The global BFSI landscape is undergoing a massive digital transformation. Core banking systems, payment orchestration layers, digital lending platforms, and cloud-based analytics tools are reshaping how financial institutions operate. Yet, as organizations embrace new technologies, they also face an unintended consequence of platform fragmentation.

Many banks and insurers today manage overlapping systems for compliance, customer experience, data management, and transaction processing. This fragmented ecosystem increases operational costs, slows innovation, and limits scalability. True digital progress demands platform consolidation, as a strategic enabler of innovation.

Here lies the role of technology benchmarking. By comparing technologies, platforms, and vendor ecosystems through a data-driven lens, financial institutions can identify which systems deliver the best combination of performance, compliance adaptability, and innovation potential.

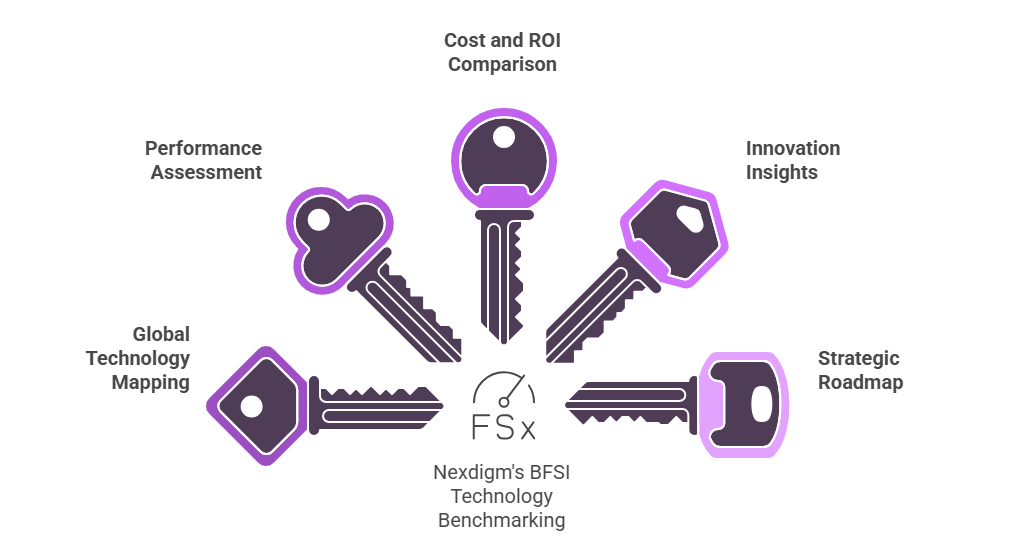

Nexdigm’s BFSI Technology Benchmarking Framework

For most financial institutions, balancing modernization with operational stability is a constant challenge. Nexdigm’s BFSI Technology Benchmarking Framework provides a structured and evidence-based approach to evaluating, consolidating, and optimizing technology platforms across the banking, insurance, and financial services ecosystem.

The framework combines competitive intelligence, performance benchmarking, and strategic foresight to help organizations identify which platforms to retain, replace, or consolidate. Thus, ensuring every technology decision supports both efficiency and innovation.

Key Components of the Framework

- Global Technology Landscape Mapping: Nexdigm begins by mapping core banking, digital payments, lending, InsurTech, and RegTech platforms used by leading financial institutions worldwide. This creates a clear view of market maturity, emerging technologies, and regional innovation clusters.

- Platform Performance & Scalability Assessment: Each platform is benchmarked on uptime, transaction throughput, latency, integration speed, and compliance adaptability, identifying which technologies deliver sustainable performance at scale.

- Cost and ROI Comparison: Our benchmarking process evaluates total cost of ownership (TCO) and post-deployment ROI, helping BFSI leaders align platform investments with long-term financial efficiency and business growth.

- Innovation and Consolidation Insights: Nexdigm integrates peer performance data to identify redundant systems and uncover innovation-ready platforms that can be scaled enterprise-wide. This approach ensures consolidation drives agility, not rigidity.

- Strategic Roadmap Development: The insights are translated into a data-backed roadmap outlining technology retention priorities, vendor rationalization opportunities, and innovation acceleration pathways.

Through this framework, Nexdigm helps BFSI enterprises consolidate technology ecosystems intelligently, ensuring simplification fuels innovation. Each recommendation is backed by market benchmarks, peer intelligence, and performance data to ensure technology choices are not just compliant, but competitively future-ready.

How Leading BFSI Firms Benchmark for Innovation

Across global markets, leading BFSI organizations are using technology benchmarking not merely as a diagnostic tool but as a strategic innovation enabler. These institutions recognize that innovation must be anchored in performance, scalability, and customer impact.

Here’s how top-performing banks, insurers, and fintechs are applying benchmarking to stay ahead:

- Core System Modernization with Measurable ROI: Leading banks benchmark legacy core banking systems against next-gen digital cores based on transaction speed, interoperability, and cloud-readiness. The result is not just migration, but modernization with quantified ROI and faster time-to-market for new financial products.

- Payments and Digital Infrastructure Optimization: Global payment processors compare orchestration platforms on throughput, latency, and fraud management efficiency. Benchmarking helps them identify which systems can scale securely to handle real-time, high-volume transactions across geographies.

- AI and Automation for Customer Engagement: Financial service providers benchmark chatbots, predictive analytics tools, and workflow automation systems based on accuracy, compliance, and user satisfaction metrics.

- Data and Compliance Platform Consolidation: Insurers and asset managers benchmark regulatory and data management platforms for security, scalability, and integration agility. Thus, helping them streamline operations without compromising governance or audit readiness.

- Fintech Collaboration and API Ecosystem Evaluation: BFSI leaders evaluate partner ecosystems and open-banking APIs through benchmarking to identify scalable collaboration opportunities that accelerate innovation while maintaining security and compliance.

Through competitive intelligence and continuous benchmarking, Nexdigm empowers BFSI organizations to replicate best practices from global leaders, accelerate digital innovation, and achieve seamless platform synergy. The result is a financial enterprise that is leaner, smarter, and more responsive to the evolving needs of customers and regulators alike.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704