Agriculture has entered a new era of transformation driven by climate uncertainty, evolving consumer demand, and digitalization across the agri-value chain. While technology and data are reshaping the sector, financial visibility and profitability tracking remain the ultimate differentiators of long-term sustainability.

Across farms, cooperatives, and agribusiness networks, leaders are asking a critical question: Are our investments, inputs, and collective operations generating the expected financial returns? Traditional yield metrics and production volumes no longer provide a complete picture. What matters today is how efficiently every dollar of input, asset, or capital investment translates into measurable profitability.

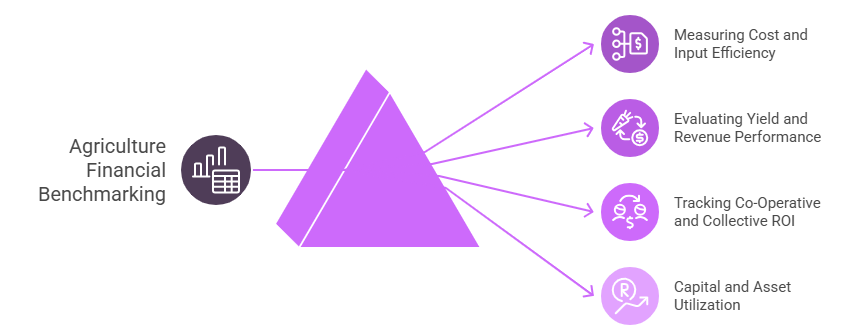

This is where Financial Benchmarking Models play a pivotal role. By comparing parameters such as cost per hectare, yield-to-input ratio, working capital utilization, and cooperative ROI across peers and regions, benchmarking allows stakeholders to identify inefficiencies, strengthen financial performance, and design data-backed strategies for growth.

Why Financial Benchmarking Is Vital for Evaluating Agricultural Profitability

Profitability in agriculture is influenced by multiple variables. Amid such uncertainty, financial benchmarking provides the much-needed clarity to evaluate performance and resilience across farms, cooperatives, and agribusiness enterprises. It transforms fragmented financial data into a structured, comparative view that drives informed decision-making.

- Measuring Cost and Input Efficiency: Benchmarking helps identify how efficiently farms utilize their inputs compared to peers in similar agroclimatic zones. By analyzing cost per hectare and input-output ratios, stakeholders can pinpoint inefficiencies, recalibrate input usage, and enhance productivity without increasing costs.

- Evaluating Yield and Revenue Performance: While yield improvement remains central to agricultural success, benchmarking places it within a financial context. It reveals whether yield gains are translating into sustainable revenue growth or being offset by rising input and logistics costs. This enables producers to distinguish between high-yield and high-profit crops.

- Tracking Co-Operative and Collective ROI: For cooperatives and farmer associations, financial benchmarking brings transparency into member-level contribution, overhead sharing, and return on pooled capital. It enables leadership teams to assess how collective efforts translate into tangible returns and ensures that profits are distributed equitably and strategically reinvested for growth.

- Capital and Asset Utilization: Agricultural operations today involve significant capital. Benchmarking metrics such as asset turnover, ROA (Return on Assets), and maintenance-to-output ratios help gauge whether these investments are yielding optimal financial returns.

Nexdigm’s Agriculture Financial Benchmarking Framework

At Nexdigm, we believe that the future of agriculture depends on financial intelligence as much as agronomic excellence. Our Agriculture Financial Benchmarking Framework helps farms, cooperatives, and agribusiness enterprises transform data into actionable insights. Thus, enabling them to measure profitability, optimize capital utilization, and enhance return on investment (ROI) across their operations.

Stage 1: Peer and Farm Mapping

We begin by identifying comparable farms, cooperatives, and agribusinesses based on geography, crop type, scale, and input intensity. This ensures benchmarking results are contextually relevant and reflective of real operating environments.

Stage 2: Financial KPI Benchmarking

Key indicators such as cost per hectare, gross margin per acre, ROA (Return on Assets), working capital cycle, and co-operative ROI are benchmarked across peer groups. This analysis reveals where performance lags and highlights improvement areas in cost control, capital productivity, and profitability management.

Stage 3: Input-Output and Efficiency Modeling

Our experts evaluate input utilization against output metrics like yield and revenue. By linking cost structure to productivity, we identify where financial efficiency can be enhanced without compromising quality or output levels.

Stage 4: Capital Allocation and Investment Evaluation

We analyze how investments in irrigation, storage, mechanization, and technology are impacting overall financial performance. Using ROI and payback modeling, we determine which projects or equipment deliver the strongest returns and which require reevaluation or optimization.

Stage 5: Strategic Dashboard and Actionable Insights

All findings are consolidated into an Agriculture Financial Benchmarking Dashboard, offering leadership teams a unified view of farm and co-operative performance across regions, crops, and production scales. The dashboard enables continuous monitoring, allowing decision-makers to reallocate resources, control costs, and prioritize high-return activities.

Nexdigm’s Financial Benchmarking Framework transforms agricultural operations from intuition-driven to insight-led, empowering stakeholders to align financial performance with sustainable, scalable growth.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704