In M&A and strategic partnerships, timing is everything. With over $3.2 trillion in global M&A deals announced in 2024 and more than 38,000 startups entering adjacent industries, companies can no longer rely on intuition or outdated market scans.

Competitive Intelligence (CI) has become the engine behind smarter, faster, and safer inorganic growth. Today, the real competitive advantage lies in seeing what others miss.

This is where Nexdigm’s Competitive Intelligence helps organizations move before competitors even react.

Why M&A and Partnerships Fail Without Competitive Intelligence

Even the strongest deal logic collapses without market foresight. These are the most damaging blind spots organizations face without structured CI support:

- Hidden Competitors That Emerge Too Late: Over 28,000 adjacently positioned startups launched globally in 2024.

- Overvalued Targets With Weak Fundamentals: Nearly 47% of failed M&A deals collapse due to operational or cultural mismatch.

- Technology and Product Roadmaps Don’t Align: Roughly 35% of post-merger integration failures stem from incompatible technology stacks.

- Limited Visibility into Adjacent Ecosystems: Nearly 1 in 4 major disruptors now originate outside the buyer’s core industry.

Spotting Emerging Players Beyond the Obvious

Growth often lies outside your direct category. But with 1 in 4 disruptive competitors now emerging from adjacent sectors, traditional monitoring is no longer enough.

Nexdigm’s CI teams track:

- Disruptive startups redefining value chains

- Cross-sector synergy opportunities (e.g., fintech + retail, healthtech + AI)

- Sector convergence signals across mobility, energy, healthcare, BFSI, and consumer tech

- Regional challengers in Tier-2/Tier-3 markets and fast-growth geographies

This helps clients capture partnerships and acquisitions before competitors even identify them.

Competitive Intelligence Across the Entire M&A Lifecycle

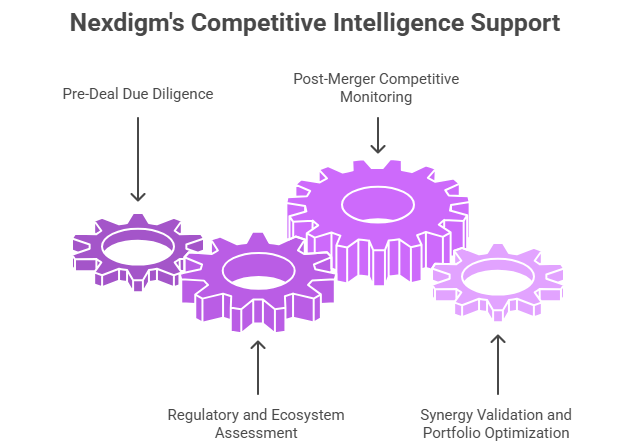

To support high-impact strategic decisions, Nexdigm integrates CI at every stage, from pre-deal screening to post-merger monitoring.

- Pre-Deal Due Diligence: We analyze target customer portfolios, pricing models, growth risks, and ecosystem pressure, ensuring valuations are grounded, not optimistic.

- Regulatory and Ecosystem Assessment: For cross-border deals, we evaluate approval risks, political sensitivities, and market-entry barriers.

- Post-Merger Competitive Monitoring: We track competitor reactions, ecosystem shifts, and partner dependencies to ensure deals remain advantageous beyond Day 1.

- Synergy Validation and Portfolio Optimization: CI validates synergy assumptions, benchmarks capability maturity, and highlights portfolio optimization opportunities.

Nexdigm Case

A global SaaS provider exploring an acquisition in Latin America faced uncertainty around competitive saturation and hidden compliance risks. Nexdigm conducted a 360° CI-led assessment, benchmarking 14 regional players, analyzing pricing movements, and flagging two regulatory red flags. Within eight weeks, the client recalibrated its valuation model, avoided a potential compliance liability, and shortlisted a stronger alternative target. Thus, saving an estimated USD 11 million in post-deal corrective costs.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704