The global financial services landscape is evolving faster than ever, driven by digital disruption, regulatory complexity, and rapidly changing customer expectations. As banks, NBFCs, insurers, and fintechs expand across borders, they face a critical challenge of maintaining operational consistency and efficiency across diverse markets.

According to World Bank studies, global banks with harmonized operational strategies achieve up to 25–30% higher efficiency and faster transformation execution compared to decentralized peers. This highlights the importance of cross-market benchmarking, which enables BFSI institutions to measure, compare, and align their global operations with industry leaders.

Why Cross-Market Benchmarking Matters for Financial Institutions

As financial institutions expand globally, performance disparities between markets often emerge, driven by differences in technology maturity, regulatory intensity, and operational agility. These inconsistencies limit scalability and erode profitability. Cross-market benchmarking provides a strategic lens to identify these variations, standardize best practices, and create cohesive, high-performing organizations.

Key Reasons Cross-Market Benchmarking Is Essential:

- Operational Consistency Across Geographies: Benchmarking helps institutions compare efficiency metrics across regions, uncovering inefficiencies and enabling standardization of workflows.

- Technology and Digital Alignment: By evaluating automation levels, data analytics adoption, and digital channel maturity across subsidiaries, institutions can harmonize their digital transformation journey and accelerate enterprise-wide innovation.

- Balanced Profitability Models: Cross-market comparison of cost-to-income ratios, NIM, and operational overheads provides clarity on where margin pressure exists.

- Regulatory and Compliance Synchronization: Benchmarking compliance frameworks across geographies ensures that all regional units maintain governance parity while adapting to local regulatory nuances.

- Customer Experience Uniformity: Global BFSI leaders use benchmarking to measure and replicate high-performing customer engagement and service models, ensuring consistent brand experience worldwide.

Through cross-market benchmarking, financial institutions can bridge regional silos, replicate operational excellence, and align strategic goals, creating scalable, efficient, and globally competitive financial networks.

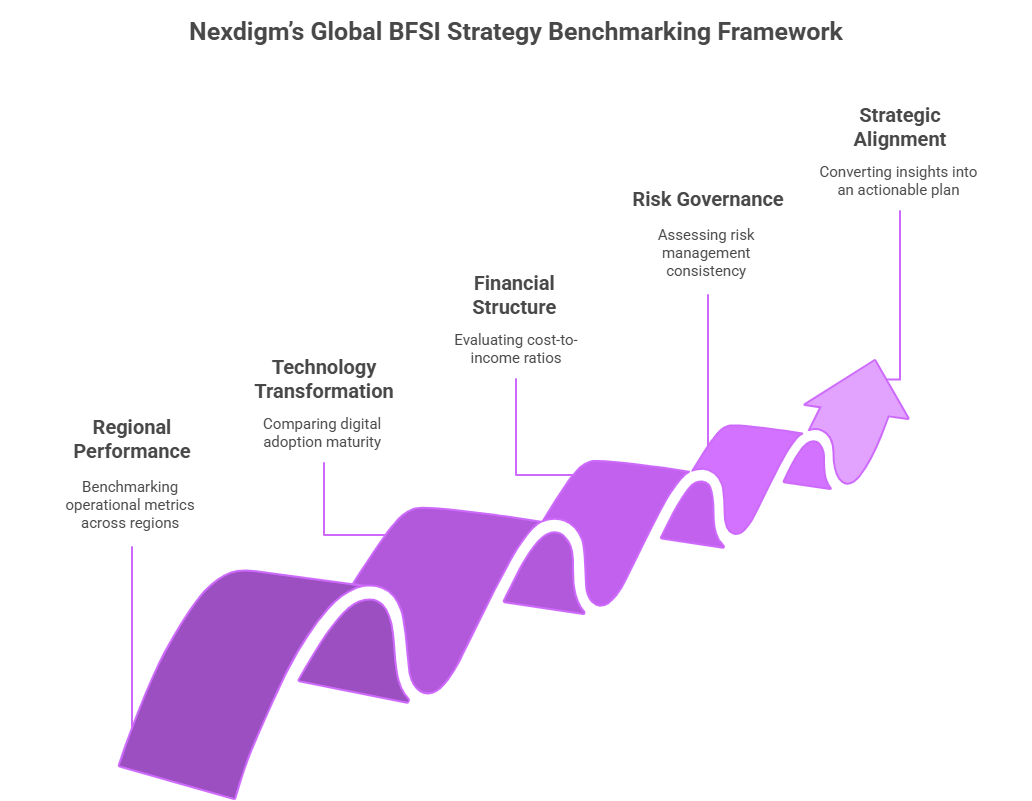

Nexdigm’s Global BFSI Strategy Benchmarking Framework

Nexdigm’s Global BFSI Strategy Benchmarking Framework helps financial institutions create a unified view of performance across geographies. By combining competitive intelligence, data analytics, and performance benchmarking, the framework enables organizations to identify operational gaps, prioritize improvement areas, and align global strategies for consistent excellence.

It provides leadership teams with data-backed visibility into how different markets perform in terms of efficiency, profitability, digital readiness, and compliance maturity, transforming scattered regional strengths into a cohesive global advantage.

Core Components of the Framework:

- Regional Performance Mapping: Benchmarks key operational metrics such as transaction speed, claims settlement turnaround, loan approval timelines, and process automation levels across countries or business units.

- Technology and Digital Transformation Benchmarking: Compares digital adoption maturity to identify opportunities for enterprise-wide technology alignment.

- Financial and Cost Structure Benchmarking: Evaluates cost-to-income ratios, NIM, ROE, and productivity levels across geographies to optimize profitability and resource allocation.

- Risk and Governance Benchmarking: Assesses the consistency of risk management, compliance controls, and governance frameworks across subsidiaries and regulatory environments.

- Strategic Alignment Roadmap: Converts benchmarking insights into an actionable execution plan, outlining process standardization, technology replication, and best-practice sharing models across markets.

Through this comprehensive approach, Nexdigm enables BFSI institutions to build globally synchronized operations, reduce duplication, and enhance decision-making, driving measurable gains in efficiency, digital maturity, and long-term competitiveness.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704