Global online retail sales have crossed USD 6 trillion, now accounting for nearly 20% of all retail transactions. But with this growth comes complexity.

Every new market brings different e-commerce laws, customs rules, logistics realities, consumer buying patterns, and platform dominance. A distribution model that works in the GCC may fail in India or Indonesia due to regulatory restrictions or fulfilment inefficiencies.

Without a structured market entry strategy, retailers face:

- delayed launch timelines

- inflated logistics costs

- compliance failures

- weak customer adoption

- poor ROI on digital investments

This is where Nexdigm’s E-Commerce Retail Distribution Entry Consulting becomes crucial.

Nexdigm’s E-Commerce Retail Distribution Entry Framework

Nexdigm helps retailers turn e-commerce expansion into a precise, data-led, predictable growth journey.

Market & Digital Readiness Assessment

We evaluate the true readiness of each target market using:

- Digital retail penetration rates

- Smartphone & internet access levels

- Payment infrastructure stability, including adoption of UPI, wallets, BNPL, etc.

- Category-specific demand trends such as beauty, electronics, and home goods

- Platform dominance

Outcome: Retailers identify the right entry timing, demand pockets, category feasibility, and customer acquisition potential.

Regulatory & Policy Intelligence

E-commerce regulations vary significantly across borders. Nexdigm maps:

- Inventory-based vs. marketplace restrictions

- Customs & import duties

- Digital advertising compliance

- Consumer protection laws

- Data storage & privacy requirements (GDPR, DPDPA, PDPA)

- Product labeling & certification norms

Outcome: Clients avoid compliance pitfalls, accelerate market approvals, and reduce regulatory risk exposure.

Distribution Model Strategy & Evaluation

The choice of distribution model shapes cost, scalability, and customer experience. Nexdigm helps evaluate:

- Marketplace model

- Hybrid fulfillment (own inventory + marketplace fulfilment)

- Direct-to-consumer (D2C) model using owned platform

- Cross-border e-commerce

We benchmark operational metrics such as:

- delivery SLAs

- platform commission rates

- fulfilment fees

- last-mile reliability

Outcome: Retailers select the highest-ROI model aligned with brand control, cost structure, and regulatory permissions.

Logistics, Fulfillment & Ecosystem Mapping

E-commerce succeeds when logistics succeeds. Nexdigm analyzes:

- Warehouse availability & cost structures

- 3PL/4PL networks

- Cross-border vs. local fulfilment economics

- Last-mile delivery coverage

- Reverse logistics efficiency

- Forecasting & inventory planning models

Outcome: Brands achieve faster delivery, reduced cost per shipment, stronger CSAT, and scalable fulfilment efficiency.

Financial & Operational Feasibility

Nexdigm converts strategy into measurable financial outcomes through:

- Setup cost simulation

- Unit economics

- Profit margin modelling

- Taxation analysis

- Inventory turnover estimation

- Break-even projections

- Cross-border vs. local fulfilment cost comparison

Outcome: A clear, quantified roadmap defining investment, breakeven timelines, and profitability pathways.

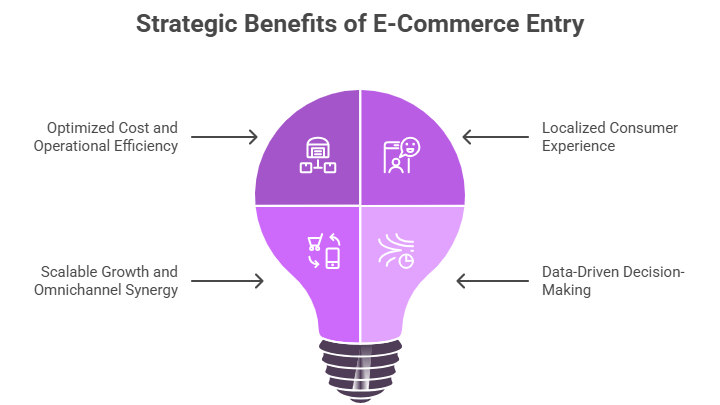

Strategic Benefits of Consulting-Led E-Commerce Entry

Nexdigm Case

Nexdigm supported a global beauty retailer entering Southeast Asia by evaluating platform economics, import duty impact, and local fulfilment partners. By redesigning the distribution model, Nexdigm reduced landed costs by 22%, improved projected margins by 14%, and avoided USD 3.2 million in unnecessary warehousing spend, enabling a faster, more profitable digital-market entry.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704