The financial services industry is witnessing a structural transformation. Traditional banking models are merging with digital-first ecosystems, creating a talent environment where specialized skills in risk analytics, cybersecurity, compliance, and digital banking command significant premiums. As fintech firms, non-banking financial companies (NBFCs), and global banks compete for the same talent pool, compensation has become a strategic differentiator rather than a routine HR function.

At the same time, macroeconomic volatility, regulatory mandates, and sustainability-linked governance norms are reshaping how organizations approach rewards. The focus has shifted from simply matching market salaries to building holistic total rewards frameworks that balance competitiveness, compliance, and cost efficiency.

In this evolving landscape, HR leaders are expected to make data-driven compensation decisions that not only attract and retain top talent but also align with profitability and long-term business resilience. This is where Nexdigm’s BFSI Compensation Benchmarking Consulting acts as a strategic partner, helping financial institutions transform their total rewards strategy into a powerful lever for workforce optimization, performance alignment, and competitive advantage.

The Need for Compensation Benchmarking in Total Rewards Strategy

As the BFSI ecosystem becomes more complex and technology-driven, traditional compensation models are struggling to keep pace. The rapid emergence of fintech disruptors, digital-first banks, and regulatory mandates has intensified competition for skilled professionals, making compensation planning a strategic HR and financial priority. To remain agile and attractive, financial institutions must base their pay structures on real-time market intelligence rather than historical norms.

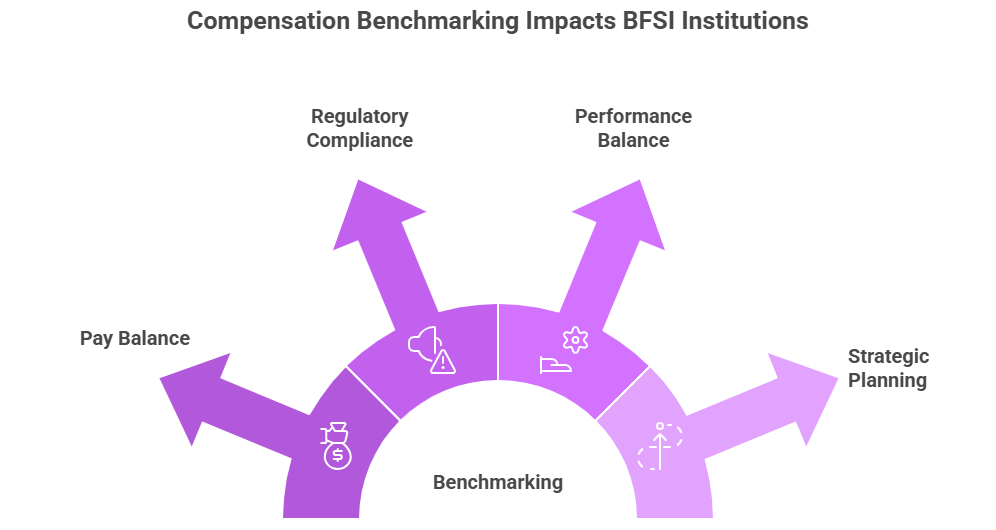

- Evolving Pay Disparities and Skill Premiums: The rise of digital transformation in BFSI has created new role clusters, whose market value is evolving faster than traditional pay cycles. Without accurate benchmarking, institutions risk either overpaying for conventional roles or underpaying for niche talent, leading to imbalance and attrition.

- Regulatory and Governance Pressures: Global banking regulators and corporate governance frameworks increasingly emphasize transparency, fairness, and ESG-linked pay disclosures. Compensation benchmarking ensures that total rewards programs align with these evolving requirements while maintaining compliance with internal risk management and compensation governance policies.

- Balancing Performance, Cost, and Retention: In a highly competitive market, financial institutions face the dual challenge of optimizing cost-to-talent ratios and retaining critical performers. Benchmarking enables HR leaders to design performance-linked incentive structures, calibrated pay bands, and reward strategies that balance internal equity with external competitiveness.

- Strategic Workforce Planning: By integrating benchmarking insights into total rewards strategy, organizations gain a clear understanding of labor market dynamics, pay progression, and workforce cost distribution. This intelligence supports forward-looking decisions in budgeting, expansion planning, and digital capability building.

Nexdigm’s BFSI Compensation Benchmarking Consulting Framework

In an environment where financial institutions compete on both agility and credibility, compensation benchmarking must go beyond salary comparisons. Nexdigm’s BFSI Compensation Benchmarking Consulting Framework is designed to help HR leaders and decision-makers translate compensation data into strategic workforce intelligence. It integrates market analytics, role mapping, and consulting expertise to optimize total rewards design across banks, NBFCs, fintechs, and insurance companies.

- Data-Driven Market Benchmarking: Nexdigm aggregates and harmonizes compensation data across multiple BFSI segments and geographies. Using both primary research and secondary datasets, the framework analyzes base pay, variable components, and long-term incentives across comparable organizations. This provides a comprehensive understanding of where the company stands in relation to market medians and performance-driven pay levels.

- Functional and Role-Based Pay Mapping: Recognizing the diversity of roles within BFSI, Nexdigm evaluates compensation structures across key domains. Each role is benchmarked for complexity, skill intensity, and market scarcity, ensuring pay structures remain both equitable and competitive.

- Incentive and Total Rewards Optimization: The framework integrates short-term and long-term incentive modeling, linking pay to productivity, profitability, and regulatory goals. It helps organizations redesign total rewards structures that combine fixed pay, performance incentives, and recognition-based components to reinforce both motivation and compliance with internal risk guidelines.

- Regulatory and ESG Alignment: With growing scrutiny on compensation governance, Nexdigm embeds regulatory compliance and ESG-linked pay transparency into its benchmarking methodology. This allows BFSI clients to maintain adherence to local and international disclosure norms while reinforcing their employer brand as a fair, responsible, and sustainable organization.

By combining deep sectoral expertise with analytics-driven insights, Nexdigm’s BFSI Compensation Benchmarking Consulting Framework empowers financial institutions to align rewards with performance, mitigate attrition risks, and strengthen governance accountability. The result is a future-ready total rewards system that supports growth, compliance, and sustained talent advantage.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704