Cross-border fintech, digital banking, and open finance ecosystems are reshaping financial services faster than ever before. International expansion has become a defining growth pathway.

But so has regulatory complexity, 120+ privacy laws, and rising cyber risks is now the biggest barrier to global growth. For BFSI firms, strategic market entry is the differentiator between leadership and stagnation.

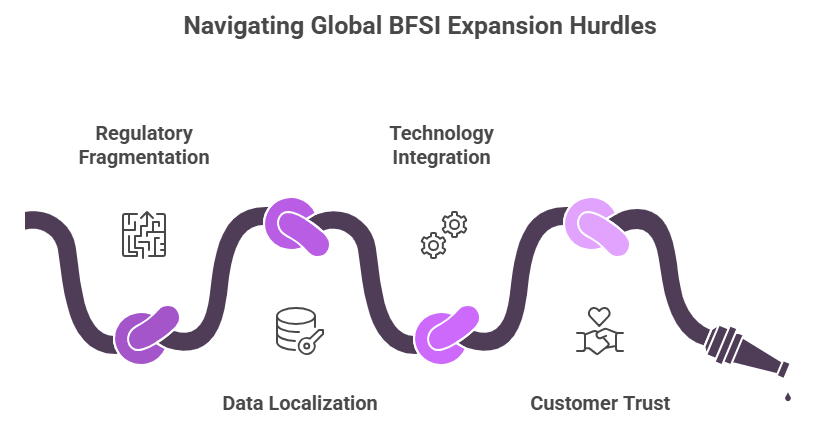

Challenges in Competing Across International Financial Markets

The globalization of financial services has created tremendous opportunities, but also new layers of complexity.

- Regulatory Fragmentation and Licensing Barriers: Obtaining digital banking or payments licenses can take 12–36 months, depending on jurisdiction.

- Data Localization and Cybersecurity Compliance: Over 120+ countries have now enacted data privacy laws

- Technology Integration and Interoperability Gaps: Integration challenges can increase go-live timelines by 30–40% if not planned upfront.

- Customer Trust and Local Market Alignment: A World Bank survey shows 70%+ customers in emerging economies prefer dealing with locally licensed, government-recognized institutions.

Nexdigm’s Global Market Entry Strategy Framework

Scaling across borders requires precision, policy intelligence, and market-specific execution. Nexdigm’s Global Market Entry Strategy Framework BFSI firms to expand confidently, compliantly, and competitively.

Regulatory & Policy Intelligence

We decode licensing frameworks, capital rules, KYC/AML mandates, fintech sandboxes, data protection laws, and central bank directives. This ensures institutions shape operating models aligned with both current and future policy directions.

Feasibility & Competitive Assessment

Nexdigm evaluates financial inclusion levels, digital payment penetration, customer segments, and competitive intensity. We identify markets where digital maturity, demand, and regulatory environment align for profitable entry.

Localization & Partnership Models

Success in BFSI depends on local validation. Nexdigm identifies trusted collaborators

- Regional banks

- Payment processors

- Fintech firms

- API aggregators

- Insurtech distributors

These partnerships accelerate trust-building and streamline regulatory acceptance.

Execution & Market Enablement

From licensing documentation to entity setup and tech integration, Nexdigm ensures seamless execution. We support:

- Governance frameworks

- Post-launch compliance monitoring

- Audit readiness

- Ongoing regulatory tracking

This enables institutions to operate securely and adapt quickly as policies evolve.

Nexdigm Case

A digital payments provider expanding into Southeast Asia struggled with licensing complexity and data-localization requirements. Nexdigm mapped regulatory pathways, identified trusted banking partners, and built a structured entry roadmap. The result: 40% faster licensing readiness and 25% lower compliance costs, enabling a smooth and confident market launch.

Strategic Advantages of BFSI Market Entry Consulting

- Faster Licensing & Market Readiness: Clients reduce time-to-market by 25–40%, enabling them to capture new opportunities ahead of competitors.

- Localized Innovation & Higher User Adoption: Localized BFSI products can increase adoption by 30%+ in emerging markets.

- Risk Reduction & Cost Efficiency: Nexdigm’s feasibility and compliance assessments reduce expansion-stage risk by up to 35% and prevent avoidable compliance expenditure.

- Stronger Ecosystem Partnerships: Partnership-driven models accelerate distribution, licensing acceptance, and operational reach, especially in markets where collaboration is the growth engine.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704