The digital lending ecosystem has rapidly evolved from an alternative credit channel to a mainstream financial engine powering both consumer and SME growth. As fintechs and NBFCs reshape how credit is distributed, the market has reached a stage where speed and convenience are expectations.

Today’s lenders are competing in a marketplace defined by feature innovation, user experience, and data-driven personalization. Borrowers now compare digital loan products based on repayment flexibility, app interface quality, integration with digital wallets, and the overall ease of engagement. However, in this rush to innovate, many players end up offering feature-similar products, leading to commoditization.

To stay ahead, digital lenders must move from imitation to informed innovation. This is where product benchmarking plays a pivotal role. By systematically analyzing how leading fintechs and NBFCs design, price, and deliver their loan products, lenders can identify innovation gaps and opportunity spaces that drive measurable differentiation and sustained competitiveness.

How Product Benchmarking Fuels the Next Generation of Digital Lending

The next phase of digital lending growth will not be defined by who offers credit faster, but by who designs smarter, more adaptive, and experience-led lending products. As competition intensifies, product benchmarking acts as a catalyst for this evolution, guiding fintechs and NBFCs toward innovation that is both relevant and profitable.

Benchmarking drives clarity in innovation priorities. By analyzing peer products across digital lending ecosystems, lenders can identify which features truly enhance customer value. For instance, assessing the prevalence of AI-based underwriting, instant disbursal options, or customizable repayment cycles reveals where differentiation is possible and where innovation is becoming hygiene. This clarity helps lenders channel R&D investments toward high-impact product enhancements rather than replicating market norms.

It transforms product development into a data-led process. Instead of launching new features based on assumption, lenders can benchmark competitor offerings and customer response patterns to refine design and usability. For example, a feature such as in-app credit tracking or embedded insurance may be common in top-performing platforms but underutilized by mid-tier players. Such insights drive targeted product innovation, ensuring alignment with user expectations.

Benchmarking also links technology evolution with business performance. By studying how top players leverage APIs, digital KYC, alternative data, and AI-driven analytics, lenders gain perspective on how technology integration directly impacts approval speed, risk management, and customer retention. This insight bridges the gap between feature innovation and operational scalability.

Nexdigm’s Digital Lending Product Benchmarking Framework

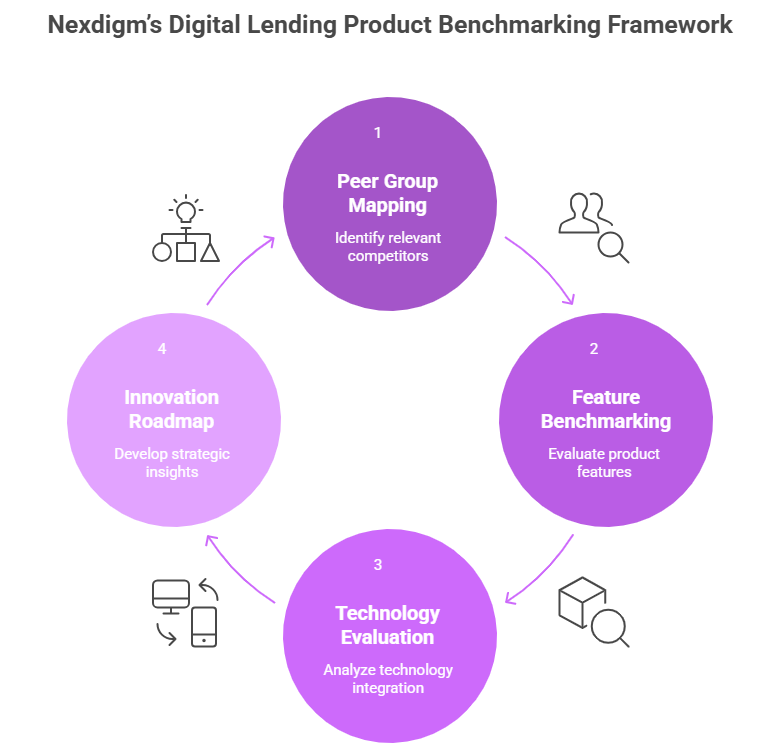

Nexdigm’s Digital Lending Product Benchmarking Framework is designed to help fintechs and NBFCs identify innovation opportunities across digital lending ecosystems. It blends product intelligence, technology analysis, and customer experience benchmarking to deliver a comprehensive perspective on how lenders can achieve sustained differentiation and operational excellence.

- Peer Group Mapping: The process begins with identifying relevant competitors across fintech, NBFC, and digital-first banking ecosystems. Peer selection considers parameters such as loan type, target borrower segment, and technology adoption maturity. This ensures meaningful comparisons that highlight both market best practices and emerging innovation trends.

- Feature and Experience Benchmarking: Nexdigm conducts a deep-dive assessment of lending products to evaluate feature diversity, onboarding simplicity, approval turnaround, repayment flexibility, and digital engagement depth. This step uncovers white spaces in product capabilities, helping lenders identify which attributes drive real customer value and which ones merely add complexity.

- Technology and Integration Evaluation: The framework further analyzes the role of APIs, automation tools, AI-driven credit assessment, and alternative data utilization in shaping lending performance. This helps lenders understand how digital maturity correlates with customer experience and risk outcomes, enabling them to realign their technology priorities for future scalability.

- Innovation Roadmap and Strategic Insights: The final stage translates benchmarking findings into an actionable innovation roadmap. Nexdigm provides prioritized recommendations for feature enhancement, digital integration, and user journey redesign, helping organizations evolve their lending products from transactional offerings to strategic digital ecosystems that anticipate borrower needs.

Through this structured approach, Nexdigm empowers digital lenders to move beyond competitive observation and toward data-backed feature innovation, ensuring that every enhancement contributes directly to customer engagement, profitability, and market leadership.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704