The global banking and financial services industry is evolving faster than ever. Digital transformation, regulatory tightening, and economic volatility have reshaped how financial institutions define success. Today, competitiveness is measured by financial agility, operational resilience, and profitability efficiency on a global scale.

As banks and NBFCs expand across markets, they face a critical challenge: aligning regional performance with international standards while maintaining profitability and risk control. Despite having access to vast financial data, many institutions still lack a comparative view of their performance against global peers.

This is where Financial Performance Intelligence becomes transformative. By benchmarking key indicators such as cost-to-income ratio, return on equity (ROE), net interest margin (NIM), liquidity coverage, and capital efficiency against global best practices, financial institutions can identify performance gaps, uncover cost efficiencies, and strategically position themselves for sustainable global growth.

Why Financial Benchmarking Is Key to Global Competitiveness in BFSI

In a financial world increasingly defined by globalization and digitization, competitiveness is no longer confined within borders. Institutions now compete across markets, regulatory regimes, and customer segments. To succeed, they must understand where they stand globally. This is precisely where financial benchmarking becomes indispensable.

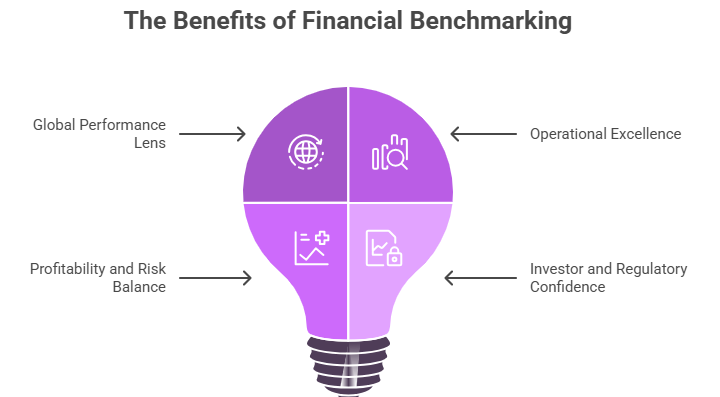

- Creating a Global Performance Lens: Benchmarking allows banks, NBFCs, and financial institutions to see their operations through a comparative lens, evaluating performance against leading players across regions. It highlights where cost structures deviate, where capital is underutilized, and where returns can be enhanced. By understanding these disparities, institutions can align strategies with global best practices.

- Driving Operational Excellence and Efficiency: Benchmarking helps financial leaders identify inefficiencies across lending, deposits, and digital operations. Comparing cost-to-income ratios, credit cost ratios, and operational expenses with top-performing peers enables BFSI players to uncover productivity gaps and rationalize cost structures.

- Balancing Profitability With Risk: Sustained competitiveness requires an equilibrium between growth and prudence. Benchmarking quantifies risk-adjusted returns, provisioning levels, and asset quality metrics, giving leadership clarity on whether profitability is being achieved at acceptable risk levels. This balance is crucial for maintaining credit stability while scaling operations globally.

- Enhancing Investor and Regulatory Confidence: Global investors, credit agencies, and regulators increasingly expect transparency and comparability. Benchmarking provides the analytical foundation for data-backed disclosures, valuation models, and compliance narratives, helping institutions demonstrate financial discipline and strategic accountability.

Nexdigm’s Financial Performance Intelligence Framework for BFSI

At Nexdigm, we believe that true competitiveness in the global BFSI ecosystem demands actionable intelligence that connects performance metrics to strategic decisions. Our Financial Performance Intelligence Framework enables banks, NBFCs, and financial institutions to evaluate their global standing, identify financial inefficiencies, and design data-driven roadmaps for profitability and growth.

Stage 1: Global Peer Group Identification and Data Calibration

We start by identifying comparable institutions based on scale, business model, product mix, and regional presence. This ensures benchmarking comparisons are meaningful and contextually accurate. Financial data is normalized across currencies, regulatory frameworks, and accounting standards to create a consistent baseline for analysis.

Stage 2: Key Financial Ratio and Performance Benchmarking

Core ratios are benchmarked against global and regional leaders. This step helps institutions uncover hidden inefficiencies, operational imbalances, and profit levers across divisions and geographies.

Stage 3: Regional and Business Segment Mapping

We then drill down into business lines to understand their contribution to overall profitability. This analysis highlights which segments outperform peers globally and which require strategic restructuring.

Stage 4: Scenario Modeling and Sensitivity Analysis

Our analysts simulate multiple macroeconomic and regulatory scenarios to test financial resilience under different conditions. This allows BFSI institutions to quantify the potential impact of interest rate shifts, credit losses, or liquidity constraints on profitability and capital adequacy.

Stage 5: Strategic Dashboard and Insight Delivery

Insights are consolidated into a Global Financial Competitiveness Dashboard, which visually maps performance across cost, capital, and profitability dimensions. The dashboard supports executive decision-making, investment prioritization, and continuous performance monitoring.

Nexdigm’s Financial Performance Intelligence Framework transforms traditional benchmarking into a strategic decision-enabling process, helping BFSI leaders navigate global uncertainty with clarity, confidence, and competitive precision.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704