Cross-border manufacturing growth is accelerating worldwide, but so are the challenges of making the right entry decisions. Over 70+ countries announced new industrial incentives between 2022–2024, while cross-border manufacturing investments exceeded USD 1.2 trillion last year alone.

But expansion isn’t simple. Complex FDI rules, rising compliance burdens, land availability issues, and volatile logistics costs mean that even high-potential markets can turn unviable without rigorous feasibility assessment.

This is where Nexdigm’s Global Manufacturing Mode of Entry Advisory strengthens decision-making with data-driven, compliance-aligned, and execution-ready expansion strategies.

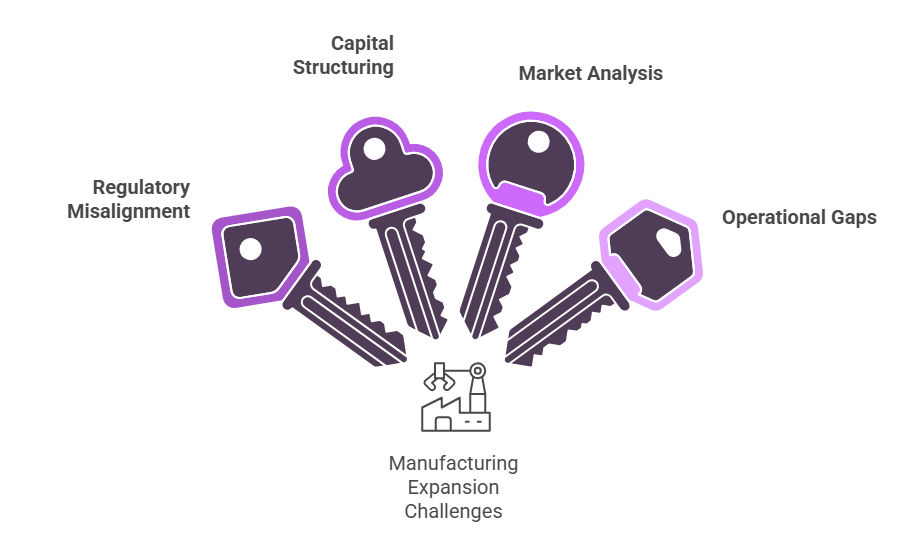

Why Manufacturers Struggle Without a Guided Entry Strategy

- Regulatory and Policy Misalignment: Over 90 countries revised FDI or industrial licensing rules between 2022–2024

- Inefficient Capital Structuring and Tax Planning: High import volumes often mask saturation, Southeast Asia imported 22+ million tonnes of industrial goods in 2023

- Inadequate Market and Demand Analysis: Double taxation, missed incentives, and non-optimized import duty structures can erode 10–18% of annual project return

- Operational and Supply Chain Gaps: In markets like Africa, logistics delays increase cost-to-serve by 12–20%, impacting profitability.

Nexdigm’s Global Manufacturing Mode of Entry Advisory Framework

Market & Policy Feasibility Analysis

We evaluate economic and industrial performance through:

- GDP growth and industrial output trends

- trade balance and import dependency

- logistics and energy cost indices

- industrial zone incentives and policy stability

Outcome: Clients identify high-potential, policy-aligned markets where manufacturing ROI is structurally stronger.

Entry Mode Evaluation & Strategic Fit

Nexdigm analyzes the suitability of:

- wholly owned subsidiaries

- joint ventures

- strategic alliances

- contract manufacturing

- brownfield/greenfield entry

- Each option is assessed using:

- control and compliance needs

- capex and opex projections

- scalability potential

- exit flexibility

Outcome: Businesses choose the entry route that optimizes risk, investment, and operational control.

Financial, Tax, and Investment Structuring

Our financial modeling includes:

- incentive mapping (tax holidays, subsidies, FTZ benefits)

- cross-border tax planning

- import duty optimization

- capital structuring support

- ROI, NPV, and sensitivity scenario modeling

Outcome: Manufacturers prevent value leakage and unlock 5–12% cost advantages through optimized structuring.

Partnership Identification & Due Diligence

We conduct:

- partner scouting across suppliers, EPC firms, distributors

- operational and financial due diligence

- synergy and capability assessment

- ESG and compliance checks

Outcome: Clients secure credible partners who accelerate market setup and regulatory acceptance.

Implementation Roadmap & Compliance Enablement

We support clients with:

- entity setup and regulatory filings

- land acquisition and industrial approvals

- environmental clearances

- workforce and labor law alignment

- project timelines and risk mitigation planning

Outcome: A predictable and compliant launch, backed by continuous regulatory monitoring.

Nexdigm Case

Nexdigm supported a mid-sized electronics manufacturer expanding into Southeast Asia by evaluating four entry routes, mapping 30+ industrial incentives, and conducting due diligence on local partners. The engagement reduced projected duty exposure by 11%, secured USD 6.2 million in incentives, and identified a partner with a 98% delivery reliability rate — enabling a compliant and financially strong market entry.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704