The automotive retail and aftermarket ecosystem is undergoing a rapid transformation, driven by the rise of electric vehicles (EVs), connected mobility, and shifting consumer expectations. Dealerships and service networks, traditionally viewed as transactional channels, are now emerging as experience-driven touchpoints for brand loyalty and revenue generation. However, this evolution has intensified challenges related to talent retention, pay parity, and performance-linked incentives across regions.

Across major automotive markets, disparities in compensation structures are widening. A certified EV service technician in Bengaluru, for instance, may earn 30–40% less than a counterpart in Pune or Chennai despite similar workload and certification levels. As dealerships expand into new geographies and OEMs diversify their service formats.

Against this backdrop, Nexdigm’s Automotive Compensation Benchmarking practice helps OEMs, dealership networks, and aftermarket operators design data-driven pay structures that reflect regional market dynamics, performance metrics, and workforce productivity benchmarks.

Nexdigm’s Automotive Compensation Benchmarking Approach

In an increasingly competitive automotive landscape, dealerships and aftermarket players are realizing that compensation structures directly impact sales conversion, service quality, and workforce stability. Nexdigm’s Automotive Compensation Benchmarking approach combines regional analytics, peer benchmarking, and role-based intelligence to help clients design strategic pay structures that balance competitiveness with profitability.

Our framework is built around five critical components:

- Regional Market and Peer Analysis: Nexdigm conducts deep-dive mapping of compensation trends across authorized dealerships, service chains, and regional peers. This analysis identifies wage disparities influenced by location, labor costs, and customer volumes. By calibrating these regional variations, dealerships can ensure pay alignment across metros, semi-urban, and rural centers without compromising operational margins.

- Role Taxonomy and Skill Clustering: We categorize dealership and aftermarket roles into specialized clusters, from sales consultants and finance executives to EV technicians and service advisors. This taxonomy enables benchmarking at the functional and skill level, ensuring pay structures reflect each role’s contribution to customer experience and revenue generation.

- Data Triangulation and Benchmark Validation: Our benchmarking process integrates data from multiple validated sources like job postings, OEM filings, HR disclosures, and Nexdigm’s proprietary salary databases. These datasets are normalized for cost-of-living indices, benefit ratios, and regional inflation to deliver reliable and actionable compensation insights tailored to specific geographies.

- Pay Structuring and Incentive Design: We develop pay models that blend fixed and variable compensation, linking incentives directly to dealership performance metrics such as sales targets, customer satisfaction scores, and service turnaround efficiency. This approach enhances motivation, accountability, and long-term workforce retention while maintaining financial discipline.

- Strategic Deliverables and Reporting: Our deliverables include regional pay heatmaps, incentive competitiveness dashboards, and role-based salary differentials across markets. These insights equip HR leaders and business heads to make data-backed compensation decisions that align workforce performance with profitability goals.

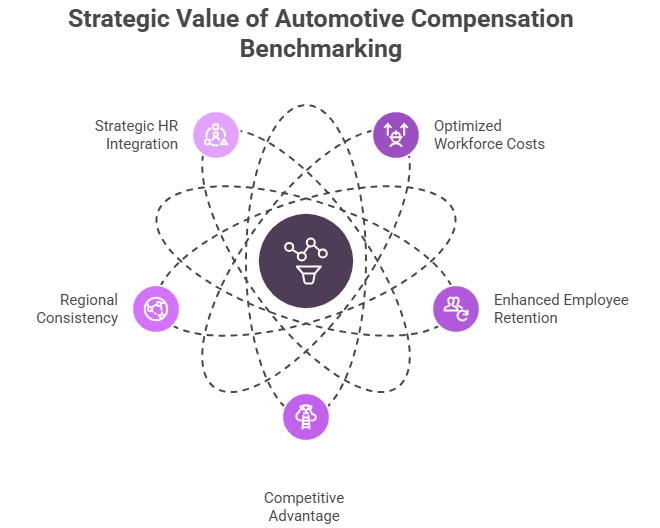

Strategic Value to Clients

In the evolving automotive ecosystem, dealership and aftermarket profitability hinges as much on workforce motivation and efficiency as it does on sales and service volume. Nexdigm’s Compensation Benchmarking solutions enable clients to make compensation a strategic tool for competitiveness, enhancing employee engagement, customer experience, and cost optimization simultaneously.

Here’s how our insights translate into tangible business value:

- Optimized Workforce Costs: By aligning pay scales with regional market realities, dealerships can control labor costs without compromising on talent quality. Our benchmarking models identify optimal salary ranges and variable pay ratios, helping clients maintain cost efficiency across their retail and service networks.

- Enhanced Employee Retention and Engagement: Equitable and transparent pay structures significantly reduce attrition among high-performing sales and service professionals. Through data-backed salary parity and incentive design, Nexdigm enables clients to build stronger employee loyalty and improve performance consistency across branches.

- Competitive Advantage Through Performance-Linked Pay: Our analytics-driven frameworks help organizations tie compensation directly to measurable outcomes such as customer satisfaction (CSAT), repeat business, and parts-to-labor revenue ratios. This alignment fosters a performance-first culture, driving productivity and accountability at every level of the dealership.

- Regional Consistency and Brand Alignment: Regional benchmarking ensures that pay structures reflect both local economic conditions and brand standards. This creates consistency in compensation practices across geographies, supporting standardized service quality, workforce morale, and operational fairness.

- Strategic HR and Financial Planning Integration: Compensation insights generated by Nexdigm serve as a foundation for workforce planning, budgeting, and expansion strategies. Leadership teams can model future headcount costs, optimize incentives for new product launches, and forecast returns on human capital investments with greater accuracy.

By embedding compensation benchmarking within broader competitive intelligence, Nexdigm helps automotive clients translate pay data into strategic foresight.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704