinces continue to flourish due to legacy infrastructure and expertise in gold mining techniques. This combination of factors ensures South Africa’s dominance in the global gold market.

Technological advancements in the mining sector have led to improved extraction techniques and enhanced safety measures. For instance, investments in automated drilling systems and artificial intelligence have shown a reduction in operational costs by as much as 30% through increased efficiency. In 2022, South African miners invested USD 800 million in gold-specific technology development to optimize processes.

Market Segmentation

By Type of Gold Mine

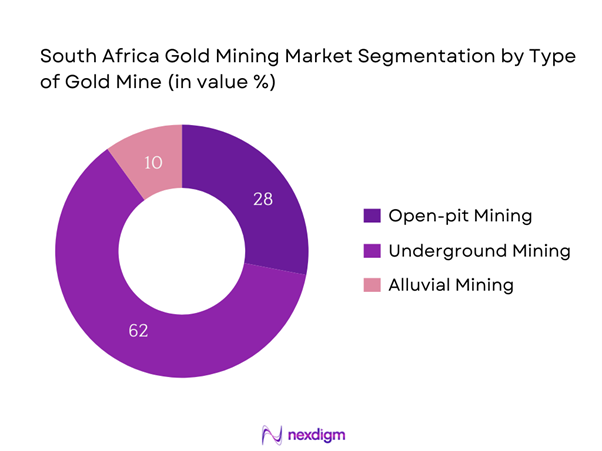

The South Africa gold mining market is segmented by type of gold mine into open-pit mining, underground mining, and alluvial mining. Recently, underground mining has gained dominant market share due to its ability to extract ore at depths where gold concentrations are higher. This method minimizes surface disturbance and reduces the environmental footprint of mining operations, making it more sustainable. The advancements in underground mining technologies and safety measures have also improved its viability and profitability, thus prompting a shift away from open-pit methods, especially in regions where land reclamation is critical.

By Gold Production Size

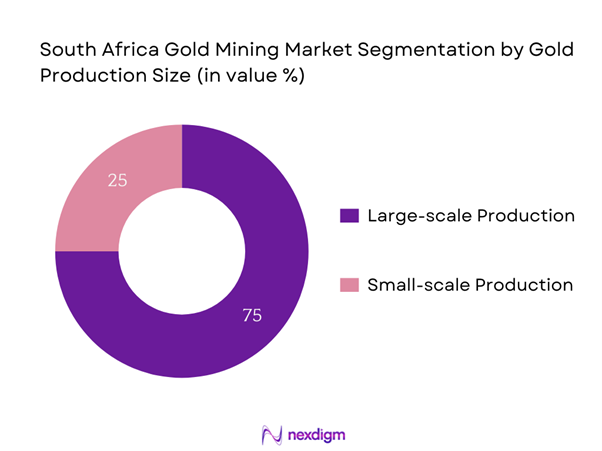

The South Africa gold mining market is further segmented by gold production size into large-scale production and small-scale production. Large-scale production dominates due to the economies of scale achieved in mining operations, which allows for lower costs per unit of gold produced. Moreover, large-scale operations can invest in more advanced technologies and skilled labor, enhancing operational efficiency. This segment is supported by major corporations that leverage substantial financial resources to optimize extraction processes and improve overall yield from the mines.

Competitive Landscape

The South Africa gold mining market is characterized by a few major players, including established corporations like AngloGold Ashanti and Harmony Gold. These companies dominate the market due to extensive operational infrastructures, financial resilience, and a strong global presence. This consolidation underscores the competitive nature of the industry where established players engage in continuous innovations and strategic partnerships to maintain their leading positions.

| Company Name | Establishment Year | Headquarters | Market Cap (USD) | Production Capacity | Key Technology | Sustainability Practices | Global Footprint |

| AngloGold Ashanti | 2004 | Johannesburg | – | – | – | – | – |

| Harmony Gold Mining Co. | 1950 | Randfontein | – | – | – | – | – |

| Sibanye Stillwater | 2013 | Westonaria | – | – | – | – | – |

| Gold Fields Limited | 1887 | Cape Town | – | – | – | – | – |

| DRDGold | 2000 | Johannesburg | – | – | – | – | – |

South Africa Gold Mining Market Analysis

Growth Drivers

Increasing Global Demand for Gold

The global demand for gold reached 4,021 tons in 2022, with jewelry accounting for approximately 50% of total demand. Demand for gold as a haven asset has surged due to ongoing geopolitical tensions and economic uncertainties, making it a priority for investors seeking stability. Furthermore, the International Monetary Fund (IMF) reported that central banks collectively purchased about 400 tons of gold in the same year, contributing significantly to the rising global demand. The sustained interest in gold investment, now more than ever, underlines the precious metal’s essential role in financial security.

Favorable Mining Policies

The South African government has implemented favorable mining policies aimed at creating a conducive environment for investment. In 2023, the Department of Mineral Resources and Energy launched several initiatives to streamline mining applications and reduce red tape, which can take more than two years to approve. The Mining Charter encourages investments in local communities and ensures equitable distribution of mining revenues. These policies are a response to the sector’s contribution of approximately USD 6.6 billion to the South African GDP in 2022, reinforcing the government’s commitment to fostering a robust mining framework.

