The banking and financial services industry is navigating one of its most competitive eras, shaped by rapid digital transformation, shifting customer expectations, and fintech disruption. Traditional advantages like branch networks and long-standing customer relationships are no longer enough to ensure market leadership. Instead, performance excellence has become the foundation for sustainable growth.

Performance benchmarking allows financial institutions to compare their operational, customer, and financial metrics with peers and industry leaders. By identifying gaps, uncovering strengths, and tracking progress over time, banks and NBFCs gain the intelligence they need to refine strategies, accelerate digital adoption, and remain competitive. In today’s landscape, knowing where you stand is just as important as knowing where you want to go.

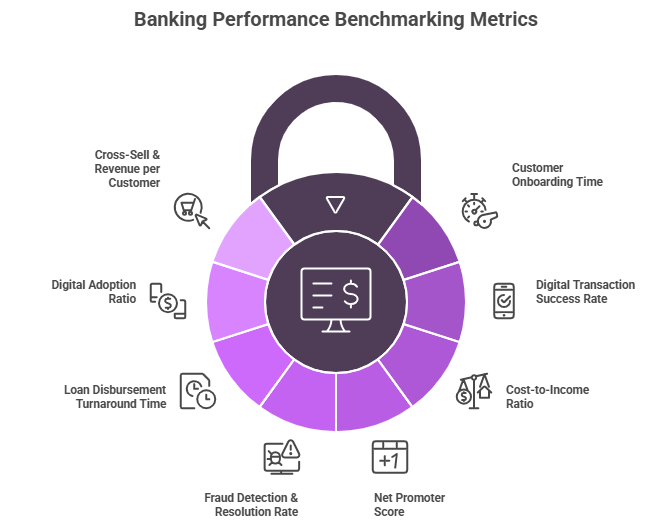

Key Banking Performance Benchmarking Metrics

To succeed in a market where fintechs are redefining agility and customer expectations, banks and NBFCs must track a core set of performance benchmarks. These metrics provide actionable insights into efficiency, customer satisfaction, and profitability:

- Customer Onboarding Time: The speed and simplicity of account opening and KYC processes set the tone for customer relationships. A smooth, fast onboarding process is often the key differentiator between fintechs and traditional banks.

- Digital Transaction Success Rate: System uptime, transaction error rates, and mobile app stability are critical for retaining digitally savvy customers. Benchmarking these ensures seamless experiences.

- Cost-to-Income Ratio: This metric highlights operational efficiency. Institutions with leaner structures and higher automation typically achieve stronger ratios, ensuring long-term sustainability.

- Net Promoter Score (NPS): A reliable measure of customer satisfaction and loyalty. Tracking NPS helps banks evaluate their customer engagement strategies against competitors.

- Fraud Detection & Resolution Rate: With rising cyber risks, benchmarking fraud monitoring and resolution times is vital for both regulatory compliance and customer trust.

- Loan Disbursement Turnaround Time (TAT): The efficiency of credit approval and disbursement processes can directly influence competitiveness in retail and SME lending.

- Digital Adoption Ratio: Comparing the share of digital vs. branch transactions highlights progress in digital transformation journeys.

- Cross-Sell & Revenue per Customer: Benchmarking revenue contribution from cross-sold products offers insights into customer relationship depth and profitability.

Nexdigm’s BFSI Competitive Intelligence Approach

At Nexdigm, we help financial institutions turn benchmarking data into actionable strategies. Our Competitive Intelligence services are designed to provide banks, NBFCs, and fintech firms with a clear view of where they stand against peers and industry disruptors.

We adopt a 360-degree approach, combining:

- Primary research to capture real-time industry practices and customer perspectives.

- Secondary data analysis to map financial, operational, and digital performance benchmarks.

- Proprietary frameworks that highlight strengths, gaps, and improvement areas across critical KPIs.

We analyze peer strategies, product innovations, technology adoption, compliance frameworks, and customer engagement models. This enables BFSI leaders to identify blind spots, enhance decision-making, and invest in areas that directly impact competitiveness.

By leveraging Nexdigm’s BFSI Competitive Intelligence, institutions gain the clarity to strengthen digital adoption, refine customer experience, and accelerate profitability, ensuring they remain resilient in an evolving fintech-driven market.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91 96549 82241