The automotive industry is evolving far beyond the point of vehicle sales, with the aftermarket segment emerging as a critical driver of long-term profitability. From spare parts and maintenance to extended warranties and digital service platforms, post-sale services now account for a substantial share of revenue for OEMs and Tier-1 suppliers.

In today’s market, however, traditional service models are being disrupted. The rise of electric vehicles (EVs), growing consumer expectations for faster turnaround, and the entry of digital-first service providers are forcing companies to rethink their approach. To remain competitive, businesses must not only adapt but also benchmark their aftermarket strategies against industry leaders. Strategic benchmarking provides the insights needed to optimize operations, improve customer satisfaction, and unlock new growth opportunities in the post-sale landscape.

Why Aftermarket Benchmarking Matters in Automotive

The aftermarket has become one of the most resilient and profitable revenue streams for automotive companies, often delivering higher margins than vehicle sales themselves. With consumers keeping cars longer and EV adoption reshaping service requirements, post-sale performance is now a critical differentiator for OEMs and Tier-1 suppliers.

Benchmarking enables businesses to assess their performance against industry leaders across key areas such as:

- Service turnaround times: Faster and more reliable service drives customer retention and loyalty.

- Spare parts pricing and availability: Comparing inventory efficiency and distribution speed ensures competitiveness against independent garages and e-commerce platforms.

- Warranty and subscription-based services: Benchmarking evolving models like extended warranties, predictive maintenance, and software-driven upgrades.

- Customer satisfaction metrics: Evaluating digital service adoption, online booking systems, and feedback channels to ensure seamless engagement.

Without structured benchmarking, companies risk losing market share to agile competitors, experiencing revenue leakage in spare parts, and failing to meet the evolving expectations of digitally savvy customers. By using benchmarking as a strategic tool, automotive players can transform their aftermarket operations into a sustainable growth engine.

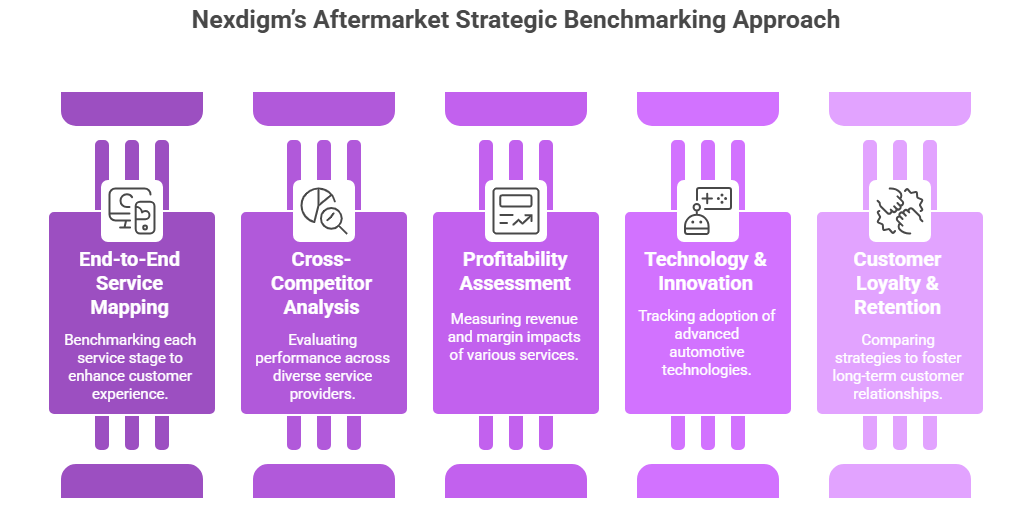

Nexdigm’s Aftermarket Strategic Benchmarking Approach

At Nexdigm, we view the automotive aftermarket as a profitability engine that demands continuous measurement and improvement. Our aftermarket strategic benchmarking approach goes beyond traditional KPIs, focusing on end-to-end service performance and customer experience. By leveraging competitive intelligence, we help OEMs, Tier-1 suppliers, and service providers align with industry leaders while uncovering untapped opportunities.

Key pillars of our approach include:

- End-to-End Service Mapping: Benchmarking every stage, from customer onboarding and diagnostics to service completion and post-service engagement.

- Cross-Competitor Analysis: Evaluating performance across OEM-authorized workshops, independent garages, and emerging digital-first service models.

- Profitability Assessment: Measuring revenue contributions and margin impacts of spare parts, extended warranties, and value-added services.

- Technology & Innovation Benchmarking: Tracking adoption of predictive maintenance tools, AI-driven diagnostics, and connected car service platforms.

- Customer Loyalty & Retention Insights: Comparing loyalty programs, service subscriptions, and digital interaction touchpoints to identify best practices that sustain long-term relationships.

Through this structured approach, Nexdigm equips automotive players with the intelligence needed to strengthen aftersales models, improve efficiency, and maximize customer value in a rapidly evolving market.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704