Market Challenges

Environmental Regulations

Environmental regulations in South Africa impose significant challenges on mining operations. In 2023, the government enforced stricter laws concerning mining waste and water usage, mandating that mining companies reduce their water consumption by 25% by end of 2025. These regulations stem from the need to mitigate the impact of mining activities on local ecosystems. Consequently, companies must invest significantly in compliance measures, which can cost upwards of USD 500 million annually, creating financial strain on operations and affecting overall profitability in the sector.

Labor Issues

Labor issues continue to pose significant challenges for the gold mining industry in South Africa. The mining sector employed approximately 450,000 workers in 2022, facing ongoing labor disputes that lead to production stoppages. In 2023, strikes demanding better wages and working conditions resulted in a cumulative loss of 35,000 ounces of gold per month. The costs associated with labor disruptions are estimated at about USD 200 million annually. Addressing these issues is critical for maintaining operational stability and productivity in the highly competitive mining landscape.

Opportunities

Exploration of Untapped Resources

There remains substantial potential in exploring untapped resources within South Africa’s vast geographical landscape. The country is rich in mineral resources, with significant gold deposits identified but not yet exploited. As of 2023, only 20% of exploration assessments had been conducted in less accessible regions. Government incentives, such as tax breaks for new mining ventures, are encouraging companies to invest in these unexplored areas. Consequently, the ongoing interest is fueling anticipation for future discoveries that could significantly bolster gold production and contribute to economic growth.

Investment in Sustainable Practices

Investment in sustainable mining practices is poised to reshape the gold mining market. With environmental concerns taking center stage, mining companies are increasingly prioritizing sustainability. In 2022, investments in green mining technologies in South Africa reached USD 250 million, focused on leveraging renewable energy sources and minimizing carbon footprints. This shift not only aligns with global sustainability goals but also positions companies favorably in securing investment from environmentally conscious stakeholders. Moreover, adhering to such practices fosters community goodwill and enhances operational efficiencies, setting the stage for long-term viability.

Future Outlook

Over the next five years, the South Africa gold mining market is expected to show significant growth driven by advancements in mining technologies, increasing global demand for gold, and supportive government policies. Continuous investment in exploration and innovations aimed at improving environmental sustainability are also anticipated to enhance the industry’s resilience against economic fluctuations. Moreover, the integration of digital technologies such as artificial intelligence and machine learning could revolutionize operations, leading to reduced costs and increased efficiency in gold extraction. Additionally, a growing trend towards responsible mining practices will likely bolster the market’s acceptance and facilitate smoother operations within communities surrounding mining areas.

Major Players

- AngloGold Ashanti

- Harmony Gold Mining Co.

- Sibanye Stillwater

- Gold Fields Limited

- DRDGold

- African Rainbow Minerals

- Village Main Reef

- Pan African Resources

- Caledonia Mining Corporation

- Central Rand Gold

- Great Basin Gold

- Kloof Gold Mine

- Eastplats

- Berkswell Resources

- Thungela Resources

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Mineral Resources and Energy)

- Mining Equipment Suppliers

- Environmental Consulting Firms

- Gold Trading Platforms

- Gold Jewelry Manufacturers

- Mining Industry Associations

- Infrastructure Development Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the South Africa gold mining market. This step relies on extensive desk research, employing a mix of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics such as production methods, regulatory environment, and economic conditions.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the South Africa gold mining market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Additionally, an evaluation of service quality statistics will be undertaken to ensure reliable and accurate revenue estimates, considering factors such as historical production levels and market growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses will be validated through computer-assisted telephone interviews (CATIs) with industry experts representing a wide array of companies within the sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating market data, thereby enhancing the credibility of the research findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple gold mining firms to acquire detailed insights into product segments, sales performance, consumer preferences, and other critical factors. This interaction will serve to verify and complement statistics derived from a bottom-up analysis, ensuring a comprehensive, accurate, and validated examination of the South Africa gold mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Landscape and Historical Context

- Regulatory Framework

- Major Players Timeline

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Global Demand for Gold

Favorable Mining Policies

Technological Advancements - Market Challenges

Environmental Regulations

Labor Issues - Opportunities

Exploration of Untapped Resources

Investment in Sustainable Practices - Trends

Rising Investment in Green Mining Technologies

Increasing Automation in Mining Operations - Government Regulation

Mining Charter Compliance

Health and Safety Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Grade (g/t), 2019-2024

- By Type of Gold Mine (In Value %)

Open-pit Mining

Underground Mining

Alluvial Mining - By Gold Production Size (In Value %)

Large-scale Production

Small-scale Production - By Region (In Value %)

Witwatersrand Basin

Kriel

Barberton

Free State - By Technology Used (In Value %)

Cyanide Leaching

Gravity Separation

Flotation - By End-use Applications (In Value %)

Jewelry Manufacturing

Electronics Industry

Investment Products

Dental Applications

- Market Share of Major Players Based on Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Market Segmentation, Distribution Strategy, Exploration Activities, Sustainability Initiatives)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Key Mining Projects

- Detailed Profiles of Major Companies

AngloGold Ashanti

Harmony Gold Mining Company Limited

Sibanye Stillwater

Gold Fields Limited

African Rainbow Minerals

Village Main Reef

DRDGold

Pan African Resources

Caledonia Mining Corporation

Central Rand Gold

Great Basin Gold

Berkswell Resources

Kloof Gold Mine

Eastplats

B2Gold Corp

- Market Demand and Utilization Patterns

- Consumer Behavior and Preferences

- Regulatory and Compliance Considerations

- Market Needs, Desires, and Pain Point Analysis

- Decision-Making Process in Procurement

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Grade (g/t), 2025-2030