The global Food & Beverages (F&B) industry is evolving at an unprecedented pace, driven by shifting consumer preferences, technological integration, and the rapid emergence of new growth markets. While mature economies face market saturation, emerging markets across Asia, the Middle East, and Africa are becoming the new frontiers of opportunity but also of financial complexity.

As companies expand their manufacturing footprints, diversify portfolios, and enter new geographies, managing profitability, capital intensity, and investment readiness becomes increasingly challenging. Variations in input costs, currency volatility, and regulatory environments often lead to significant disparities in EBITDA performance, CapEx allocation, and return on investment across markets.

This is where Global Food Financial Benchmarking Studies play a transformative role. By systematically comparing EBITDA margins, CapEx-to-revenue ratios, and M&A readiness indicators against regional and global peers, food enterprises gain actionable insights into operational efficiency, capital productivity, and long-term financial sustainability.

Why Financial Benchmarking Matters for Food Companies in Emerging Markets

Emerging markets represent both the biggest growth opportunity and the greatest financial uncertainty for the global food industry. Rising incomes, urbanization, and evolving consumption habits are driving massive demand for packaged food, beverages, and quick-service formats. For leadership teams and investors, financial benchmarking is a strategic enabler. It helps identify where financial structures are optimized, where cost leakages occur, and how companies can balance expansion with profitability in dynamic market conditions.

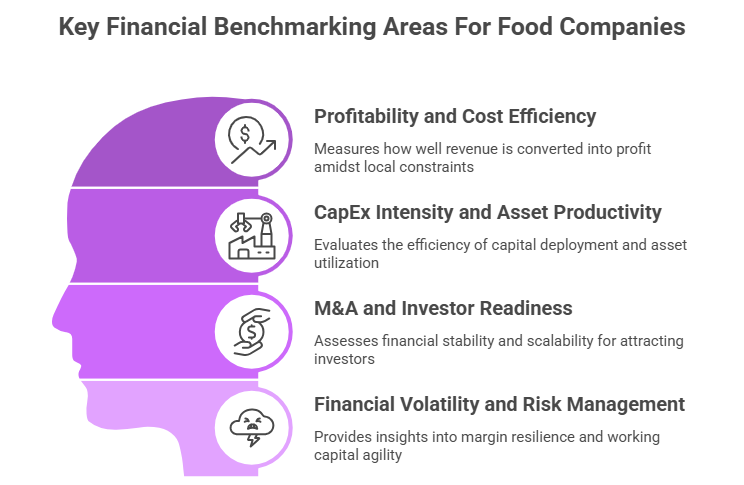

- Measuring Profitability and Cost Efficiency: Benchmarking EBITDA performance across emerging markets reveals how well a company converts revenue into profit amidst local constraints like distribution inefficiencies and raw material inflation. It allows decision-makers to compare their profitability with regional peers, identifying best practices in cost management, pricing discipline, and production efficiency.

- Understanding CapEx Intensity and Asset Productivity: Emerging markets often require significant capital investments in manufacturing, cold chain, and logistics. However, over-investment or delayed payback can reduce returns. Benchmarking CapEx-to-sales ratios, fixed asset utilization, and depreciation patterns helps food companies evaluate whether their capital is being deployed efficiently and where asset-light models or contract manufacturing could improve ROI.

- Assessing M&A and Investor Readiness: As consolidation accelerates in the global F&B sector, companies operating in high-growth regions must demonstrate financial stability, transparency, and scalability to attract investors or acquisition partners. Financial benchmarking helps assess key indicators like cash flow strength, debt leverage, governance maturity, and integration readiness, positioning firms as credible targets or acquirers in cross-border transactions.

- Managing Financial Volatility and Risk: Volatile currencies, variable input costs, and evolving tax structures are part of the emerging-market reality. Benchmarking provides a comparative understanding of margin resilience and working capital agility across geographies, helping CFOs anticipate risks and design strategies for sustained profitability.

Nexdigm’s Global Food Financial Benchmarking Framework

At Nexdigm, we understand that the global food industry’s success depends on balancing scale with financial precision. Our Global Food Financial Benchmarking Framework is designed to help food and beverage enterprises evaluate their financial competitiveness across markets uncovering insights into EBITDA efficiency, CapEx productivity, and M&A readiness.

Stage 1: Market and Peer Mapping

We begin by mapping peer groups and regional clusters across emerging markets categorized by product type (snacks, dairy, beverages, frozen foods, condiments). This ensures benchmarks are contextually relevant and aligned with local market dynamics.

Stage 2: EBITDA and Profitability Benchmarking

Nexdigm benchmarks gross margin, EBITDA, and contribution margin against regional and global peers to identify how efficiently companies convert sales into profit. Our analytics reveal performance variances caused by pricing strategy, distribution costs, or raw material volatility.

Stage 3: CapEx Intensity and Asset Utilization Analysis

We evaluate CapEx-to-sales ratios, ROI on manufacturing investments, and asset turnover performance across production facilities, logistics networks, and packaging units. This analysis helps organizations determine whether capital investments are aligned with output efficiency and long-term sustainability.

Stage 4: M&A and Financial Readiness Evaluation

Nexdigm’s framework assesses financial governance, leverage structure, and scalability to determine M&A or investor readiness. We benchmark key metrics such as net debt-to-EBITDA ratio, free cash flow adequacy, and capital structure resilience, providing actionable insights for potential acquirers or targets.

Stage 5: Strategic Dashboard and Market Intelligence

All insights are presented in a Global Food Financial Benchmarking Dashboard, offering leadership teams a 360° view of performance drivers, capital efficiency, and valuation potential. Nexdigm supplements this with tailored recommendations whether to optimize CapEx allocation, rationalize operations, or prepare for an upcoming M&A cycle.

Nexdigm’s framework bridges financial data with strategic foresight, helping global food enterprises achieve sustainable profitability and investment-grade growth across emerging markets.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704