Agriculture is more global than ever, yet more restricted. Despite USD 1.8 trillion in annual agri-trade, market access is tightening due to tariffs, ESG-linked rules, and geopolitical shifts.

High-growth regions such as Asia, Africa, and the Middle East are projected to boost agri demand by 35–40% by 2030, but each enforces its own trade policies and compliance mandates, making entry complex. With rising sustainability and traceability requirements, exporters must now prove carbon transparency and ethical sourcing to avoid delays or rejection.

In this landscape, a structured Global Agriculture Market Entry Strategy becomes essential.

Trade Barriers and Market Access Challenges

Agricultural trade operates within a highly regulated and fragmented environment. Understanding these barriers is the first step toward building a resilient entry strategy.

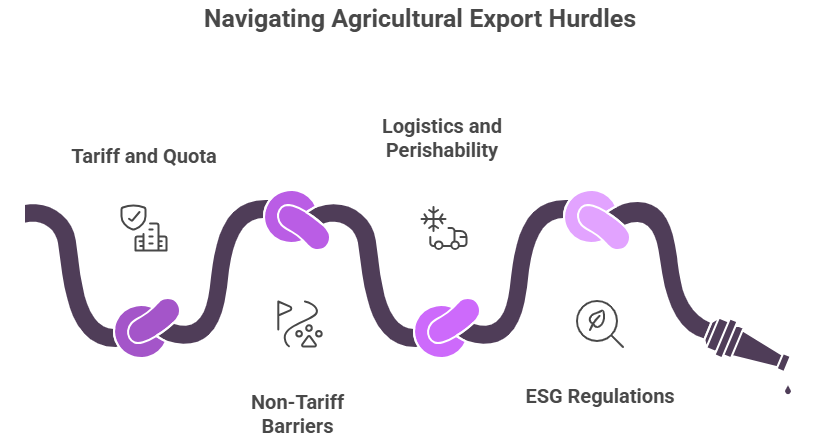

- Tariff and Quota Restrictions: Many countries safeguard domestic farming through steep import duties and quotas. Tariffs for agri-products can range from 10% to 60%, significantly altering margins for exporters.

- Non-Tariff Barriers (NTBs): Non-tariff barriers such as SPS norms, labeling rules, food safety certifications, and pesticide residue limits often pose more disruption than tariffs themselves. NTBs account for over 60% of trade rejections globally.

- Logistics, Customs, and Perishability Challenges: Agriculture is time-sensitive. Customs delays can reduce product value by 15–25%, especially for perishables. Poor cold-chain infrastructure results in up to 30% post-harvest loss in many developing markets.

- ESG and Sustainability Regulations: Global trade is shifting toward sustainability compliance. Standards such as EU CBAM (carbon-border rules), Asia’s new traceability mandates, US transparency laws are redefining what “export-ready” means for agribusinesses.

Nexdigm Market Entry Strategy Framework for Agribusiness Expansion

To navigate tariffs, sustainability norms, and regulatory complexity, agribusinesses need an integrated approach. Nexdigm’s Market Entry Strategy Framework converts trade complexity into clarity through four core pillars.

Regulatory and Trade Policy Intelligence

Nexdigm begins by decoding trade policies of the target region, including:

- Applicable import tariffs

- FTA advantages

- Documentation and customs norms

- SPS, labeling, and packaging regulations

By identifying compliance prerequisites early, clients reduce approval delays by up to 50% and avoid costly disruptions.

Market Feasibility and Localization Analysis

At Nexdigm, we understand success depends on aligning products with local economics and trade dynamics. We analyze:

- Price sensitivities across regions

- Competitive benchmarks and white spaces

- Cost-to-serve and landed cost analysis

- Potential for product adaptation or local processing

Localized processing can reduce tariff impact by 10–20% and accelerate market acceptance.

Strategic Partnerships and Distribution Networks

Nexdigm identifies reliable in-country distributors, logistics partners, and JV collaborators who can enable:

- Faster licensing

- Warehousing access

- Last-mile market penetration

Strong local partnerships can improve market-entry speeds by 30–40%.

Execution Support and Continuous Monitoring

Nexdigm provides ongoing support through:

- Compliance monitoring systems

- Supply-chain optimization

- Policy-tracking dashboards

- Benchmarking of operational performance

This ensures clients remain compliant and resilient even in volatile trade settings.

Nexdigm Case

Nexdigm helped a global agri-input supplier navigate Middle Eastern trade hurdles by mapping import duties, SPS norms, and distributor networks, enabling a 35% faster market entry and stronger compliance alignment across three GCC countries.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704