The ecommerce landscape has entered an era where growth metrics alone no longer define success. As online retailers expand across multiple digital channels they face mounting pressures from rising logistics costs, fluctuating digital ad spends, and increasingly price-sensitive consumers. What was once a game of scale has now become a race for sustainable profitability.

Despite sophisticated analytics tools, many retailers struggle to see the complete financial picture. Operating margins remain volatile, SKU-level profitability is often misjudged, and cash flow efficiency is constrained by high fulfillment and return costs. This is where Financial Benchmarking Consulting becomes pivotal, helping ecommerce enterprises translate complex financial data into actionable insights for performance improvement.

By comparing key metrics like gross margin, cost-to-serve, and marketing ROI against industry peers, benchmarking reveals where financial efficiencies can be gained and where capital can be redeployed. It gives leadership teams the visibility to assess whether their digital channels, pricing models, and logistics strategies are truly creating value.

Nexdigm’s Ecommerce Financial Benchmarking Consulting Framework

At Nexdigm, we recognize that ecommerce success depends on how efficiently every dollar of capital, marketing, and logistics cost translates into value. Our Ecommerce Financial Benchmarking Consulting Framework helps retailers decode the financial DNA of their operations, benchmark performance against high-performing peers, and build actionable roadmaps for sustainable profitability.

Stage 1: Peer Group Identification and Data Standardization

We begin by identifying comparable ecommerce peers based on scale, product mix, market presence, and operating models (D2C, marketplace, or hybrid). This ensures that benchmarking insights are accurate, relevant, and grounded in industry reality. All financial data is standardized to eliminate distortions caused by accounting variations, currency differences, or regional anomalies.

Stage 2: Cost Structure and Margin Analysis

Our experts analyze financial levers across fulfillment, marketing, warehousing, and returns management. Key metrics such as gross margin, EBITDA ratio, cost-to-serve, and SG&A efficiency are benchmarked against industry averages and top performers. This step reveals structural inefficiencies and highlights the most significant cost optimization opportunities.

Stage 3: Channel and Category Profitability Assessment

Ecommerce profitability varies widely across platforms, product categories, and customer segments. We assess contribution margins across channels (marketplaces vs. brand-owned platforms) and identify which SKUs or categories deliver the highest return on capital. These insights help decision-makers recalibrate inventory, pricing, and marketing strategies.

Stage 4: Scenario Modeling and Financial Sensitivity Testing

Using advanced simulation tools, Nexdigm models various “what-if” financial scenarios. This enables retailers to forecast potential profitability improvements and make informed investment decisions.

Stage 5: Strategic Insights Dashboard

The process culminates in a Financial Benchmarking Dashboard, combining key KPIs, variance analysis, and peer comparisons. Retail CFOs and strategy leaders can instantly visualize where they stand in the competitive landscape and which levers can be activated for short- and long-term profitability gains.

Nexdigm’s benchmarking framework converts raw ecommerce data into strategic foresight, empowering businesses to move from reactive cost control to proactive financial design.

Strategic Benefits for Ecommerce Retailers

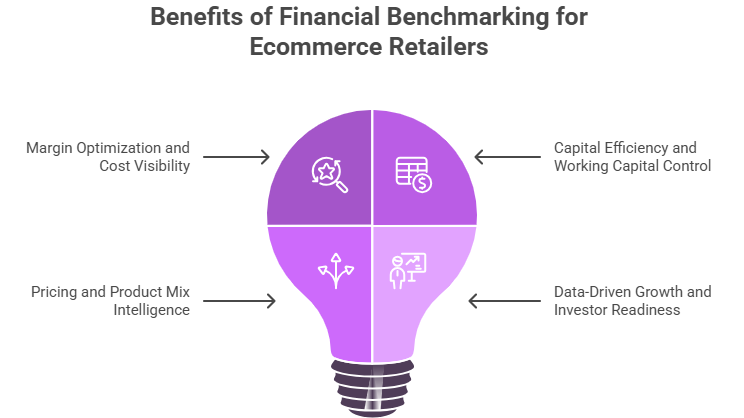

Financial benchmarking is a strategic accelerator that enables ecommerce leaders to align business performance with profitability, scalability, and investor expectations. Nexdigm’s consulting-led approach transforms benchmarking outcomes into tangible strategic benefits across financial, operational, and decision-making dimensions.

- Margin Optimization and Cost Visibility: Our benchmarking studies help ecommerce retailers uncover margin leakages hidden in logistics, returns, and digital marketing expenses. By benchmarking these cost centers against best-in-class peers, retailers gain visibility into where efficiency improvements can yield the highest financial impact.

- Capital Efficiency and Working Capital Control: Ecommerce models often strain working capital due to inventory holdings and payment cycle delays. Nexdigm’s benchmarking insights enable CFOs to optimize inventory turnover ratios, vendor payment terms, and receivable cycles.

- Pricing and Product Mix Intelligence: Through category-level margin and pricing analysis, retailers can identify which SKUs and product categories drive maximum contribution margins and which dilute profitability. Benchmarking informs smarter pricing, assortment, and discount strategies to balance competitiveness with profitability.

- Data-Driven Growth and Investor Readiness: Our benchmarking framework creates an investor-ready financial narrative supported by data. Retailers can demonstrate operational resilience, scalability, and disciplined capital management.

Nexdigm’s Financial Benchmarking Consulting helps ecommerce retailers turn cost challenges into competitive advantages.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704