The financial services industry is undergoing a fundamental transformation, driven by the rapid rise of digital banking and the relentless pace of fintech innovation. According to the World Bank, more than 76% of adults globally now have access to digital financial services, a sharp rise from just 51% a decade ago.

In this high-stakes environment, BFSI players can no longer rely solely on legacy strengths such as brand reputation or branch networks. To stay competitive, they must continuously measure their digital maturity against industry leaders and disruptive fintech entrants. This is where digital banking performance benchmarking becomes a powerful tool, providing banks, NBFCs, and fintech firms with the competitive intelligence needed to refine strategies, improve efficiencies, and deliver superior customer outcomes.

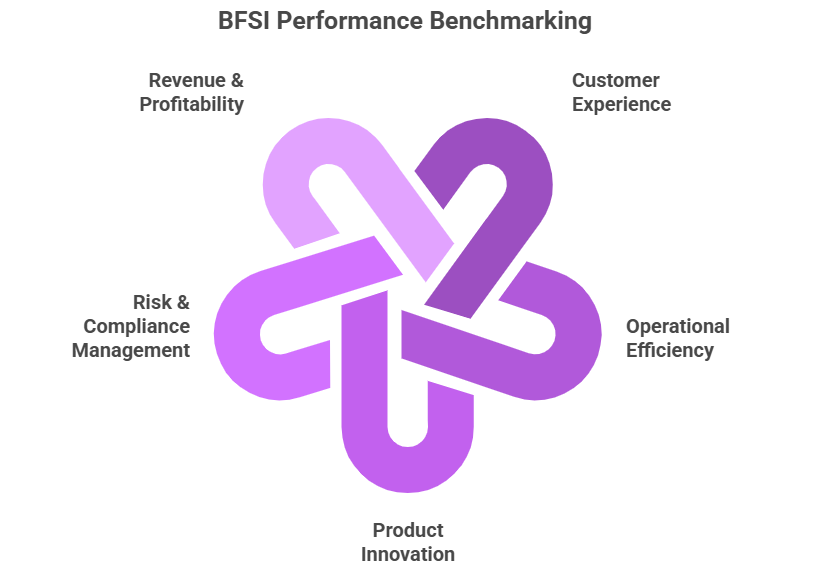

Key Areas Where Benchmarking Shapes Competitive Advantage

Performance benchmarking in digital banking does more than highlight gaps; it enables BFSI players to identify where and how to compete effectively. Some of the most critical areas include:

- Customer Experience: Fintechs have set new benchmarks for seamless digital onboarding, intuitive app design, and 24/7 support. Metrics like average onboarding time, mobile app latency, and net promoter scores reveal where banks and NBFCs must catch up. For instance, a 2023 World Bank survey noted that in emerging markets, more than 60% of users choose fintechs primarily for faster digital onboarding, underscoring its competitive weight.

- Operational Efficiency: Cost-to-income ratios, straight-through processing rates, and digital adoption levels are vital benchmarks for efficiency. Banks still dependent on manual processes see higher operational costs, while fintechs leverage automation and cloud-native platforms to scale quickly. Benchmarking these dimensions helps institutions adopt leaner, more resilient operating models.

- Product Innovation: From BNPL solutions to digital wallets and super apps, fintechs are continuously redefining financial product portfolios. Benchmarking innovation adoption rates, feature launches, and cross-sell penetration helps incumbents anticipate trends and allocate resources where the competitive pressure is highest.

- Risk & Compliance Management: With cyberattacks in the BFSI sector rising significantly, compliance and fraud detection are top priorities. Benchmarking resilience in fraud detection, AML (Anti-Money Laundering) frameworks, and KYC efficiency allows institutions to strengthen regulatory alignment while minimizing reputational risks.

- Revenue & Profitability: Comparing benchmarks such as digital transaction contribution to total revenue, fee income per customer, and cross-sell ratios offers actionable insights into revenue models. As fintechs continue to expand aggressively, benchmarking ensures that BFSI institutions sustain profitability while diversifying income streams.

Nexdigm’s BFSI Competitive Intelligence Approach

At Nexdigm, we recognize that digital banking competition is not just about data, but about transforming insights into strategic advantage. Our Competitive Intelligence offering for the BFSI sector is designed to help banks, NBFCs, and fintech firms benchmark their performance against peers, anticipate competitive moves, and uncover new growth opportunities.

We combine primary research, secondary data analysis, and proprietary benchmarking frameworks to deliver actionable insights across critical performance dimensions, from customer experience to product innovation, operational efficiency, and compliance readiness. By mapping key performance indicators (KPIs) against market leaders and disruptive fintechs, we enable BFSI players to identify strengths, address blind spots, and prioritize investments.

Our approach goes beyond surface-level comparisons. We provide deep-dive analyses of peer strategies, technology adoption, partnership ecosystems, and customer engagement practices, ensuring clients can position themselves effectively in a crowded market. For example, while one bank may lead in AI-driven credit scoring, another may dominate in digital payments volume. Nexdigm’s intelligence highlights such nuances, equipping decision-makers with the clarity to respond strategically.

Ultimately, our BFSI Competitive Intelligence services empower organizations to sustain profitability, enhance customer trust, and stay resilient in the face of fintech-driven disruption.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91 96549 82241