Global manufacturing is scaling faster than ever. Yet over 45% of cross-border manufacturing investments face cost overruns or delays, largely due to poor feasibility assessment, regulatory gaps, or infrastructure miscalculations.

As supply chains reconfigure and global firms diversify beyond single-country dependencies, choosing where to expand and how has become a boardroom priority.

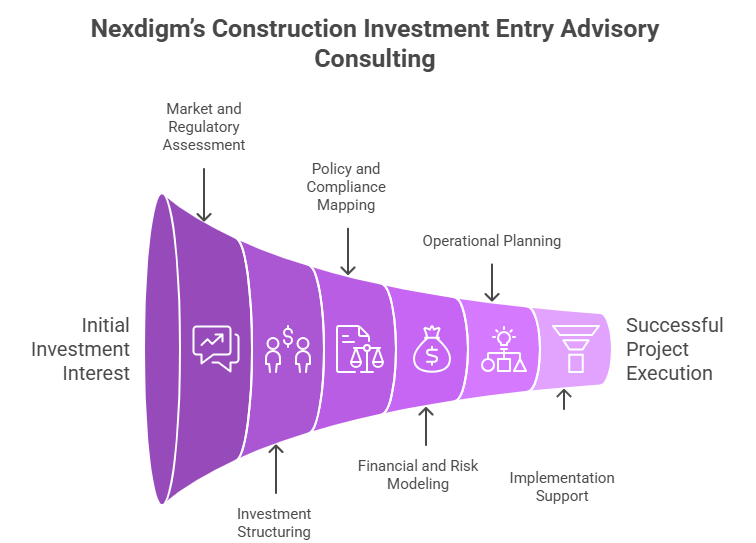

This is where Nexdigm’s Construction Investment Entry Advisory Consulting ensures expansion is driven by data, not guesswork.

Challenges in Market Expansion Without Feasibility Insights

- Unrealistic Demand & Capacity Projections: In reality, up to 30% of imported industrial goods are re-exported.

- Regulatory & Environmental Compliance Risks: Between 2022–2024, over 90 countries tightened industrial, ESG, or environmental compliance norms.

- Infrastructure & Supply Chain Limitations: Poor logistics corridors can raise cost-to-serve by 20–40%.

- Labor & Skill Availability Gaps: More than 50% of emerging markets face shortages of skilled industrial workers.

A feasibility study reduces these risks before capital is committed, saving millions in long-term losses.

Nexdigm’s Construction Investment Entry Advisory Consulting Framework

Our framework helps manufacturers make investment decisions that are compliant, data-backed, and ROI-focused.

Market Opportunity & Demand Assessment

Nexdigm evaluates sector demand using:

- GDP & industrial output trends

- Trade flows (import/export volumes)

- Consumption patterns & capacity utilization

- Competitor footprint and pricing dynamics

Outcome: Clear visibility on true market demand, potential growth pockets, and realistic plant sizing.

Regulatory & Policy Intelligence

We decode all policy layers including:

- Foreign investment norms & ownership caps

- Environmental and zoning regulations

- Industrial licensing procedures

- ESG reporting requirements

- Tax incentives & fiscal benefits

Outcome: Zero surprises during approvals, faster regulatory clearance, and compliance-first planning.

Technical & Infrastructure Feasibility

We assess operational readiness through:

- Energy tariffs & reliability

- Water availability

- Port and logistics corridor efficiency

- Supplier ecosystem strength

- Land suitability & industrial cluster benchmarking

Outcome: Selection of locations that minimize cost, downtime, and logistical inefficiencies.

Financial & Economic Viability Modeling

Nexdigm builds models that include:

- Capex/Opex forecasting

- Taxation scenarios

- Fiscal incentive impact

- Sensitivity analysis

- Long-term ROI modeling

Outcome: Complete clarity on investment attractiveness and break-even timelines.

Location Benchmarking & Site Selection

We create a comparative scoring matrix using:

- Infrastructure index

- Labor availability index

- Cost competitiveness

- Policy support score

- Logistics efficiency

Outcome: Selection of the optimal site based on measurable, data-backed criteria.

Implementation Roadmap & Risk Mitigation

Nexdigm supports execution through:

- Project timelines & milestone planning

- Regulatory documentation & approvals

- Local partner identification

- Supply chain integration

- Risk heatmaps & contingency planning

Outcome: Smooth transition from feasibility to execution with minimized risk exposure.

Nexdigm Case

Nexdigm supported an EPC contractor evaluating expansion in East Africa through a detailed feasibility and regulatory assessment across three countries. By analyzing 40+ policy parameters, infrastructure gaps, and long-term cost scenarios, Nexdigm helped the client reduce projected project costs by 26%, secure USD 4.8 million in incentives, and identify a zone with 35% faster permitting, enabling a confident, de-risked market entry.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704