The courier and last-mile logistics industry is at the center of the global e-commerce revolution. From express parcel deliveries to hyperlocal shipments, courier enterprises now handle unprecedented delivery volumes across increasingly complex networks. But as the industry scales, maintaining profitability has become a growing challenge.

Rising fuel costs, labor shortages, and technology investments have compressed margins, while customer expectations for faster and cheaper deliveries continue to escalate. Despite operational expansion, many courier companies lack visibility into true unit economics, making it difficult to sustain growth profitably.

This is where Courier Financial Benchmarking Studies by Nexdigm come into play. By systematically comparing cost-to-revenue ratios, delivery margins, working capital cycles, and asset utilization metrics, we help courier enterprises uncover financial inefficiencies and identify scalable growth paths.

Why Financial Benchmarking Matters for Courier Profitability and Scalability

The courier and last-mile delivery industry thrives on speed, precision, and reliability from pickup logistics and line-haul expenses to last-mile operations, sorting center overheads, and technology investments. Without clear visibility into these cost drivers, courier companies risk scaling volume at the expense of profitability. Financial benchmarking enables courier businesses to go beyond operational metrics and measure how efficiently every delivery contributes to the bottom line. It provides a financial lens through which organizations can assess unit economics, track delivery profitability, and evaluate the scalability of their network models.

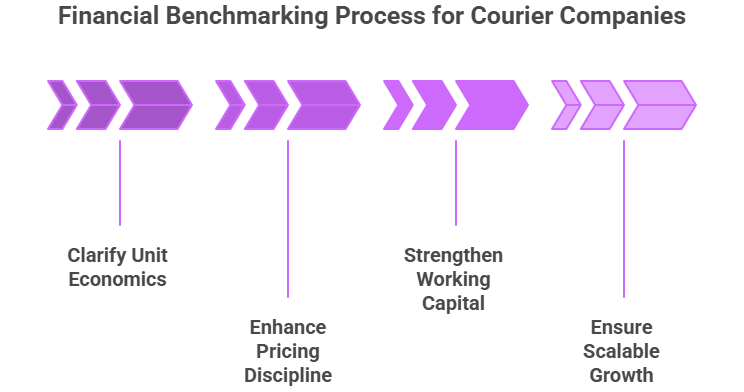

- Clarifying Unit Economics and Cost Efficiency: Benchmarking helps courier companies understand the true cost per parcel, factoring in variable and fixed components like transportation, workforce, packaging, and digital infrastructure. This clarity supports better pricing, margin management, and process automation strategies.

- Enhancing Pricing and Margin Discipline: By comparing revenue per shipment, gross margins, and route-level profitability with market peers, benchmarking reveals pricing inefficiencies and areas for optimization, enabling competitive yet profitable rate setting.

- Strengthening Working Capital and Liquidity: Benchmarking metrics such as Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), and cash conversion cycles provide a clearer view of liquidity health, helping courier enterprises improve cash flow management and fund growth sustainably.

- Ensuring Scalable Growth: As networks expand, financial benchmarking evaluates how costs behave with volume increases. It helps leadership assess whether scaling up will dilute or strengthen delivery margins, ensuring new capacity investments are backed by solid financial logic.

Nexdigm’s Courier Financial Benchmarking Framework

At Nexdigm, we help courier and logistics enterprises bring financial clarity and scalability discipline into their operations. Our Courier Financial Benchmarking Framework is built to assess how effectively each shipment, route, and hub contributes to profitability, helping leadership teams make informed, data-backed decisions on pricing, expansion, and cost optimization.

Stage 1: Peer and Business Model Mapping

We begin by identifying relevant peer sets based on business model (express, parcel, hyperlocal, or on-demand), network scale, and geographic coverage. This ensures that benchmarks are realistic and reflect comparable market and cost conditions.

Stage 2: Financial KPI Benchmarking

Nexdigm benchmarks essential metrics such as cost per parcel, average revenue per shipment, delivery cost-to-revenue ratio, EBITDA per network zone, and CapEx intensity. These insights help identify profit leakages and financial imbalances within network operations.

Stage 3: Unit Economics and Cost Diagnostics

We conduct a deep dive into fixed and variable cost structures including transportation, warehousing, delivery fleet expenses, and technology overheads. This allows us to calculate the contribution margin per delivery and identify cost optimization opportunities without compromising service quality.

Stage 4: Network Scalability and Performance Simulation

Through scenario modeling, Nexdigm evaluates the financial impact of volume growth, route expansion, and automation investments. This helps courier enterprises forecast whether scaling up will enhance or dilute delivery margins.

Stage 5: Strategic Dashboard and Actionable Insights

All insights are presented in a Courier Financial Benchmarking Dashboard, offering real-time visibility into cost efficiency, profitability, and scalability indicators. Nexdigm complements this with recommendations on pricing, capital deployment, and performance improvement priorities.

Nexdigm’s framework empowers courier companies to balance growth ambition with financial control, ensuring that each delivery contributes to sustainable, measurable profitability.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704