The automotive battlefield is exploding with competition, legacy OEMs, EV disruptors, battery innovators, and software-first mobility players.

With global road transport contributing USD 7 trillion to GDP and 300+ new EV/startup launches every year, no brand can afford blind spots.

This is where automotive competitor analysis becomes a performance multiplier, helping leaders see what competitors build, how they sell, and where they are winning long before the market feels the impact.

Why Automotive Competitor Analysis Matters

- Product Innovation That Follows Real Demand: Top OEMs spend USD 20–30 billion yearly on software, ADAS, and connectivity.

- Sharper Differentiation in a Crowded Market: Aftersales contributes up to 30% of lifetime revenue.

- Stronger Customer Stickiness: Brands with superior service networks see 40% higher repeat purchase rates.

- Early Detection of Market Shifts: More than 50 new EV models hit global markets each year.

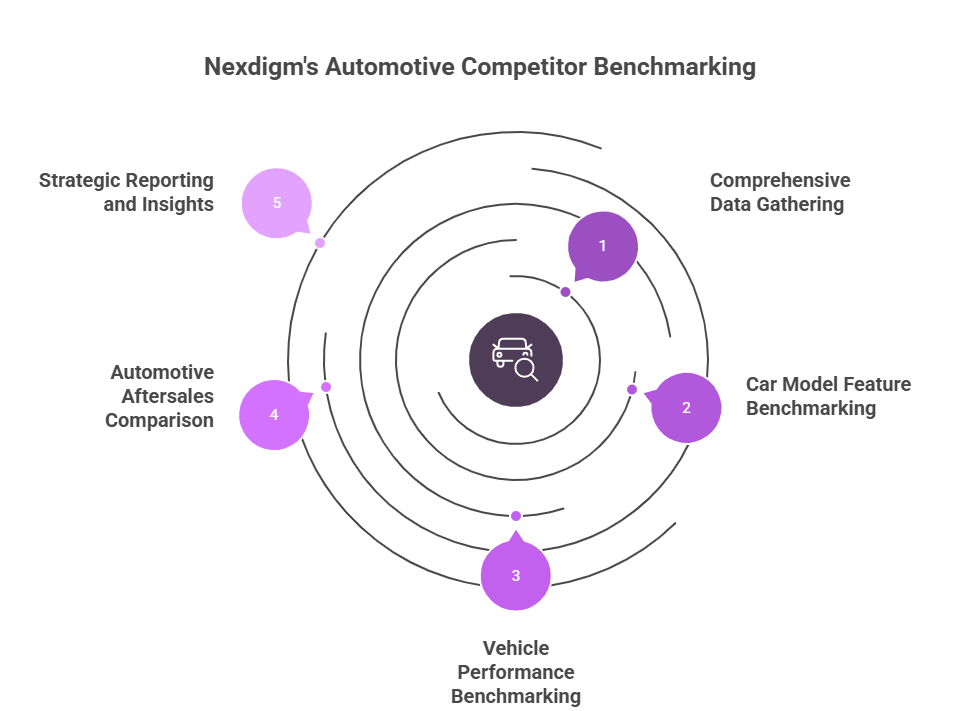

How Nexdigm Delivers High-Impact Automotive Competitor Analysis

We Decode the Market Using 25+ Reliable Data Sources

You can’t beat what you can’t see, and most OEMs see only 30–40% of what competitors are actually doing.

We pull intelligence from OEM technical databases, 140+ dealership networks, regulatory filings across 20+ countries, consumer review platforms with millions of data points, and premium research repositories.

This multi-source model gives a 360° view of product gaps, pricing leaks, and customer sentiment, far beyond what public data alone can reveal.

We Benchmark Car Features the Way Customers Compare Them

Nexdigm compares 80–120 features per model, including ADAS levels, safety assists, OTA upgrades, battery architecture, digital connectivity, and infotainment systems.

We highlight where rivals offer 10× better software integration, longer range, or advanced cockpit UX, helping you identify feature gaps before they hit your sales.

We Analyze Real-World Performance, Not Just Lab Specs

Our vehicle performance benchmarking maps parameters such as fuel economy, 0–100 kmph acceleration, range, crash-test ratings, durability, and NVH performance across leading brands.

With global players logging millions of autonomous and on-road testing miles, we align your engineering roadmap with real-world benchmarks that matter.

We Benchmark Aftersales Where 55–65% of Lifetime Revenue Is Earned

We evaluate dealer footprint density, spare part pricing across 10,000+ SKUs, warranty terms, service turnaround times, and digital service adoption.

With aftersales contributing up to 60% of an OEM’s lifetime profit, our comparison helps you build a service model that beats competitors on value, speed, and customer trust.

We Convert Complex Data Into Leadership-Ready Strategy

Nexdigm converts raw benchmarking into actionable strategy blueprints, including product upgrade maps, pricing ladders, performance scorecards, and competitor movement forecasts.

These reports give leadership clarity on where to invest, what to improve, and how to win, without getting lost in data overload.

Nexdigm Case

A growing EV components company was losing bids despite strong specs. Nexdigm benchmarked 18 rival models, identified missing value signals, redesigned their positioning, and helped them secure two major OEM partnerships within a single quarter.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704