Energy is shifting, but opportunity is expanding. With the global oil & gas market surpassing USD 7.5 trillion, companies are racing to secure positions in high-growth markets across the Middle East, Africa, and Southeast Asia.

At the same time, the industry is navigating a new reality of carbon taxation, tightened ESG disclosures, volatile pricing, and infrastructure gaps.

In this environment, expansion is not about entering markets but entering them intelligently.

Challenges in Global Oil & Gas Expansion Without Structured Investment Strategy

Entering new O&G markets without a data-driven strategy exposes companies to expensive strategic blind spots. Key risks include:

- Regulatory and Policy Misalignment: Over 70+ countries updated licensing rules and local content requirements in the last 36 months.

- Fiscal Ambiguity and Investment Leakage: Regions with shifting tax royalties can reduce project returns by 8–15%.

- Operational Infrastructure Gaps: Limited pipeline access and weak terminal infrastructure can increase logistics cost by 20–30%, affecting viability.

- Sustainability and Carbon Compliance Burden: More than 45 countries now enforce carbon accounting or methane-reduction mandates.

A structured investment entry strategy eliminates these risks by turning uncertainty into clarity.

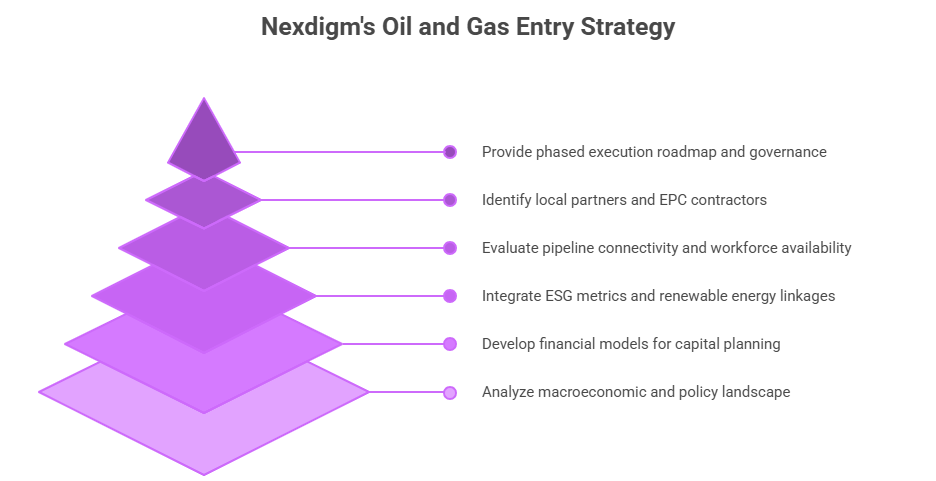

Nexdigm’s Global Oil and Gas Investment Entry Strategy Consulting Framework

Nexdigm’s Global Oil and Gas Investment Entry Strategy Consulting Framework enables companies to evaluate markets holistically.

Market & Regulatory Feasibility Assessment

Nexdigm evaluates the macroeconomic and policy environment using:

- Energy consumption trends

- Licensing regimes & production-sharing contracts

- Import/export restrictions

- Local content laws & fiscal incentives

Outcome: Clarity on market attractiveness, risk hotspots, and entry viability.

Investment & Financial Structuring

We build rigorous financial models covering:

- Capex & Opex forecasting

- Taxation rules, royalties & fiscal incentives

- Foreign exchange fluctuations

- Profitability benchmarks across regions

Outcome: Investment decisions that maximize ROI and minimize regulatory exposure.

Sustainability & ESG Integration

Nexdigm integrates ESG parameters directly into market entry:

- Carbon intensity benchmarks

- Emissions reporting frameworks

- Responsible sourcing and green operations

- Renewable energy integration options

Outcome: Projects aligned with global transition goals and local ESG mandates.

Operational & Infrastructure Readiness

We assess infrastructure such as:

- Pipeline networks

- Refinery and LNG terminal proximity

- Storage capacity

- Port connectivity

- Workforce & contractor ecosystem

Outcome: Stable, disruption-free supply chain planning.

Partnership & Localization Strategy

Nexdigm conducts deep evaluation to identify reliable partners:

- EPC firms

- Logistics providers

- Local distributors

- Technology & drilling partners

Outcome: Strong, compliant local alliances that accelerate regulatory acceptance.

Implementation Roadmap & Governance

We provide execution plans covering:

- Entity setup

- Regulatory submissions

- Talent acquisition

- Operational rollout

- ESG & performance dashboards

Outcome: Predictable, compliant project activation backed by data-driven governance.

Nexdigm Case

A regional LNG equipment supplier sought expansion into East Africa but struggled with unclear licensing and fragmented infrastructure. Nexdigm conducted a rapid feasibility study, benchmarked fiscal regimes, assessed nine partners, and modeled multiple entry scenarios. Within four months, the client secured a compliant entry route, cut logistics costs by 12%, and fast-tracked regulatory approval—enabling a confident, future-ready launch.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704