Market Overview

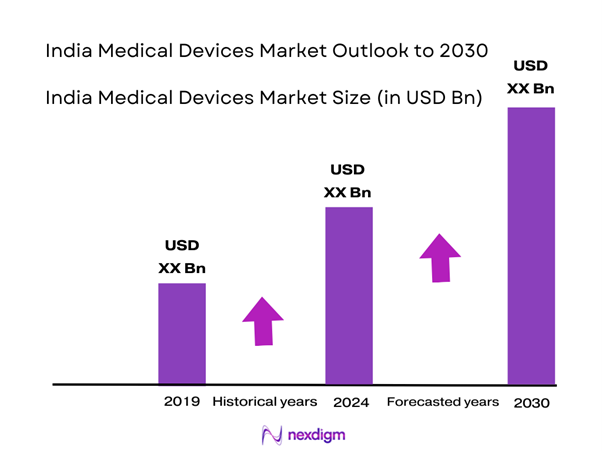

The India Medical Devices Market is valued at USD 12 billion in 2024 with an approximated compound annual growth rate (CAGR) of 19% from 2024-2030, based on a five-year historical analysis. The market is predominantly driven by the increasing prevalence of chronic diseases, an expanding healthcare infrastructure, and rapid technological advancements in medical devices. With rising healthcare expenditures and government initiatives promoting medical device innovation, the sector is poised for significant growth.

Key cities dominating the India Medical Devices Market include Mumbai, Delhi, and Bengaluru. Mumbai is the financial capital with numerous healthcare institutions and research facilities, enabling innovation and collaboration. Delhi, being the political and administrative hub, attracts significant investments and helps shape healthcare policies. Bengaluru, known as the ‘Silicon Valley of India,’ is a hotspot for technology-driven healthcare solutions, making it vital for the medical devices sector.

Healthcare expenditure in India has seen a notable resurgence, rising to USD 165 billion in 2023, reflecting a growing commitment to improving healthcare infrastructure. The government’s decision to allocate 2.1% of GDP to healthcare by end of 2025 highlights its aim to enhance health services and investment in medical technologies. Furthermore, the rise in disposable income among the urban population is driving private healthcare spending, which is projected to reach 65% of total healthcare expenditure by the end of 2025.

Market Segmentation

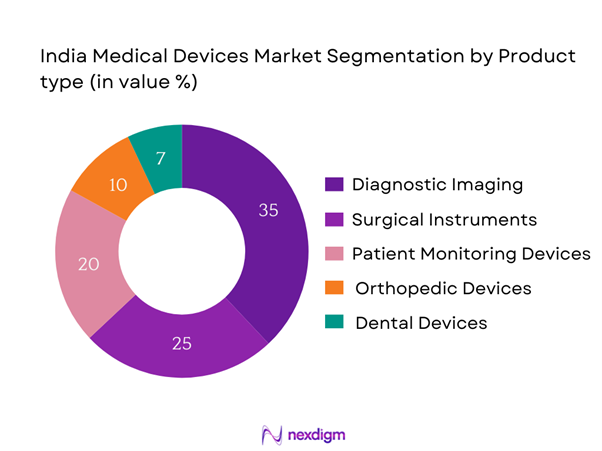

By Product Type

The India Medical Devices Market is segmented by product type into diagnostic imaging devices, surgical instruments, patient monitoring equipment, orthopedic devices, and dental devices. Diagnostic imaging devices currently dominate the market due to their essential role in early disease detection and patient management. The increasing incidence of chronic diseases, such as diabetes and cardiovascular conditions, necessitates regular diagnostic screenings. Moreover, the proliferation of technologically advanced imaging devices, like MRI and CT scans, and supportive government regulations encouraging early diagnosis further solidify the dominance of this segment.

