In the modern automotive industry, profitability extends far beyond vehicle sales. As competition intensifies and margins on new vehicles shrink, the aftersales and service segment has emerged as the backbone of sustainable growth for OEMs and dealerships. From scheduled maintenance to spare parts sales, aftersales operations contribute significantly to both customer retention and long-term brand profitability.

However, maintaining profitability in this segment demands benchmarking. Without understanding how service turnaround times and margins compare to industry peers, many manufacturers and service networks operate with hidden inefficiencies.

A structured Automotive Aftersales Market Analysis enables organizations to evaluate service performance, pricing competitiveness, and process efficiency across markets. By combining data-driven benchmarking with operational insights, automotive players can streamline service delivery, reduce costs, and enhance overall profitability.

Why Benchmarking Service Turnaround and Margins Matters

In an era where customer loyalty is defined by post-purchase experience, the aftersales segment has become a crucial differentiator for automotive brands. Benchmarking service turnaround times and margins helps manufacturers and service providers identify performance gaps, enhance operational agility, and strengthen profitability.

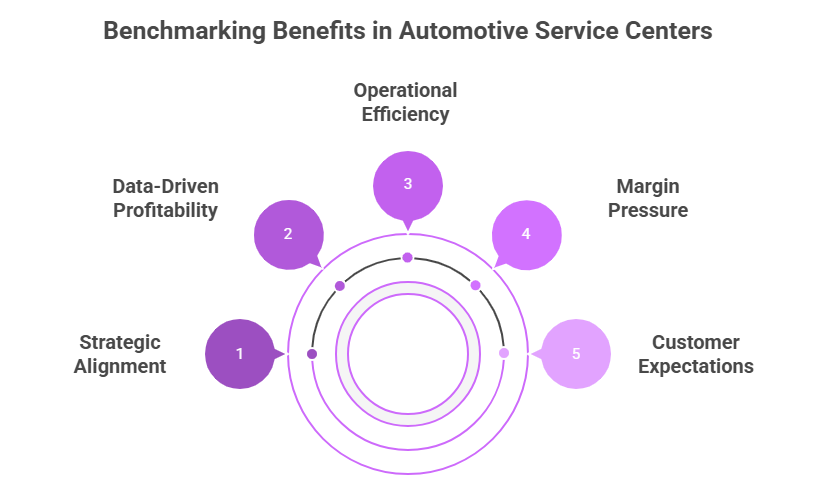

- Rising Customer Expectations: Modern customers demand faster, transparent, and convenient service experiences. Benchmarking turnaround times enables service centers to align with market-leading standards, reducing delays, improving satisfaction, and enhancing brand loyalty.

- Margin Pressure in a Competitive Landscape: With independent garages and digital service aggregators disrupting the aftersales space, traditional networks face shrinking profit margins. Benchmarking cost structures, labor utilization, and spare parts pricing helps maintain profitability while staying competitive.

- Operational Bottlenecks and Inefficiencies: Many service centers suffer from low technician productivity, parts unavailability, or inconsistent service workflows. Benchmarking identifies these bottlenecks and enables the deployment of standardized, efficiency-driven processes across locations.

- Data-Driven Profitability Management: Through comparative analysis of service revenues, warranty claims, and cost of operations, organizations can make evidence-based decisions to balance service quality with profit targets.

- Strategic Alignment with Global Standards: Benchmarking against global and regional peers ensures that OEMs and dealers remain aligned with best-in-class performance metrics, enabling consistent customer experience and operational excellence across markets.

By continuously monitoring turnaround performance and profitability metrics, automotive businesses can transform aftersales operations from a support function into a strategic profit center.

Nexdigm’s Automotive Aftersales Market Assessment Framework

At Nexdigm, we understand that efficient aftersales operations require a blend of operational benchmarking, market analytics, and strategic foresight. Our Automotive Aftersales Market Assessment Framework is designed to help OEMs, Tier-1 suppliers, and service networks identify inefficiencies, optimize profitability, and enhance customer retention through data-backed decision-making.

Step 1: Aftersales Market Landscape Mapping

- Assess the size, structure, and dynamics of the aftersales ecosystem—including OEM workshops, multi-brand service centers, and independent garages.

- Analyze macro trends influencing service demand, such as vehicle parc growth, electrification, and digital service platforms.

- Identify regional disparities in service maturity and customer behavior.

Step 2: Service Turnaround and Process Benchmarking

- Evaluate key operational metrics such as technician productivity, service lead times, and parts availability ratios.

- Benchmark workshop performance against industry standards to identify underperforming areas.

- Analyze workflow efficiency, use of diagnostics, and automation readiness to enhance service throughput.

Step 3: Cost and Margin Analysis

- Examine labor costs, parts margins, and service pricing models across different workshop formats.

- Identify high-margin and low-margin service categories to optimize revenue mix.

- Evaluate profitability drivers through cost-to-serve models and performance variance analysis.

Step 4: Customer Experience and Retention Insights

- Conduct primary and digital research to measure customer satisfaction, repeat service intent, and pain points.

- Identify improvement areas in transparency, pricing communication, and aftersales engagement.

- Map how customer sentiment correlates with service turnaround and perceived value.

Step 5: Strategic Recommendations and Implementation Roadmap

- Deliver actionable recommendations for operational standardization, pricing optimization, and capacity planning.

- Support decision-making through comparative dashboards and ROI-based investment prioritization.

- Enable long-term improvement through continuous performance monitoring and KPI tracking frameworks.

By applying this structured approach, Nexdigm empowers automotive clients to turn service operations into profit engines, balancing customer satisfaction with operational excellence and financial performance.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704