Across the global banking and financial landscape, technology has become the defining force behind customer experience and competitive differentiation. From digital lending platforms and mobile-first banking to AI-driven advisory and embedded insurance models, every leading BFSI organization is innovating to stay relevant in a customer-first economy.

However, the pace of technological advancement has made innovation increasingly complex and fragmented. Financial institutions today navigate a crowded ecosystem of emerging solutions, each promising efficiency, personalization, or agility. The challenge lies not in finding technologies, but in selecting the right ones that align with both business outcomes and evolving customer expectations.

This is where technology benchmarking becomes a strategic differentiator. By applying data-driven comparisons of tools, platforms, and implementations across peers and markets, BFSI organizations can separate high-impact innovations from passing trends. When coupled with competitive intelligence, benchmarking transforms from a measurement exercise into an engine for customer-centric innovation.

The Challenge: Innovation Without Direction

In the race to modernize, many BFSI organizations are investing heavily in digital transformation, yet few achieve meaningful differentiation. The problem isn’t a lack of innovation, but a lack of direction. New technologies are often adopted reactively, driven by competitive pressure, vendor persuasion, or short-term targets, rather than by a clear understanding of how they enhance customer value.

Financial institutions frequently face:

- Fragmented technology stacks that create silos between legacy systems, fintech collaborations, and digital channels.

- Misaligned investments in tools that improve operations but fail to elevate the customer experience.

- Innovation fatigue, where multiple pilot projects deliver limited enterprise-scale impact.

- Rising regulatory and cybersecurity complexity, which slows down experimentation and adoption cycles.

As a result, many organizations struggle to link digital investments with measurable outcomes such as customer satisfaction, retention, and lifetime value.

Technology benchmarking addresses this gap by turning scattered innovation into a structured strategy. Through comparative intelligence, BFSI leaders can identify technologies that deliver real impact, whether improving mobile onboarding speed, enhancing credit risk models, or personalizing customer engagement.

When applied systematically, benchmarking becomes a strategic framework for innovation alignment, helping BFSI enterprises pursue transformation that is focused, measurable, and customer-centric.

Nexdigm’s BFSI Technology Benchmarking Framework

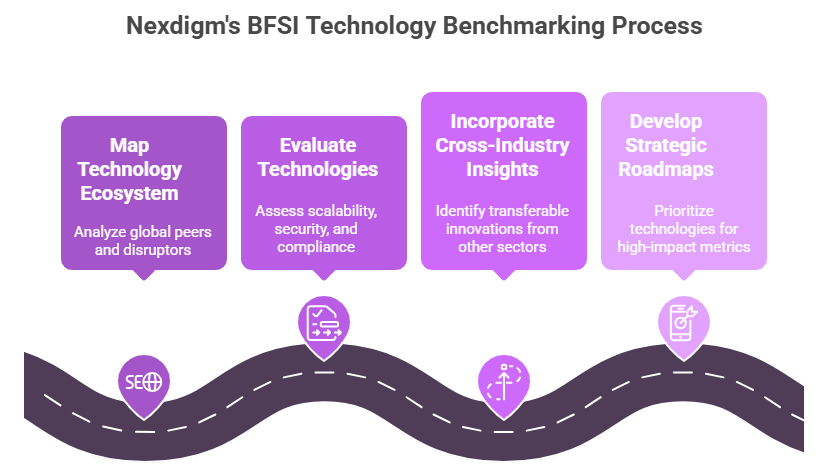

Driving innovation in BFSI demands a structured, evidence-based approach to choosing the right ones. Nexdigm’s BFSI Technology Benchmarking Framework is built to help financial institutions navigate this complexity by transforming scattered innovation efforts into a clear, data-backed strategy.

Our methodology integrates competitive intelligence, technology performance benchmarking, and strategic foresight, enabling banks, insurers, and fintechs to align digital transformation with measurable customer outcomes.

Core Elements of the Framework

- Technology Landscape & Peer Mapping: Nexdigm begins by mapping the BFSI technology ecosystem, analyzing how global peers and disruptors deploy innovations that improve customer experience and efficiency.

- Capability and Performance Benchmarking: Technologies are evaluated against key parameters such as scalability, integration agility, response time, security robustness, and compliance adaptability, ensuring each investment supports both innovation and regulatory resilience.

- Cross-Industry and Regional Intelligence: Our analysts incorporate insights from adjacent industries like eCommerce and telecom to identify transferable innovations and region-specific technology trends that can enhance BFSI customer engagement.

- Strategic Roadmapping: The benchmarking results are translated into actionable innovation blueprints, prioritizing technologies that deliver high impact on metrics such as onboarding speed, transaction satisfaction, and digital adoption rates.

Through this structured framework, Nexdigm enables BFSI enterprises to innovate with intent, balancing customer-centricity, compliance, and profitability. By comparing real-world technology performance and adoption outcomes, we help leaders replace guesswork with data-driven clarity and competitive foresight.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704