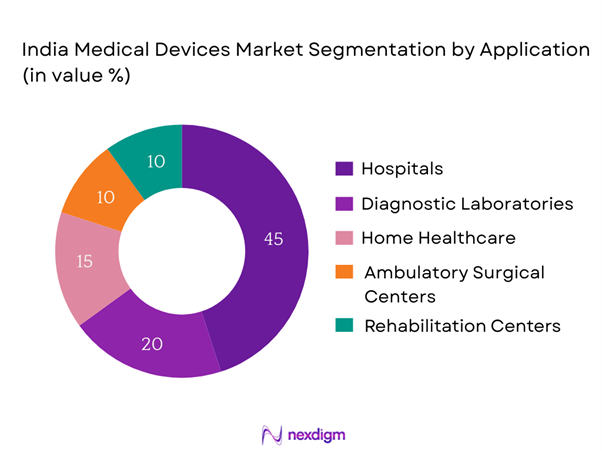

By Application

The market is also segmented by application into hospitals, diagnostic laboratories, home healthcare, ambulatory surgical centers, and rehabilitation centers. Hospitals are the leading application segment as they are the primary settings for advanced medical procedures and patient care. The high patient footfall in hospitals, coupled with the increasing need for specialized medical devices to improve patient outcomes, drives investment in this sector. Moreover, with the government focusing on improving healthcare services in rural and urban areas, hospitals remain a significant application area.

Competitive Landscape

The India Medical Devices Market is characterized by a competitive landscape dominated by a mix of established local and international players. Key players include Siemens Healthineers, GE Healthcare, Philips Healthcare, Medtronic, and Johnson & Johnson. These companies leverage their technological expertise and global presence to offer high-quality medical devices. The consolidation of leading firms indicates their significant influence and ability to shape trends in the market.

| Company | Year Established | Headquarters | Market Share | Product Types Offered | R&D Investment | Global Outreach |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – | – |

| GE Healthcare | 1892 | Chicago, USA | – | – | – | – |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – |

| Johnson & Johnson | 1886 | New Brunswick, USA | – | – | – | – |

India Medical Devices Market Analysis

Growth Drivers

Increasing Incidence of Chronic Diseases

The increasing incidence of chronic diseases, such as diabetes and cardiovascular issues, is a significant growth driver in the India Medical Devices Market. Currently, around 77 million people in India are afflicted with diabetes, and this number is projected to reach over 134 million by 2045, according to the International Diabetes Federation. Additionally, cardiovascular diseases account for 28% of all deaths in India, emphasizing the urgent need for medical devices that can aid in the management and treatment of these conditions. The surge in chronic disease cases has led to an increased demand for advanced medical solutions, including diagnostic imaging and patient monitoring systems tailored for these health issues.

Advances in Technology

Advancements in technology have been pivotal in enhancing the capabilities and applications of medical devices in India. The country is witnessing a rise in innovative medical technologies, with over 2,400 health startups emerging in the healthcare space as of 2023. For instance, technologies such as AI in diagnostic imaging and telehealth systems have revolutionized patient care by improving accuracy and accessibility. The government’s push for the ‘Make in India’ initiative also encourages local production of advanced medical devices, which is expected to propel growth. Moreover, initiatives like the Digital India campaign are facilitating the integration of digital tools in healthcare, further driving market advancement.

Market Challenges

Regulatory Hurdles

India’s medical devices market is faced with significant regulatory hurdles that pose challenges to market entry and growth. The Medical Device Rules, 2017 governs the registration and approval process, which can be lengthy and complex. For instance, it is reported that obtaining necessary approvals can take up to 18 months. Compliance with stringent quality and safety standards mandated by the Central Drugs Standard Control Organization (CDSCO) is vital but often delays product launches. This regulatory complexity can result in increased costs and slower time-to-market for new devices, thereby hindering the overall growth of manufacturers in the sector.

High Cost of Advanced Medical Devices

The high cost associated with advanced medical devices remains a major challenge in the India Medical Devices Market. With hospitals and healthcare systems facing budget constraints, acquiring high-cost equipment poses significant obstacles. For instance, advanced imaging machines like MRI scanners can cost upwards of INR 30 million, which is prohibitive for many healthcare providers. Moreover, government health schemes and reimbursement policies often fall short in covering the cost of these expensive devices, leading to limited accessibility for patients. This financial burden on both healthcare providers and patients can deter the adoption of advanced medical technologies, impacting market growth.

