The global BFSI sector is navigating an era of accelerated transformation, marked by digitization, talent globalization, and cross-border competition for specialized skills. As financial institutions expand their footprints across regions, managing compensation parity has become a complex strategic challenge.

Global HR leaders now face the dual task of maintaining internal pay equity while ensuring external competitiveness across varied economic, regulatory, and cultural environments. Disparities in cost of living, inflation rates, and compliance frameworks often result in fragmented pay structures that hinder mobility, increase attrition risk, and impact employer branding.

In this context, Nexdigm’s Global BFSI Compensation Benchmarking Report acts as a strategic workforce planning tool, offering cross-market visibility into pay trends, total rewards structures, and role equivalences. By transforming market data into actionable intelligence, the report enables HR and business leaders to forecast labor costs, design fair compensation frameworks, and align workforce planning with long-term organizational goals.

Nexdigm’s Global BFSI Compensation Benchmarking Framework

For global financial institutions, compensation decisions must be as data-driven and agile as their market operations. Nexdigm’s Global BFSI Compensation Benchmarking Framework is built to transform pay benchmarking into a strategic enabler for global workforce planning. It blends market analytics, regional intelligence, and consulting expertise to help BFSI organizations design scalable, equitable, and forward-looking compensation structures across multiple geographies.

- Cross-Market Compensation Analytics: Nexdigm harmonizes compensation data across developed and emerging BFSI markets, including major hubs like the U.S., UK, Singapore, UAE, and India. By standardizing for exchange rates, inflation, and purchasing power parity, the framework enables true cross-market comparability and helps organizations identify where wage premiums or cost advantages exist across business units.

- Role Normalization and Job Family Mapping: The framework ensures that equivalent roles across countries, are evaluated on consistent parameters like skill intensity, responsibility, and regulatory exposure. This alignment supports fair benchmarking and facilitates internal mobility within multinational BFSI organizations.

- Regulatory and ESG Integration: Given the sector’s sensitivity to regulatory oversight, Nexdigm’s framework embeds global pay governance, diversity, and ESG-linked compliance into its benchmarking methodology. The insights help institutions align total rewards with emerging disclosure norms and maintain transparency across.

- Forecasting and Workforce Planning Intelligence: Beyond compensation comparison, the framework applies predictive analytics to project wage growth, market inflation, and talent cost evolution across key geographies. This foresight allows HR and finance teams to anticipate shifts in workforce economics and plan budgets or role relocations with greater accuracy.

Through this integrated framework, Nexdigm empowers global BFSI organizations to move beyond static salary surveys toward dynamic, intelligence-led workforce planning. The result is a globally aligned compensation strategy that supports competitiveness, compliance, and sustainable growth across diverse markets.

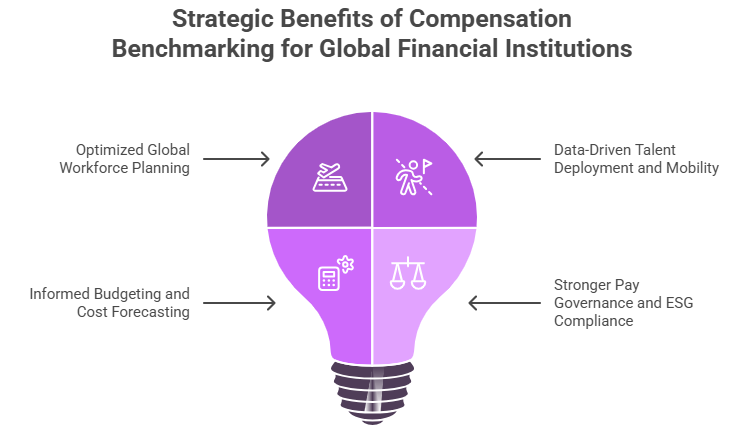

Strategic Benefits for Global Financial Institutions

For multinational BFSI organizations, compensation benchmarking is a strategic enabler for efficient workforce management, financial planning, and global competitiveness. Nexdigm’s Global BFSI Compensation Benchmarking Report helps financial institutions unlock tangible business value by aligning talent strategy with market realities and future growth priorities.

- Optimized Global Workforce Planning: The benchmarking report provides a unified view of labor cost structures and skill-based pay variations across financial hubs worldwide. This intelligence helps organizations strategically allocate functions to cost-efficient locations without compromising capability or productivity.

- Data-Driven Talent Deployment and Mobility: With clear visibility into role-based compensation trends, HR leaders can confidently facilitate cross-border talent movement and internal job rotations. This ensures equitable pay alignment for expatriates, remote teams, and regional leadership roles, reinforcing fairness and transparency across the global workforce.

- Informed Budgeting and Cost Forecasting: By integrating predictive insights into compensation planning, Nexdigm enables BFSI institutions to anticipate wage shifts and inflationary pressures, helping finance teams forecast talent costs for the next business cycle. This forward-looking approach supports more accurate budgeting and long-term cost sustainability.

- Stronger Pay Governance and ESG Compliance: The report supports HR and governance teams in adhering to global compensation disclosure, diversity, and sustainability requirements. With standardized pay transparency metrics and regional compliance insights, institutions can strengthen their ESG positioning and stakeholder trust.

By connecting compensation insights with business objectives, Nexdigm helps financial organizations align their global human capital strategies with evolving market, regulatory, and ESG expectations.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704