Staying Ahead in a $20 Trillion Industry Starts With Knowing Your Competitors

The BFSI sector is transforming faster than any other. With more than 300+ fintechs launched every month, banks and insurers no longer compete only with traditional rivals—they battle digital disruptors, embedded finance ecosystems, and AI-native players rewriting the rules.

In this high-velocity landscape, guessing your competitive position is no longer an option.

BFSI competitor benchmarking gives leaders the visibility they need to anticipate market shifts, refine offerings, and protect long-term relevance.

Why BFSI Benchmarking Matters

- Identify Digital Competency Gaps: Banks adopting AI for operations have seen 20–30% cost savings, while laggards face widening gaps.

- Strengthen Product Competitiveness: Fintech lenders grew loan books 5x faster than traditional lenders between 2020–2024.

- Improve Customer Retention: Financial institutions with personalized CX report up to 3x higher CLV.

- Future-Proof Regulatory Readiness: Non-compliance penalties exceeded $5.8 billion globally in 2023, making benchmarking crucial.

Nexdigm’s BFSI Competitor Benchmarking

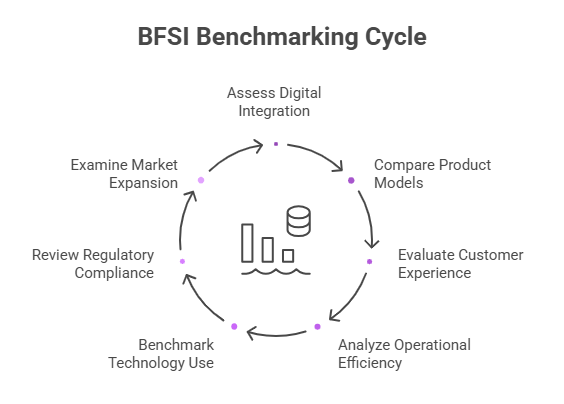

Our benchmarking framework goes beyond simple comparisons. We decode how competitors innovate, price, engage, comply, scale, and differentiate across the global financial ecosystem.

We analyze players across:

- Digital adoption & fintech integration

- Product & pricing innovation

- Customer experience quality

- Operational & automation maturity

- Risk, compliance & regulatory readiness

- Partnership ecosystems & regional expansions

By blending proprietary research with global financial intelligence, Nexdigm helps BFSI leaders understand not just where they stand, but what needs to change to win.

Key Areas We Benchmark in BFSI

- Digital Banking & Fintech Integration: Over 78% of banking interactions globally are now digital-first. We assess mobile apps, APIs, open banking readiness, fintech partnerships, and digital onboarding maturity.

- Product & Pricing Models: Loan spreads, micro-insurance pricing, robo-advisory fees, embedded finance models, and competitive differentiators across lending, insurance, and investments.

- Customer Experience & Retention: With 41% of customers switching banks due to poor CX, we benchmark omnichannel journeys, personalization maturity, service SLAs, and loyalty drivers.

- Operational Efficiency: Global banks operating at sub-50% cost-to-income ratios set the benchmark. We analyze automation depth, process standardization, and productivity levers.

- Technology & Innovation: AI-driven fraud detection, cloud migrations, blockchain pilots, cybersecurity readiness—benchmarked against global leaders making $250B+ in tech spend annually.

- Regulation & Risk Management: Basel III, IFRS-17, open banking, digital KYC, cross-border compliance—mapped against top performers.

- Market Expansion & Partnerships: We track regional expansion moves, ecosystem partnerships (fintechs, telcos, wallets), and niche market plays.

How Firms Benefit

- Banks: Identify gaps in digital offerings, optimize branch-to-digital transition, and strengthen customer acquisition strategies by learning from peers and leading fintech collaborations.

- Insurers: Benchmark underwriting efficiency, claims automation, and product innovation to design competitive insurance solutions aligned with evolving customer expectations.

- Investment & Wealth Management Firms: Compare advisory models, digital wealth platforms, and robo-advisors to improve portfolio performance and client engagement.

- Fintechs & New Entrants: Gain insights into established players’ strengths and weaknesses, helping them differentiate, find untapped niches, and accelerate growth.

Nexdigm Case

A regional mid-size bank struggled to compete with fast-scaling fintechs in digital onboarding and customer retention. Nexdigm benchmarked 11 leading BFSI competitors, mapped digital maturity gaps, redesigned their onboarding flow, and optimized pricing.

Result: onboarding time reduced by 38% and new-to-bank customer conversions increased by 24% within four months.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704