Opportunities

Growing Geriatric Population

The growing geriatric population presents significant opportunities for the India Medical Devices Market. By end of 2025, India’s population aged over 60 is expected to reach approximately 143 million, creating a substantial demand for healthcare solutions tailored to this demographic. Older adults typically require various medical devices catering to chronic conditions such as diabetes, mobility issues, and cardiac health. Furthermore, the increasing focus on aged care and home healthcare solutions encourages the development of innovative medical devices designed for the elderly, enhancing their quality of life. Companies focusing their research and development initiatives on products aimed at this segment can leverage this growth opportunity effectively.

Expanding Medical Tourism

India’s medical tourism sector is experiencing substantial growth, which can drive the demand for medical devices. The country attracted over 500,000 international patients in 2023, with projections to see exponential growth in the coming years. Several factors contribute to this rise, including affordable treatment costs, high-quality healthcare facilities, and the availability of advanced medical devices.

Future Outlook

Over the next five years, the India Medical Devices Market is expected to exhibit strong growth driven by continual advancements in technology, increasing healthcare spending, and growing consumer awareness of health and wellness. The shift towards personalized and home healthcare alongside government innovation initiatives will further enhance the market landscape. The rise of telehealth and digital health solutions will also be significant contributors to this growth trajectory.

Major Players

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Medtronic

- Johnson & Johnson

- Baxter International

- Braun Melsungen AG

- Stryker Corporation

- Abbott Laboratories

- 3M Health Care

- Cardinal Health

- Thermo Fisher Scientific

- Fresenius Kabi

- Zimmer Biomet

- Olympus Corporation

Key Target Audience

- Private Healthcare Providers

- Hospitals and Healthcare Facilities

- Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

- Insurance Companies

- Investments and Venture Capitalist Firms

- Medical Device Manufacturers

- Clinical and Research Laboratories

- Healthcare Consulting Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Medical Devices Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables affecting market dynamics, including consumer behavior, regulatory impact, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Medical Devices Market. This includes assessing market penetration, the ratio of manufacturers to service providers, and the resultant revenue generation. An evaluation of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates. This step will yield insights into current market performance and future trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through structured interviews and consultations with industry experts representing a diverse array of companies in the medical devices sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining the market data and validating the conclusions drawn from quantitative analyses.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple medical devices manufacturers and stakeholders to acquire detailed insights into product segments, sales performance, consumer preferences, and regulatory challenges. These interactions will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Medical Devices Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Methodology, Data Collection Techniques, Interviews with Key Opinion Leaders, Limitations and Future Insights)

- Definition and Scope

- Overview Genesis

- Historical Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Incidence of Chronic Diseases

Advances in Technology

Rising Healthcare Expenditure - Market Challenges

Regulatory Hurdles

High Cost of Advanced Medical Devices - Opportunities

Growing Geriatric Population

Expanding Medical Tourism - Trends

Shift Towards Minimally Invasive Procedures

Digital Transformation in Healthcare - Government Regulation

Quality Control Standards

Import Policies and Tariffs - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging Devices

Surgical Instruments

Patient Monitoring Equipment

Orthopedic Devices

Dental Devices - By Application (In Value %)

Hospitals

Diagnostic Laboratories

Home Healthcare

Ambulatory Surgical Centres

Rehabilitation Centers - By Distribution Channel (In Value %)

Direct Sales

Distributors and Wholesalers

Online Retail - By Region (In Value %)

North India

South India

East India

West India - By End-User (In Value %)

Hospitals

Clinics

Home Care Settings

Rehabilitation Facilities

- Market Share of Major Players, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Positioning, Distribution Networks, R&D Investments, Unique Selling Prepositions, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs

- Detailed Profiles of Key Competitors

Siemens Healthineers

GE Healthcare

Philips Healthcare

Medtronic

Johnson & Johnson

Baxter International

B. Braun Melsungen AG

Stryker Corporation

Abbott Laboratories

3M Health Care

Cardinal Health

Thermo Fisher Scientific

Fresenius Kabi

Zimmer Biomet

Olympus Corporation

- Utilization Trends Across End Users

- Purchasing Power Dynamics

- Compliance Requirements

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030