Digital transformation has revolutionized the way banks operate, but it has also redefined what profitability means in the modern BFSI ecosystem. As financial institutions migrate from traditional branches to digital platforms, they face new challenges of rising technology costs, regulatory complexity, evolving consumer behavior, and shrinking interest margins.

While digital channels drive scalability and convenience, they often blur the visibility of real financial efficiency. Leaders across banks and NBFCs increasingly ask: Which digital initiatives are truly profitable? How do we compare with digitally mature peers? Are our investments in automation, analytics, and AI yielding measurable returns?

This is where Financial Benchmarking Consulting becomes a strategic necessity. It enables banks to measure profitability, operational efficiency, and cost structures against industry peers—turning disconnected financial data into competitive insight. By benchmarking key metrics such as cost-to-income ratio, operating efficiency, and digital transaction profitability, BFSI leaders can pinpoint improvement areas, rebalance investments, and realign digital strategy with financial performance.

Why Financial Benchmarking Matters in Digital Banking

The rapid adoption of digital banking has brought speed and convenience to customers but it has also added new layers of cost and complexity for financial institutions. To sustain financial health, banks and fintechs must now evaluate how their digital operations, technology investments, and cost structures compare to industry leaders. This is precisely where financial benchmarking creates strategic value.

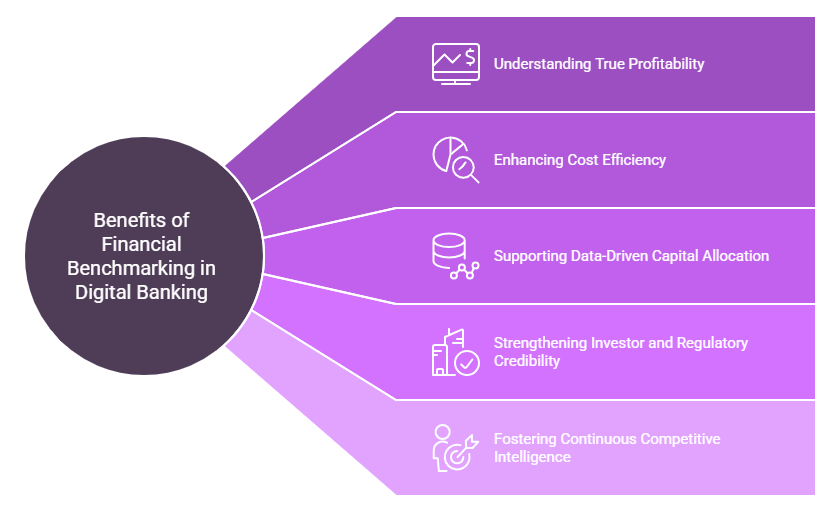

- Understanding True Profitability in the Digital Era: Digital growth does not always translate to financial success. Benchmarking helps financial institutions assess the real profitability of digital channels by comparing cost per transaction, revenue per customer, and channel contribution margins against peers.

- Enhancing Cost Efficiency and Operational Control: From cloud infrastructure to cybersecurity and digital onboarding systems, technology costs now account for a significant portion of a bank’s operating expenses. Benchmarking provides transparency into how efficiently these resources are utilized compared to peers.

- Supporting Data-Driven Capital Allocation: With multiple projects competing for investment benchmarking helps banks prioritize capital deployment based on measurable financial impact. Comparing digital ROI and revenue productivity across departments allows CFOs to ensure every investment aligns with long-term profitability.

- Strengthening Investor and Regulatory Credibility: Benchmarking supports transparent and data-backed financial storytelling, a critical requirement for investor confidence and regulatory scrutiny. By aligning performance metrics with global best practices, banks can present objective evidence of efficiency, profitability, and risk control in their annual reports, investor decks, or regulatory filings.

- Fostering Continuous Competitive Intelligence: Financial benchmarking is an ongoing intelligence process that helps banks stay agile. As market conditions evolve and new entrants emerge, regular benchmarking ensures decision-makers stay ahead of peers, anticipate shifts in profitability trends, and maintain a competitive edge.

Nexdigm’s Digital Banking Financial Benchmarking Consulting Framework

At Nexdigm, we understand that achieving profitability in digital banking demands a data-driven understanding of financial efficiency and peer competitiveness. Our Digital Banking Financial Benchmarking Consulting Framework is designed to help banks, fintechs, and NBFCs decode their financial health, identify margin improvement opportunities, and align growth strategies with measurable profitability outcomes.

Stage 1: Peer Group Identification and Data Calibration

We start by selecting relevant peer groups based on size, business model, and digital maturity. All financial data is normalized to ensure consistency across markets and accounting standards, creating a solid foundation for comparative analysis.

Stage 2: KPI and Ratio Benchmarking

Key performance indicators (KPIs) such as cost-to-income ratio, operating expense per account, digital transaction cost, net interest margin (NIM), and cross-sell income are benchmarked against top-performing peers. This provides a clear picture of where the institution stands on profitability, operational efficiency, and cost optimization.

Stage 3: Digital Efficiency and Cost Mapping

We deep-dive into technology spend, automation adoption, cloud costs, and customer acquisition expenses to evaluate how effectively digital investments translate into financial returns. Benchmarking these parameters reveals gaps in process efficiency, channel profitability, and customer lifetime value (CLV).

Stage 4: Scenario Modeling and Sensitivity Analysis

Using proprietary modeling tools, Nexdigm simulates multiple financial scenarios to help BFSI leaders forecast potential outcomes of cost restructuring, pricing adjustments, or operational redesigns. This allows CFOs and strategy heads to assess the impact of key decisions.

Stage 5: Actionable Insights and Strategic Dashboard

All insights are consolidated into a Financial Benchmarking Intelligence Dashboard, offering a comprehensive view of financial performance. The dashboard highlights profit drivers, cost inefficiencies, and margin improvement levers.

Nexdigm’s Financial Benchmarking Framework bridges the gap between financial data and strategic foresight, transforming complex digital operations into a clear roadmap for profitability, efficiency, and growth.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704