As vehicle ownership rises and fleets mature across Asia, the Middle East, and Africa, the automotive aftermarket is becoming a strategic growth engine for parts manufacturers, distributors, and service providers. With millions of vehicles moving beyond warranty coverage each year, demand for replacement parts, accessories, and maintenance solutions is expanding faster than new car sales in several emerging economies.

However, entering these markets is not without challenges. Companies face fragmented dealer networks, uneven quality standards, counterfeit risks, and evolving import regulations that differ significantly across regions. Many well-established brands struggle to replicate their success in these dynamic environments due to limited visibility into market structures, customer behavior, and distribution reliability.

To succeed, firms require localized intelligence, policy awareness, and data-driven entry models that ensure sustainable and profitable expansion. Nexdigm’s Automotive Aftermarket Entry Consulting bridges these gaps by helping businesses evaluate opportunity hotspots, identify credible local partners, and develop scalable go-to-market frameworks tailored to each country’s competitive landscape.

Nexdigm’s Automotive Aftermarket Market Entry Consulting Framework

Expanding into an emerging aftermarket requires precision, understanding the interplay of customer needs, policy environments, and supply chain realities. Nexdigm’s automotive aftermarket Market Entry Consulting Framework provides a structured, evidence-based roadmap that helps aftermarket players enter new geographies efficiently while minimizing risks and maximizing speed to market.

- Market Feasibility and Opportunity Assessment: Nexdigm begins with an in-depth analysis of vehicle demographics, ownership patterns, and replacement cycles to determine where demand will be strongest. This involves evaluating vehicle parc data, urbanization trends, and per-capita income growth to map high-potential clusters such as Tier-2 cities in India, industrial hubs in Indonesia, or logistics corridors in the GCC. The result is a granular understanding of which product categories offer the most sustainable market entry points.

- Regulatory and Import Evaluation: Compliance remains a key determinant of success. Nexdigm helps clients navigate import duties, homologation standards, labeling requirements, and local certification norms that vary by country. For example, understanding India’s BIS certification, Saudi Arabia’s SASO regulations, or Indonesia’s customs tariff bands can make or break profitability. This regulatory benchmarking allows firms to optimize pricing, assess local assembly feasibility, and plan compliant supply chains from day one.

- Partner and Distributor Identification: The aftermarket thrives on trusted relationships. Nexdigm leverages its on-ground networks and due diligence processes to identify distributors, retailers, and service center partners with proven credibility and reach. Each partner is assessed for financial stability, distribution coverage, and product handling capabilities, ensuring that brand integrity is maintained across all sales channels.

- Localization and Supply Chain Optimization: To compete effectively, companies must balance cost efficiency with delivery reliability. Nexdigm supports clients in identifying optimal warehouse locations, inventory management models, and logistics partners, using comparative cost modeling to minimize total landed costs. Localization studies also help evaluate whether regional assembly or packaging operations could enhance competitiveness.

- Go-to-Market and Business Modeling: Finally, Nexdigm translates insights into actionable plans. The team builds go-to-market blueprints that define target customer segments, pricing tiers, promotional strategy, and sales channel mix, whether B2B distribution, D2C digital platforms, or hybrid franchise models. Financial models covering CAPEX, OPEX, margin simulations, and payback projections allow clients to visualize commercial viability before deployment.

This end-to-end approach ensures that aftermarket entrants not only identify opportunities but also execute with clarity, compliance, and confidence, turning expansion into long-term market leadership.

Unlocking Competitive Advantage Through Strategic Entry

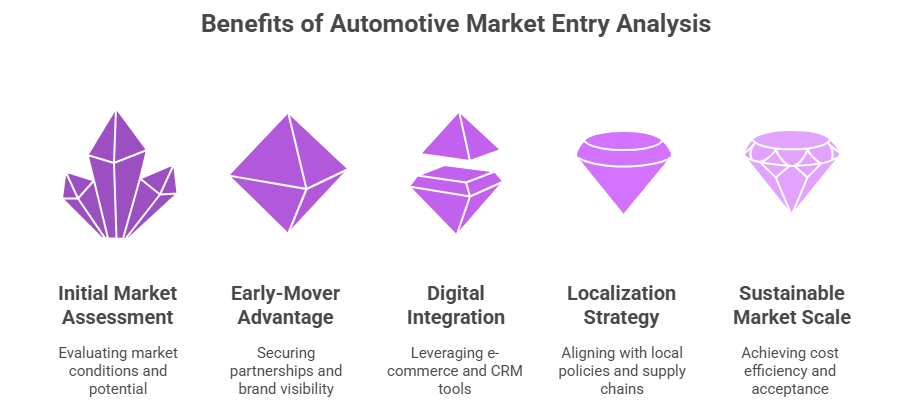

Emerging aftermarkets are transforming rapidly with digitization, policy reform, and rising vehicle ownership. For new entrants, success depends not only on entering the market but on how early and how strategically they do it.

- Early-Mover Edge: Companies that act now can secure strong distributor partnerships, prime locations, and brand visibility before competition scales up. Nexdigm helps identify the right timing and regions through policy and infrastructure benchmarking.

- Digital-Driven Market Growth: E-commerce and connected maintenance platforms are redefining how parts reach consumers. Nexdigm supports firms in integrating digital channels, CRM tools, and online marketplaces to accelerate penetration and engagement.

- Localization for Sustainable Scale: Aligning with local supply chains and industrial policies such as “Make in India” or “Vision 2030” improves cost efficiency and long-term acceptance. Nexdigm ensures each entry model is tailored to local ecosystems and consumer behavior.

A well-executed entry strategy transforms expansion into a lasting competitive advantage, positioning aftermarket players to grow faster and lead confidently in emerging economies.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704